doi: 10.56294/dm2023137

ORIGINAL

To diagnose industry 4.0 by maturity model: the case of Moroccan clothing industry

Para diagnosticar la Industria 4.0 mediante un modelo de madurez: el caso de la industria textil marroquí

Younes JAMOULI1,2 ![]() *, Samir TETOUANI1

*, Samir TETOUANI1 ![]() *, Omar CHERKAOUI1

*, Omar CHERKAOUI1 ![]() *, Aziz SOULHI2

*, Aziz SOULHI2 ![]() *

*

1LINA Laboratory, Higher School of Textile and Clothing Industries. Casablanca, Morocco.

2Systems management and engineering Team, National Higher School of Mines. Rabat, Morocco.

Cite as: Jamouli Y, TETOUANI S, CHERKAOUI O, SOULHI A. To diagnose industry 4.0 by maturity model: the case of Moroccan clothing industry. Data and Metadata. 2023;2:137. https://doi.org/10.56294/dm2023137

Submitted: 10-08-2023 Revised: 26-10-2023 Accepted: 29-12-2023 Published: 30-12-2023

Editor: Prof.

Dr. Javier González Argote ![]()

ABSTRACT

In 2011, the German government launched the visionary initiative known as Industry 4.0, with the goal of positioning itself at the forefront of cutting-edge manufacturing and the shift towards digital transformation. In the wake of this transformative wave, numerous manufacturers are continuously exploring avenues to bolster their capabilities and remain competitive in the market. This empirical study adopts a maturity model inspired by the Economic Development Board’s Singapore Smart Industry Readiness Index. The model empowers companies to perform self-assessments, facilitating a systematic and comprehensive alignment with the principles of Industry 4.0. The research delves into the assessment of Industry 4.0 maturity within the Moroccan clothing industry, examining clustering index factors and the influence of key factors on companies’ self-assessment. The results classify 252 Moroccan Clothing enterprises into three distinct categories, highlighting a strong positive correlation among process, technology, and organization. Significantly, a majority of the 252 companies evaluated using the maturity model still appear to be in early stages or partially mature, necessitating significant improvements and a reevaluation of their Industry 4.0 transformation strategies. Conclusively, the Singapore Smart Industry Readiness Index proves to be a valuable tool for conducting self-assessments within Moroccan-based enterprises. These findings offer practical guidance for both industry practitioners and researchers seeking to navigate the complexities of Industry 4.0 maturity and grouping.

Keywords: Industry 4.0; Maturity Model; Self-Assessment Model; Clothing Industry.

RESUMEN

En 2011, el gobierno alemán lanzó la iniciativa visionaria conocida como Industria 4.0, con el objetivo de posicionarse a la vanguardia de la fabricación de última generación y del cambio hacia la transformación digital. A raíz de esta ola transformadora, numerosos fabricantes exploran continuamente vías para fortalecer sus capacidades y permanecer competitivos en el mercado. Este estudio empírico adopta un modelo de madurez inspirado en el Índice de Preparación para la Industria Inteligente de Singapur del Economic Development Board. El modelo permite a las empresas realizar autoevaluaciones, facilitando una alineación sistemática y completa con los principios de la Industria 4.0. La investigación profundiza en la evaluación de la madurez de la Industria 4.0 dentro de la industria textil marroquí, examinando los factores de índice de agrupación y la influencia de los factores clave en la autoevaluación de las empresas. Los resultados clasifican a 252 empresas de confección marroquíes en tres categorías distintas, resaltando una fuerte correlación positiva entre procesos, tecnología y organización. Significativamente, la mayoría de las 252 empresas evaluadas mediante el modelo de madurez aún parecen encontrarse en etapas tempranas o parcialmente maduras, lo que requiere mejoras significativas y una reevaluación de sus estrategias de transformación hacia la Industria 4.0. En conclusión, el Índice de Preparación para la Industria Inteligente de Singapur demuestra ser una herramienta valiosa para realizar autoevaluaciones en empresas con sede en Marruecos. Estos hallazgos ofrecen orientación práctica tanto para los profesionales de la industria como para los investigadores que buscan navegar por las complejidades de la madurez y la agrupación de la Industria 4.0.

Palabras clave: Industria 4.0; Modelo de Madurez; Modelo de Autoevaluación; Industria Textil.

INTRODUCTION

Amid the fourth industrial revolution, manufacturing industries are witnessing a global shift towards intelligent manufacturing, driven by the fusion of cutting-edge advancements in smart technology and information and communication technology (ICT). Governments worldwide, such as Germany (with Industry 4.0), the United States (embracing Smart Manufacturing), and South Korea (pioneering Smart Factory), are actively investing in technology development for intelligent manufacturing(1,2,3) Their efforts involve the implementation of diverse programs and initiatives, all aimed at positioning themselves as frontrunners in the realm of intelligent manufacturing.

As per the insights derived from the case study,(4) the adoption of Industry 4.0 (I4.0) is poised to introduce a myriad of challenges. While substantial research has examined the advantages and obstacles associated with I4.0 in developed nations, there exists a notable gap when it comes to understanding its implications in developing countries. Consequently, this case study sought to scrutinize the obstacles and advantages in order to assess the feasibility of implementing I4.0 within emerging African economies, drawing from diverse data sources. The study revealed that key hurdles in the path to I4.0 implementation in African countries with emerging economies encompass the promotion of innovative technologies via investments in research and development, the augmentation of intellectual property assets, the cultivation of requisite human capital, and the development of the "Internet plus" industry. The process of digitization within the global manufacturing landscape represents a new and transformative opportunity for Moroccan businesses to position themselves within the framework of Industry 4.0.

Hence, it is imperative to undertake a comprehensive review and evaluation of the readiness and maturity of each manufacturer and associated service providers in the context of Industry 4.0. Companies have the flexibility to select from various self-assessment models tailored to the implementation of their strategic initiatives. The collection of data regarding the current state of industries' development and the identification of key success factors are essential for companies looking to sustain their position as market leaders.

A significant global economic shift is taking place towards Africa, underscoring the increasing importance of the region in becoming a primary driver of global economic growth. Moroccan enterprises occupy a pivotal role in shaping the trajectory of the current global economy and in positioning North Africa, in particular, as the emerging hub for world manufacturing.

In 2020, Morocco secured the 4th position among MENA countries in the "Digital Risers" ranking, as per the European Centre for Digital Competitiveness. Hence, the inevitable shift towards manufacturing-based digital transformation is taking hold in these countries, with a particular focus on North Africa, where the active involvement of multinational corporations (MNCs) and large-scale enterprises (LC) is propelling the region closer to Industry 4.0. It's important to note that small and medium-sized enterprises (SMEs) also play a vital role in these industries.

The clothing industry in Morocco is a pivotal force in the nation's economy, acting as a key player in both manufacturing and exports. Rooted in a culturally rich textile heritage, Morocco has transitioned towards an export-oriented model, with a focus on ready-to-wear apparel targeting global markets, especially Europe and the U.S. In the context of Industry 4.0, the clothing industry in Morocco is undergoing a paradigm shift with the integration of advanced technologies.(5)

The primary objective of this study is to gauge the maturity level of Moroccan clothing manufacturing companies and investigate the disparities in how they evaluate and execute their strategies for implementing Industry 4.0. The following key research questions will be addressed. The Singapore Industry 4.0 Readiness Index (referred to as "the Index") is chosen as the central assessment instrument due to its multi-dimensional nature, which not only measures an enterprise's existing capabilities but also offers insights into strategies for improvement. Furthermore, the Index is designed with the practical application in mind, accommodating both small and medium-sized enterprises (SMEs) and multinational corporations (MNCs), with government support. The study's specific focus is on Moroccan enterprises, with particular emphasis on clothing enterprises, in order to evaluate their maturity levels.

Research Questions

RQ 1: (a) Is there a correlation between the maturity level of companies striving to meet Industry 4.0 criteria and their company size? (b) Are there positive or negative correlations among their technological, process, and organizational maturity levels? (c) Do these companies cluster together based on their evaluations?

RQ 2: (a) Do companies exhibit common characteristics based on their types and integration level? (b) Do certain enterprises type demonstrate higher maturity levels and hold strategic advantages?

RQ 3: Does the Singapore Index adequately cater to the needs of current Moroccan clothing companies seeking to enhance their capabilities in line with Industry 4.0 strategies?

To elucidate the concepts related to formulating and executing a transformation strategy, as guided by the research questions and objectives of this study, we investigate the interplay among processes, technology, and organizational aspects.

The subsequent sections of this paper are structured as follows: Section 2 outlines the empirical research design adopted, encompassing data gathered from 252 apparel companies in Morocco. Section 3 offers the research findings, including a cluster analysis of the groups and a comparison of groupings across different domains. Section 4 offers an in-depth discussion. Section 5 provides concluding remarks and offers suggestions for future research.Haut du formulaire

METHODS

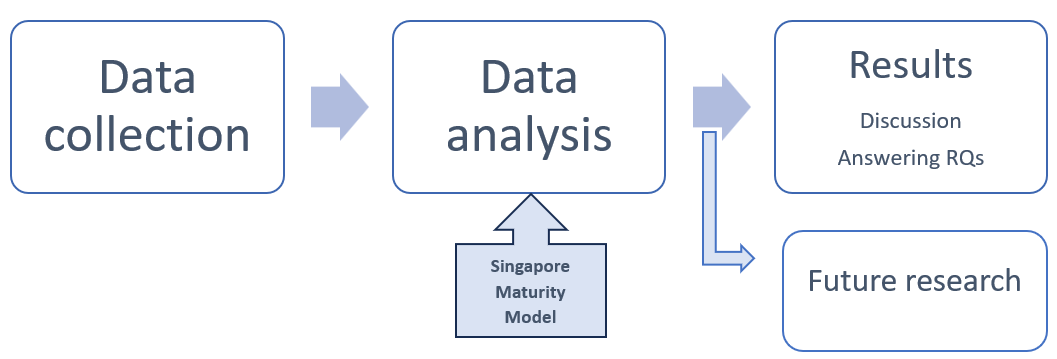

The following empirical analysis utilizes the Singapore Industry Maturity Model as its foundation. Figure 1 provides a visual representation of the research design employed in this study. Through an empirical study, we aim to evaluate the maturity levels of Morocco's clothing manufacturing systems, and the data collection process relies on online questionnaires to facilitate comprehensive analysis.

Figure 1. Empirical research process

Data collection

We administered online questionnaires to 252 Moroccan-based apparel manufacturing companies, the sample selection process is based on Slovin formula (6), targeting experienced executives in engineering, manufacturing, and decision-making roles. The apparel manufacturing industry plays a crucial role in Morocco's economic development, and the production of electric equipment and electronic appliances has driven a growing demand for new technologies to meet global customer needs and enhance market competitiveness. (7)

The Index

The Singapore Smart Industry Readiness Index, introduced by Singapore's Economic Development Board in November 2017, holds the distinction of being the world's first government-proposed tool for assessing the transformation of industrial sectors in the context of the fourth industrial revolution or Industry 4.0. This pioneering initiative originated from the Reference Architecture Model Industrie (RAMI) framework, designed to evaluate various industrial applications and enterprises of all sizes, including both small and medium-sized enterprises (SMEs) and multinational corporations (MNCs), while appraising the current state of their facilities.(8) Experts in academia and the field have conducted extensive assessments to ascertain the Index's suitability for practical application in assessing companies' progress related to Industry 4.0.(9)

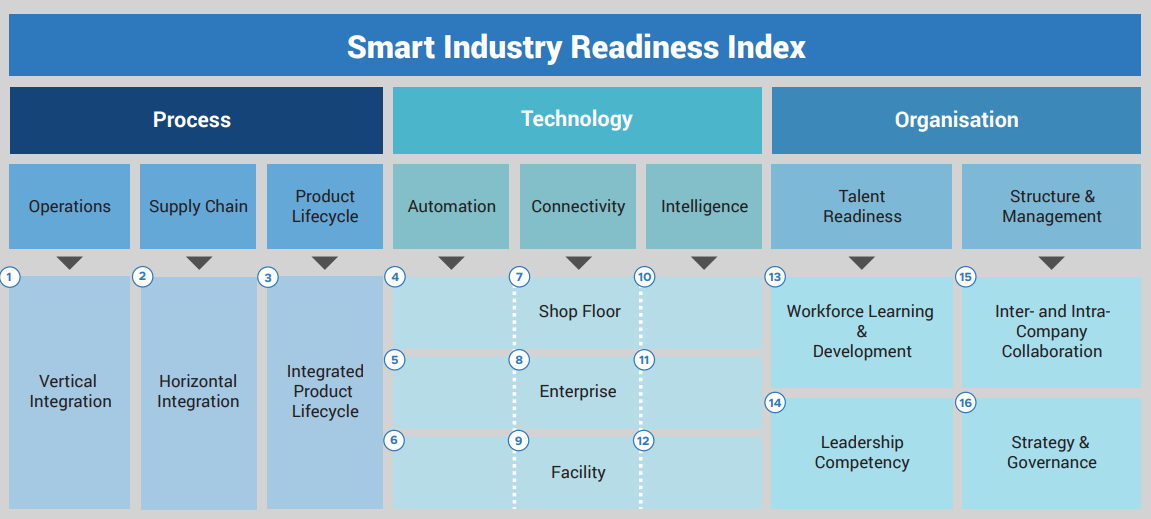

Figure 2 delineates the Index's structure, which encompasses three layers (process, technology, and organization) and delves into eight pillars of focus. These pillars, in turn, are further subdivided into 16 dimensions of assessment (Vertical Integration, Horizontal Integration, Integrated Product Lifecyle, Shopfloor Automation, Shopfloor Connectivity, Shopfloor Intelligence, Enterprise Automation, Enterprise Connectivity, Enterprise Intelligence, Facility Automation, Facility Connectivity, Facility Intelligence, Workforce Learning & Development, Leadership Competency, Inter-and Intra-Company Collaboration, Strategy & Governance), which represent the critical components of an organization. The Index provides an assessment matrix that empowers companies to gauge their existing processes, systems, and structures in alignment with these 16 dimensions. Additionally, the matrix offers a comprehensive improvement guide, where companies are guided through the necessary steps for each dimension.(8)

Figure 2. Singapore industry readiness index “SIRI”(8)

The comparative analysis conducted by Felippes et al.(10), demonstrates that the Index exhibits broader applicability across industry domains, types of enterprises, and government programs. This expanded scope allows manufacturing companies to leverage the Index for self-assessment as an integral component of their strategic planning process.

Maturity level description

The assessment of the 16 dimensions of the SIRI will be conducted using the SIRI Assessment Matrix (11). Moreover, we have provided definitions for maturity levels that manufacturing enterprises can use when self-assessing their transformation using the Index (figure 1).

Looking at table 2, it becomes evident that the required maturity level for the transition to smart manufacturing, with a focus on performance indicators and adaptability, will influence all transformation processes. For manufacturers, the extent and quality of their companies' adaptability to Industry 4.0 are pivotal. Therefore, companies should exert considerable effort to transition effectively towards smart manufacturing.

Enterprises must accurately identify the appropriate stage of model and strategy implementation to ensure a successful transformation. Drawing from the CMMI framework(12) and incorporating elements from Schuh et al.(13), we define the maturity levels as follows: not initiated, initial, managed, defined, optimized, and self-adapted (as depicted in Table 1), encompassing six levels of maturity for assessment. The initial levels bear similarities to prior I4.0 maturity models like the DREAMY Model,(14) while the 5th level draws inspiration from Schuh et al.(13) and aligns with the concept of adaptability, where continuous adaptation empowers a company to delegate certain decisions to IT systems, allowing for self-optimization in response to dynamic business environments. We have selected these two models primarily because they offer a structured maturity framework that aptly describes enterprises' capabilities at each level, closely resembling the conceptualization of the Index.

Table 2 illustrates that at level 0 (not initiated), a company fails to meet the criteria for at least one of the three maturity building blocks (process, technology, organization). Conversely, level 5 (self-adapted) implies that the company attains a maximum score (five) across the three building blocks of the SIRI, signifying comprehensive maturity. As a CMMI-based Model, SIRI introduces an initial step as 'level 0,' acknowledging that a company can enhance distinct areas with varying capabilities. In line with our goal of encompassing all possibilities within the six levels, 'level 1' in the SIRI Model (referred to as 'initiated') supersedes the CMMI levels 'performed' (for continuous improvement) and 'initial' (for staged improvement). The 'optimized' level of the SIRI diverges from the CMMI approach, consolidating the last two CMMI levels ('quantitatively managed' and 'optimized') into a single concept.

The topmost level in the SIRI is 'self-adapted,' representing an autonomous process wherein, for example, a piece of equipment is guided by sensors and actuators in real-time, responding to prevailing conditions. Decision-making in this context relies on algorithms that assess performance and offer suggestions to a well-trained human decision-maker.(10,15)

In our study, we establish six maturity levels within the Index for assessment purposes, as delineated in table 2. Maturity assessments provide insights into a company's current status for evaluation and lay the groundwork for further enhancements. This model defines six levels (0–5) of maturity across technology, process, and organization. Given that 16 questionnaires were administered in this study, the maximum attainable maturity score stands at 5, as illustrated in table 3. The maturity level score is calculated to offer an aggregated assessment of the achieved results, determining the company's overall maturity level effectively based on normalized values.

|

Table 1. Proposed Maturity Level definitions for the Index(10, 12,13,14,15) |

||

|

Levels |

Readiness status |

Definition |

|

Level 0 |

Not initiated |

At this level, the company lacks alignment with at least one of the three foundational building blocks of readiness. In such a scenario, while the company may have its internal processes in place, it lacks the capacity to effectively implement the principles of Industry 4.0. Consequently, it lacks a satisfactory level of maturity in organizational structure, technology, and/or processes, which are essential for preparing the company to adapt to the new Industry 4.0 paradigm. |

|

Level 1 |

Initiated |

The company aligns with the three readiness dimensions, indicating a willingness and recognition of the importance of Industry 4.0. However, this alignment is somewhat unstructured. The company is aware of the need for transformation but lacks a clear understanding of how to implement these changes effectively. |

|

Level 2 |

Managed |

the company has a good grasp of Industry 4.0 and actively plans for its implementation. It allocates resources, personnel, and infrastructure for this purpose. However, the solutions are still somewhat fragmented, with each department implementing individual solutions that require manual adjustments. The company is moving toward a more integrated approach but has not yet achieved a fully unified and automated system. |

|

Level 3 |

Defined |

the company has clearly defined goals, methods, and performance indicators for implementing Industry 4.0. It has established a well-defined and implemented process that includes all departments within the organization. This integrated approach ensures that the implementation of Industry 4.0 is systematic and cohesive across the entire company. |

|

Level 4 |

Optimized |

the company has implemented a data-driven optimization process for its goals, methods, and performance indicators related to Industry 4.0. These optimizations are carried out with managerial approval, ensuring that decision-makers are involved in the process. The company regularly evaluates its Industry 4.0 improvements within specified time periods and derives improvement measures, although this is still done manually. This signifies a proactive approach to continuous improvement in the context of Industry 4.0. |

|

Level 5 |

Self-adapted |

Building upon the concept of adaptability, as outlined in Schuh et al.(13), at this level, the company possesses a set of autonomous systems and a flexible organizational structure, technologies, and processes that enable self-optimization without the need for prior approval. This represents a high degree of adaptability and autonomy in the context of Industry 4.0. |

|

Table 2. Maturity level score and stage (based on questionnaire) |

|||||

|

Not initiated |

Initiated |

Managed |

Defined |

Optimized |

Self-adapted |

|

[0; 0,93[ |

[0,93; 1,25[ |

[1,25; 2,18[ |

[2,18; 3,12[ |

[3,12; 4,06[ |

[4,06; 5] |

|

Lack of maturity |

Incomplete maturity |

Maturity |

|||

Data analysis

Table 2 displays the scores representing the maturity levels of manufacturing enterprises, which are instrumental in assessing their current status for further analysis.

In this study, we performed

descriptive statistics on the collected data using Excel and estimated the

number of clusters. Subsequently, we conducted a K-means clustering analysis,

which is a widely used non-hierarchical clustering method among researchers.(16)

This analysis was based on the observed variables (Process, technology,

organization) in the sample and aimed to determine the most suitable number of

subgroups. Companies within the same cluster demonstrated a high degree of

homogeneity, while those belonging to different clusters exhibited greater

heterogeneity. This approach not only provided insights into the commonalities

within each cluster but also objectively categorized the companies.

The data were collected through an online survey and subsequently analyzed

using Excel to conduct cluster analysis. All constructs displayed sufficient

reliability. The analysis of covariance “ANCOVA”(17) was performed

to verify the effects of different dimensions. Additionally, we employed

Derivation and Pearson correlation analyses to explore factors influencing the

transformation aligned with Industry 4.0.

A total of 252 Moroccan clothing-based enterprises were recipients of the online questionnaire, these companies are representative of the Moroccan apparel industry, which is made up of 1 500 companies and their responses were based on the assessment matrix of the SIRI. Respondents were requested to specify their company's industry type, company size, work experience, level of integration in the value chain, and job title within the garment manufacturing domain. The examination of smart manufacturing transformation was contingent on the strategic plans of these companies. Among the respondents from the selected small and medium-sized enterprises (SMEs), large companies (LC), and multinational corporations (MNCs), 133 belonged to top management (comprising general managers, CEOs, and vice presidents), while 119 occupied senior positions in middle management (such as directors, operations managers, and technical managers with at least 13 years of experience in engineering, production management, and decision making). These enterprises operated within the clothing industry, and at the time of the study, their Industry 4.0 projects were either in the planning or execution phase.

RESULTS

Analysis results

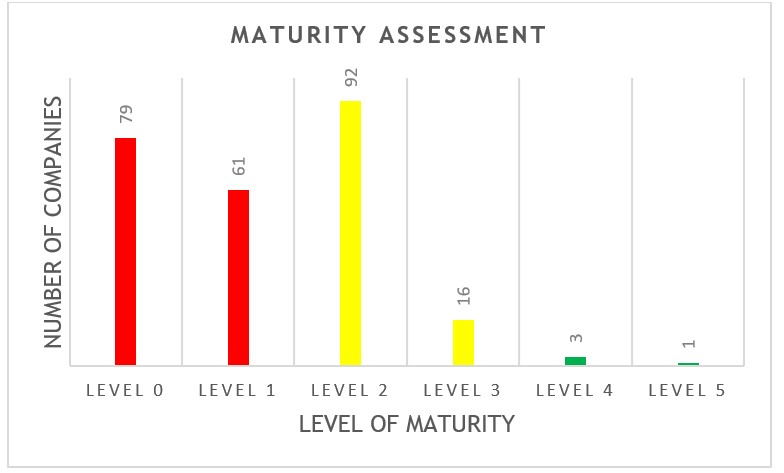

The evaluation of the 252 companies shows that 140 of them fall into “lack of maturity” category (level 0–1), 108 companies with an “incomplete maturity” (level 2–3), and 4 are considered “mature” (figure 3).

Figure 3. Overall maturity Assessment

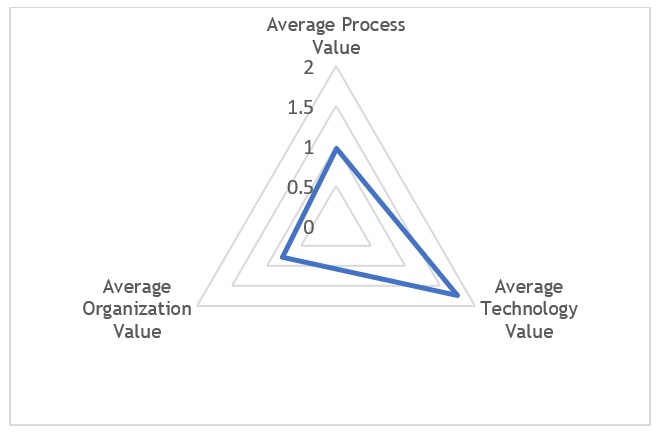

Furthermore, this study utilizes a radar chart (figure 4) to visualize the outcomes concerning the three dimensions: technology, process, and organization. On average, the technology dimension shows higher level of strength compared to the organization and process dimensions. Nevertheless, it's important to highlight that these values have potential for enhancement and do not yet signify optimal performance.

Figure 4. Overall radar chart

Table 3 displays the descriptive statistics represented by the mean values, standard deviations, Variance, and Kurtosis providing insights into the status of the three distinct groups. The study encompassed a survey of 252 companies, subjecting them to a K-means cluster analysis, resulting in their classification into three distinct groups.

|

Table 3. Descriptive statistics |

|||

|

|

Process |

Technology |

Organization |

|

Mean |

0,1947 |

0,3488 |

0,1562 |

|

S.D. |

0,0943 |

0,1716 |

0,0977 |

|

Variance |

0,0089 |

0,0294 |

0,0096 |

|

Kurtosis |

10,3694 |

0,1844 |

9,8981 |

|

N |

252 |

252 |

252 |

|

Confidence level (95%) |

0,0117 |

0,0212 |

0,0121 |

|

Note: Number of clusters observed= 3 |

|||

Table 3 elaborates on how the dimensions of process, technology, and organization contribute to a company's transformation within the context of Industry 4.0, the mean of each dimension represents the average score of the 252 enterprises (see the scale of scores in table 2). Comparing the standard deviations, it becomes evident that the technology dimension displays the highest degree (0,1716) of dispersion across the groups, indicating a higher concentration and greater variability in responses. In contrast, the dimensions of organization and process exhibit a lower dispersion. Moreover, means indicate that the central tendency differs between variables: "Technology" has a relatively higher mean (0,3488) than "Process" (0,1947) and "Organization" (0,1562). The kurtosis coefficient suggests a high concentration around the mean for "Process" (10,369) and "Organization" (9,89), while "Technology" (0,184) indicates a more balanced distribution. Finally, the confidence levels associated with the averages provide an indication of the reliability of these estimates.

Means reveal significant differences between variables, with "Technology" having a higher mean, indicating a higher central tendency for this variable. While, standard deviations show that "Technology" has a wider dispersion, reflecting greater variability in responses. Finally, the kurtosis coefficient suggests different distributions between the variables, with wider distribution tails on the positive side.

The table 4 below shows the results of the analysis of covariance (ANOVA) between the "Process", "Technology" and "Organization" variables. The values in the matrix are the covariances between the different pairs of variables.

|

Table 4. Analysis of Variance (ANOVA) |

|||

|

|

Process |

Technology |

Organization |

|

Process |

0,0088 |

0,0112 |

0,0072 |

|

Technology |

0,0112 |

0,0293 |

0,0145 |

|

Organization |

0,0072 |

0,0145 |

0,0095 |

There is a positive covariation of 0,0112 between "Process" and "Technology". This suggests that there is a tendency for these two variables to vary positively together. Moreover, there is a smaller positive covariation of 0,0072 between "Process" and "Organization". This also indicates a tendency for these two variables to vary positively together, but the relationship appears to be weaker than that between "Process" and "Technology". Also, there is a positive covariation of 0,0146 between "Technology" and "Organization". This suggests that there is a tendency for these two variables to vary positively together, with a potentially stronger relationship than that between "Process" and "Organization". The study subjecting 252 enterprises to a K-means cluster analysis for the purpose of categorization into three distinct groups.

In summary, covariance indicates the direction of the relationship between variables, but to quantify the strength of the relationship, it would be useful to calculate correlation coefficients.

Together, the statistical analyses of the "Process", "Technology" and "Organization" variables provide an in-depth understanding of the distribution, central tendency and dispersion of the data. Here are the main conclusions drawn from the three analyses: - A moderate positive correlation between "Process" and "Technology" suggests a significant relationship between these two variables, indicating a tendency to vary in a similar way. - A strong positive correlation between "Process" and "Organization" as well as "Technology" and "Organization" points to significant links between these pairs of variables. - Positive covariances between variables indicate tendencies to vary in a similar way, but do not quantify the strength of the relationship as correlation does.

The results indicate complex relationships between the variables studied. Correlations and covariances highlight dependencies between "Process", "Technology", and "Organization", while descriptive statistics reveal central tendencies and different distributions. This information is crucial for guiding future decisions and formulating further research hypotheses.

These results offer an in-depth view of the distribution, central tendency and dispersion of the data. It is important to note the differences between variables to guide a more nuanced interpretation, and to consider the contextual significance of these measures within the context of the study.

Table 5 presents Pearson's correlation coefficients, ranging from -1 to 1. A correlation coefficient closer to 1 signifies a stronger correlation between two variables, indicating that a change in one variable corresponds with a significant change in another. This correlation can either be positive or negative. The analysis uncovers a notable positive correlation among process, technology, and organization. In cases of positive correlation, the variables move in the same direction, meaning an increase in one variable leads to a proportional increase in the other. This varies from independent variables that exhibit negative correlations.

The correlation coefficient values indicate that there is a moderate positive correlation (0,6976) between the "Process" and "Technology" variables. This suggests that, in general, when one of these variables increases, the other tends to increase as well. Moreover, there is a strong positive correlation (0,7843) between the "Process" and "Organization" variables. This indicates a significant positive relationship between these two variables. Process improvement or modification is likely to go hand in hand with changes in organizational structure. In addition, there is a very strong positive correlation (0,8729) between the "Technology" and "Organization" variables. This suggests a strong relationship between technology use and process organization. Technological advances can be associated with significant changes in organizational structure.

In summary, correlation analysis indicates significant relationships between the variables studied. These results can provide useful insights into how changes in one aspect (process, technology, organization) may influence other aspects in the environment studied. However, it is important to note that correlation does not guarantee causality, and further analysis is required to understand possible causal relationships between these variables.

|

Table 5. Pearson’s correlation results |

|||

|

|

Process |

Technology |

Organization |

|

Process |

1 |

0,697 |

0,784 |

|

Technology |

0,697 |

1 |

0,872 |

|

Organisation |

0,784 |

0,872 |

1 |

|

Note: N=252 |

|||

Table 6 categorizes the 252 enterprises into three distinct groups and showcases the outcomes of the cluster analysis. The first, second, and third groups consist of 159, 78, and 15 companies, respectively. Group 1 and Group 3 exhibit substantial disparities.

In Group 2, which consists of 78 companies predominantly national prime contractor, several of them being small and medium-sized enterprises (SME) and large companies (LC), there is a notable presence of optimal values (process: 10,60, technology: 22,62, organization: 33,60). Consequently, organizations within this group display evident strength and vitality. They have made considerable advancements in relevant technologies and their processes exhibit good flexibility.

|

Table 6. Clustering analysis of groups: integration level and type |

|||

|

Grouping |

Final Clustering Centre |

||

|

C1 |

C2 |

C3 |

|

|

Process |

2,45 |

10,60 |

2,01 |

|

Technology |

3,08 |

22,62 |

4,24 |

|

Organisation |

6,99 |

33,60 |

9,06 |

|

Number of companies |

159 |

78 |

15 |

|

Level of integration /type |

90 % Sub-contractors; 92 % Co-contractors/ SMEs |

10 % Sub-contractors; 8 % Co-contractors; 95 % national prime contractor/SMEs; LC |

5 % national prime contractors; 100 % International contractors / LC; MNCs |

Groups 1 and 3, respectively, 159 and 15 enterprises, exhibit a relatively minor gap within the three dimensions. Group 1 comprises mostly SMEs, operating in sub-contracting and co-contracting. On the other hand, Group 3 includes large companies (LC) and multinational companies (MNCs) with specific expertise in finished product development. It is evident that the processes, technologies, and organizational capabilities of Group 3 surpass those of Group 2. Most of these companies are international contractors. Furthermore, Group 3 displays more flexibility in performance and boasts competitive technologies in comparison to Group 2. Nevertheless, Group 3 needs to continue their transformation journey and enhance their capabilities to remain aligned with Industry 4.0 standards, even though they already belong to the mid- or large-sized company category with expertise in various professional domains; to strive towards becoming digital champions (17), companies in Group 3 need to focus on enhancing their capabilities.

In summary, when compared to the other groups, Group 2 enjoys the advantage of diverse compositions across various integration levels, including sub-contracting, co-contracting, national prime contractor (takes orders directly from the international customer), as SMEs and LC. The different applications and fields in which these companies operate will influence the grouping and their ability to swiftly address the challenges of adopting smart manufacturing. Hence, agility and adaptability play crucial roles in influencing their processes, technologies, and organizational capabilities, allowing them to achieve greater market competitiveness.

|

|

|

|

|

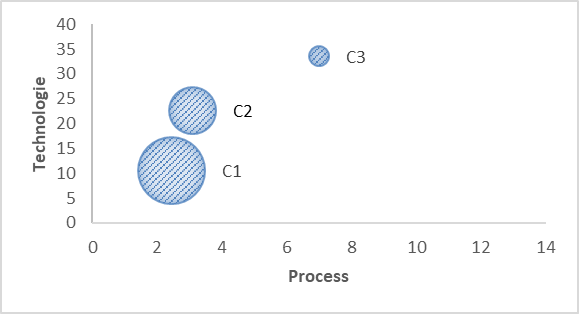

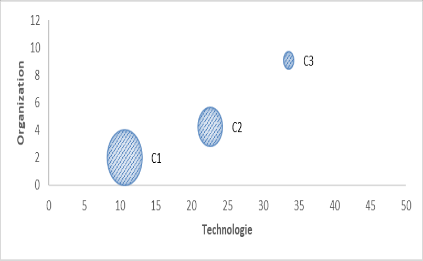

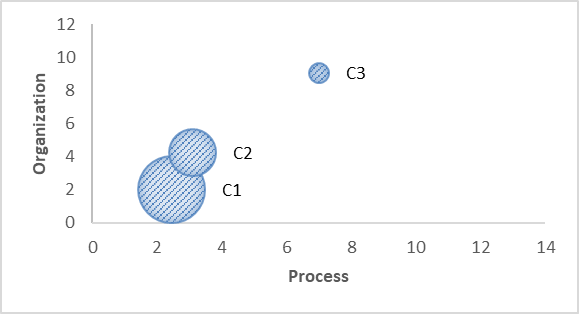

Figure 5. K-means clustering visualization |

||

Figure 5 shows the positioning of clusters in relation to different pairs of variables: Technology-Process; Organization-Technology; Organization-Process. We note that Cluster 3 (C3) companies are driven by international contractors who require regular monitoring of their orders, mainly through information technology and real-time productivity tracking. This is a channel for technology and know-how transfer. Consequently, these companies have made significant strides on the road to digital transformation, they have considerably improved their processes, organization and technological capabilities. C2 companies have made progress on the technological side, but they need to make more effort on the organization and process sides. C1 companies are lagging behind on the three pillars of digital transformation, they are essentially small companies that work mainly on the garment activity basis and only sell minutes of work.

Reliability of Data

Reliability is a fundamental concept that is commonly employed to assess and quantify biases and distortions.

|

Table 7. Reliability statistics |

||||

|

|

Process |

Technology |

Organization |

Global |

|

Number of items |

3 |

9 |

4 |

16 |

|

£S²(Xi) |

0,74808702 |

7,38969519 |

1,22628533 |

9,36406754 |

|

S²(Y) |

2,00164422 |

59,6233953 |

3,82146019 |

111,381332 |

|

Cronbach α |

0,939 |

0,985 |

0,905 |

0,976 |

Cronbach's alpha, initially developed by Lee Cronbach(19) in 1951, plays a crucial role in the assessment of questionnaires and evaluations (Guerin et al. 2015). In table 7, the Cronbach's α value exceeds 0,90 (specifically, 0,976), demonstrating a notably high level of reliability.

Cronbach's Index assesses the internal consistency of the measures in each category. The high Cronbach's Index for Technology (0,9856) underlines the high internal consistency of the measures in this category. Such a high value suggests that the different questions or items measuring technology in our survey are converging consistently towards an overall assessment of the variable. This reinforces the internal validity of our measures and increases confidence in the interpretation of results relating to the "Technology" category.

The high Cronbach's Index for the "Process" category (0,9394) and for the "Organization" category (0,9055) suggest a high degree of internal consistency between the different measures assessing processes. This implies that the different process-related questions or items converge coherently towards an overall assessment of the "Process" and "Organization" variables. This internal consistency reinforces the internal validity of the "Process" and "Organization" results.

DISCUSSION

The cluster approach has garnered widespread acceptance within academic and policymaking circles as an effective developmental strategy for both industries and societies.(20) This recognition is underscored by numerous studies that delve into innovation within Small and Medium Enterprises (SMEs),(21) technology-focused SMEs (22), and their overall performance.(23, 24, 25)

This study categorizes Moroccan Clothing enterprises into three clusters based on statistical models, a common practice in similar enterprises, as corroborated by previous research.(26,27) The exploration of Industry 4.0 clusters and their associated levels aligns with findings from an Austrian study on Industry 4.0 implementation,(28) indicating that the deployed technologies play a pivotal role in determining the level of implementation.

Results affirm that enterprises in Cluster 3 exhibit the highest Industry 4.0 deployment levels, showcasing proficiency across the three building blocks of the assessment model. These findings align with a Romanian study emphasizing the significance of technology in Industry 4.0(29) and supporting references(30) that highlight the importance of technology in Industry 4.0 deployment.

Drawing from Brozzi's work,(31) which utilized self-assessment tools for Industry 4.0 readiness, our research aligns with the identified categories: traditional craftsman, digital newcomer, ambitious, and digital champion. These categories mirror those in our study (Level 1: Initiated, Level 2: Managed, Level 3: Defined, Level4: Optimized, Level 5: Self-adapted), reinforcing the overall congruence between the research outcomes.

Contributions from this study align with Woods' findings,(26) confirming disparities in Industry 4.0 levels between SMEs and large enterprises. This supports Dubrova's assertion (32) that small businesses often face challenges in adopting high technology, potentially due to limited access to capital and associated IT expenditures, as reported by Statista.(33) The year-on-year increases in IT spending further underscore this difficulty, with SMEs experiencing a notable rise between 2017 and 2019.

Analyzing global expenditure trends from 2006 to 2021,(34) our study highlights in cluster 3, a substantial digital increase in national prime contractors (5 %) and international contractors (100 %). The cluster 2 is held by the Sub-contractors (10 %); Co-contractors (8 %); national prime contractor (95 %) as depicted by Gallab et al.(35) Cluster 1, as revealed in our research, lags behind in this aspect. However, it is also evident that there is some overlap in the clusters. This overlap is also explained by the fact that the factor variables are partly complementary and reflect the levels of Industry 4.0.

The adoption rates of robotic process automation also exhibit significant differences between small- and medium-sized enterprises and large enterprises in the field, as reported by Computer Economics.(36) This gap extends to the investment rate in robotic processes, with large enterprises far exceeding their smaller counterparts.

The results further highlight that clothing enterprises exhibit elevated values for variables at the third cluster, emphasizing the importance of technology, Process and organization in this context.

Our analysis indicates that most Clothing companies in Morocco are either immature or partially mature, emphasizing the need for further efforts toward transformation. Factors such as low capital production value, a shortage of skilled talent, and slow business model transformation are major challenges facing the manufacturing industry in Morocco.(35,37) To overcome these challenges, companies must embrace smart manufacturing processes, adopt smart applications, and make clear choices regarding their transformation path. Budget constraints and the shortage of talent resources can constrain the pace of transformation, thereby hindering market competitiveness. Given that all the companies involved in the value chain face the same challenges. In other words, the challenges imposed on them by competition to meet the demands of their principals, particularly in terms of quality and deadlines. This is why the parent company is involved in all stages of production of the components of the subcontracted product. For subcontractors, this involvement represents an opportunity to develop their skills. Similarly, parent companies, which in turn are subcontractors of major foreign principals, provide technical, managerial, technological, and financial support to help subcontractors manage their problems.(38) So, it's a question of assistance and continuous support.

CONCLUSION

This study delves into the assessment of a maturity model through K-means cluster analysis, aiming to investigate key factors influencing clustering while addressing the challenges associated with assessing the maturity of technologies, processes, and organizations within Moroccan-based clothing enterprises.

This study sheds light on companies' quest for a suitable maturity model to support their endeavors in the competitive environment of Industry 4.0. While various maturity models have been proposed, the three core dimensions remain essential for companies evaluating new opportunities and embracing transformation solutions. The study indicates that the Singapore Smart Industry Readiness Index is well-suited for conducting self-assessments in apparel Moroccan enterprises of diverse sizes and integration level. As a result, companies can leverage the findings of this study to explore avenues for self-assessment. The focus of this study is on manufacturing, in future work, other aspects such as technical developments under Industry 4.0 can be considered.

REFERENCES

1. Kang, H. S., J. Y. Lee, S. S. Choi, H. Kim, J. H. Park, J. Y. Son, B. H. Kim, and S. D. Noh. 2016. “Smart Manufacturing: Past Research, Present Findings, and Future Directions.” International Journal of Precision Engineering and Manufacturing-Green Technology 3 (1): 111–128. doi:10.1007/ s40684-016-0015-5.

2. Pereira, A. C., & Romero, F. (2017). A review of the meanings and the implications of the Industry 4.0 concept. Procedia manufacturing, 13, 1206-1214.

3. Rahamaddulla, S. R. B., Leman, Z., Baharudin, B. H. T. B., & Ahmad, S. A. (2021). Conceptualizing smart manufacturing readiness-maturity model for small and medium enterprise (sme) in malaysia. Sustainability, 13(17), 9793.

4. Kassa, M.K., Wube, H.D. (2023). Benefits and Challenges of Industry 4.0 in African Emerging Economies. In: Girma Debelee, T., Ibenthal, A., Schwenker, F. (eds) Pan-African Conference on Artificial Intelligence. PanAfriCon AI 2022. Communications in Computer and Information Science, vol 1800. Springer, Cham. https://doi.org/10.1007/978-3-031-31327-1_15.

5. Auktor, Georgeta Vidican (2022): The opportunities and challenges of Industry 4.0 for industrial development: A case study of Morocco's automotive and garment sectors, Discussion Paper, No. 2/2022, ISBN 978-3-96021-179-2, Deutsches Institut für Entwicklungspolitik (DIE), Bonn, https://doi.org/10.23661/dp2.2022

6. Wirawan, M. V., & Melinda, T. THE INFLUENCE OF SERVICE QUALITY AND PRICE TOWARDS PURCHASING DECISION FOR ANUGERAH SOUND SYSTEM SERVICE EMPLOYMENT. HELD BY CIPUTRA UNIVERSITY COLLABORATED WITH, 84.)

7. He, X., Wu, X., Croasdell, D., & Zhao, Y. (2022). Dynamic capability, ambidexterity and social network—empirical evidence from SMEs in China. Journal of Small Business and Enterprise Development, 29(6), 958-974.

8. Singapore Economic Development Board. 2017. "Singapore Smart Industry Readiness Index: Catalyzing the Transformation of Manufacturing". 1–46. Accessed 20 October 2023. https://www.edb.gov.sg/en/news-andresources/news/advanced-manufacturing-release.html

9. Shukla, M., & Shankar, R. (2023). Readiness assessment for smart manufacturing system implementation: multiple case of Indian small and medium enterprises. International Journal of Computer Integrated Manufacturing, 1-19.

10. Bruna Felippes, Isaac da Silva, Sanderson Barbalho, Tobias Adam, Ina Heine & Robert Schmitt (2022) 3D-CUBE readiness model for industry 4.0: technological, organizational, and process maturity enablers, Production & Manufacturing Research, 10:1, 875-937, DOI: 10.1080/21693277.2022.2135628.

11. Singapure, E. (2020). THE SMART INDUSTRY READINESS INDEX Catalysing the transformation of manufacturing. EDB Singapure. Recuperado de: https://www. edb. gov. sg/content/dam/edb-en/aboutedb/media-releases/news/the-smart-industry-readiness-index/the-sgsmart-industry-readiness-index-whitepaper, 20(1).

12. Chrissis, M. B., Wemyss, G., Goldenson, D., Konrad, M., Smith, K., & CARNEGIE-MELLON UNIV PITTSBURGH PA SOFTWARE ENGINEERING INST. (2003). CMMI (Trademark) Interpretive Guidance Project: Preliminary Report.

13. Schuh, G., Anderl, R., Gausemeier, J., Ten Hompel, M., & Wahlster, W. (Eds.). (2017). Industrie 4.0 maturity index: die digitale transformation von unternehmen gestalten. Herbert Utz Verlag.

14. De Carolis, A., Macchi, M., Negri, E., & Terzi, S. (2017). A maturity model for assessing the digital readiness of manufacturing companies. In Advances in Production Management Systems. The Path to Intelligent, Collaborative and Sustainable Manufacturing: IFIP WG 5.7 International Conference, APMS 2017, Hamburg, Germany, September 3-7, 2017, Proceedings, Part I (pp. 13-20). Springer International Publishing.

15. Gamache, S., Abdul-Nour, G., & Baril, C. (2020). Evaluation of the influence parameters of Industry 4.0 and their impact on the Quebec manufacturing SMEs: The first findings. Cogent Engineering, 7(1), 1771818.

16. Reisenhofer, E., Picciotto, A., & Li, D. (1995). A factor analysis approach to the study of the eutrophication of a shallow, temperate lake (San Daniele, North Eastern Italy). Analytica Chimica Acta, 306(1), 99-106.

17. Jamieson, J. (2004). Analysis of covariance (ANCOVA) with difference scores. International Journal of Psychophysiology, 52(3), 277-283.

18. PwC. 2018. “Global Digital Operations Survey.” Accessed 22 October 2023. https://www.pwc.com/gx/en/industries/industry-4-0.html

19. Cronbach, L. 1951. “Coefficient Alpha and the Internal Structure of Tests.” Psychomerika 16: 297–334. doi:10.1007/ BF02310555.

20. Rahman, S.M.T.; Kabir, A. Potential cluster regions for manufacturing small and medium enterprises in khulna city of bangladesh: A spatial examination. Int. J. Recent Technol. Eng. 2019, 8, 980–986.

21. Rodríguez, A.J.G.; Barón, N.J.; Martínez, J.M.G. Validity of dynamic capabilities in the operation based on new sustainability narratives on nature tourism SMEs and clusters. Sustainability 2020, 12, 1004. / Nestle, V.; Täube, F.A.; Heidenreich, S.; Bogers, M. Establishing open innovation culture in cluster initiatives: The role of trust and information asymmetry. Technol. Forecast. Soc. Chang. 2019, 146, 563–572.

22. Pelletier, C.; Cloutier, L.M. Conceptualising digital transformation in SMEs: An ecosystemic perspective. J. Small Bus. Enterp. Dev. 2019, 26, 855–876.

23. Jami Pour, M.; Asarian, M. Strategic orientations, knowledge management (KM) and business performance: An exploratory study in SMEs using clustering analysis. Kybernetes 2019, 48, 1942–1964.

24. Cicea, C.; Popa, I.; Marinescu, C.; S, tefan, S.C. Determinants of SMEs’ performance: Evidence from European countries. Econ. Res. Ekon. Istraz. 2019, 32, 1602–1620.

25. Dubravska, M.; Sira, E. The analysis of the factors influencing the international trade of the slovak republic. In Proceedings of the 2nd Global Conference on Business, Economics, Management and Tourism, Prague, Czech Republic, 30–31 October 2014; Iacob, A.I., Ed.; Elsevier: Amsterdam, The Netherlands, 2015; Volume 23, pp. 1210–1216.

26. Woods, J.; Galbraith, B.; Hewitt-Dundas, N. Network centrality and open innovation: A social network analysis of an SME manufacturing cluster. IEEE Trans. Eng. Manag. 2019, 1–14.

27. Viloria, A.; Lezama, O.B.P. Improvements for determining the number of clusters in k-means for innovation databases in SMEs. Procedia Comput. Sci. 2019, 151, 1201–1206.

28. Pessl, E.; Sorko, S.R.; Mayer, B. Roadmap industry 4.0—Implementation guideline for enterprises. Int. J. Sci. Technol. Soc. 2020, 5, 1728–1743.

29. Turkes, M.C.; Oncioiu, I.; Aslam, H.D.; Marin-Pantelescu, A.; Topor, D.I.; Capusneanu, S. Drivers and barriers in using industry 4.0: A perspective of SMEs in Romania. Processes 2019, 7, 153.

30. Fox, S. Moveable production systems for sustainable development and trade: Limitations, opportunities and barriers. Sustainability 2019, 11, 5154.

31. Brozzi, R.; D’Amico, R.D.; Pasetti Monizza, G.; Marcher, C.; Riedl, M.; Matt, D. Design of Self-Assessment Tools to Measure Industry 4.0 Readiness. A Methodological Approach for Craftsmanship SMEs; Springer: New York, NY, USA, 2018; Volume 540, ISBN 9783030016135, ISSN 18684238.

32. Dubrova, T.A.; Ermolina, A.A.; Esenin, M.A. Innovative activities of SMEs in Russia: Constraints and growth factors. Int. J. Econ. Bus. Adm. 2019, 7, 26–40.

33. Statista Worldwide Semiannual Small and Medium Business Spending Guide. Available online: https://www.statista.com/statistics/760799/worldwide-small-medium-business-it-spending/ (accessed on 10 November 2023).

34. IDC Worldwide Semiannual Small and Medium Business Spending Guide. Available online: https://www.statista.com/statistics/800684/worldwide-small-medium-business-it-spending-growth/ (accessed on 20 November 2023).

35. Gallab, M., Bouloiz, H., Kebe, S.A. et al. Opportunities and challenges of the industry 4.0 in industrial companies: a survey on Moroccan firms. J. Ind. Bus. Econ. 48, 413–439 (2021). https://doi.org/10.1007/s40812-021-00190-1.

36. Computer Economics Robotic Process Automation Adoption Trends and Customer Experience. Available online: https://www.statista.com/statistics/1017027/worldwide-robotic-process-automation-adoption-investment-rates-organization-size/ (accessed on 10 November 2023)

37. El Hamdi, S., Oudani, M., Abouabdellah, A. (2020). Morocco’s Readiness to Industry 4.0. In: Bouhlel, M., Rovetta, S. (eds) Proceedings of the 8th International Conference on Sciences of Electronics, Technologies of Information and Telecommunications (SETIT’18), Vol.1. SETIT 2018. Smart Innovation, Systems and Technologies, vol 146. Springer, Cham. https://doi.org/10.1007/978-3-030-21005-2_44.

38. KHOURIBA, K., & YAOUHI, M. (2021). Le degré d’intégration des sous-traitants marocains dans le secteur du textile-habillement: est-il vraiment une sous-traitance de capacité?. International Journal of Financial Accountability, Economics, Management, and Auditing (IJFAEMA), 3(3), 302-321.

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Younes JAMOULI, Samir TETOUANI, Omar CHERKAOUI, Aziz SOULHI.

Research: Younes JAMOULI, Samir TETOUANI, Omar CHERKAOUI, Aziz SOULHI.

Drafting - original draft: Younes JAMOULI, Samir TETOUANI.

Writing - proofreading and editing: Younes JAMOULI.