doi: 10.56294/dm2024208

ORIGINAL

Economic Growth Unleashed: The Power of Institutional Quality

El crecimiento económico liberado: El poder de la calidad institucional

El Houssaine Fathi1 ![]() *, Ahlam Qafas1

*, Ahlam Qafas1 ![]() *, Youness Jouilil2

*, Youness Jouilil2 ![]() *

*

1National School of Commerce and Management, Ibn Tofail University, Kenitra, Morocco.

2Hassan II University of Casablanca, Casablanca, Morocco.

Cite as: Fathi EH, Qafas A, Jouilil Y. Economic Growth Unleashed: The Power of Institutional Quality . Data and Metadata. 2024; 3:208. https://doi.org/10.56294/dm2024208

Recibido: Revisado: Aceptado: Publicado:

Editor: Prof.

Dr. Javier González Argote ![]()

ABSTRACT

This paper examines the relationship between economic growth and institutional quality in the context of the Moroccan economy. Using annual data from 1970 to 2020 and an Autoregressive Distributed Lag (ARDL) cointegration approach, we analyze the long-run and short-run nexus between these two variables. The statistical tests performed, including the ADF and Phillips Perron tests, indicate integration at different orders, and the bounds cointegration test proposed by Pesaran was also conducted. The study finds that institutional quality has a positive short-term impact on economic growth. Furthermore, in the long term, the study reveals that institutional quality continues to positively influence economic growth in Morocco (P-value=0,01<5 %). These results contribute valuable insights to the existing empirical literature and can guide policymakers and stakeholders in implementing institutional reforms to promote economic development.

Keywords: Economic Growth; Institutional Quality; ARDL; Cointegration; Stationarity.

RESUMEN

Este estudio examina la relación entre el crecimiento económico y la calidad institucional en el contexto de la economía marroquí. Utilizando datos anuales desde 1970 hasta 2020 y un enfoque de cointegración de Retraso Distribuido Autorregresivo (ARDL, por sus siglas en inglés), analizamos la conexión a largo y corto plazo entre estas dos variables. Las pruebas estadísticas realizadas, incluidas las pruebas ADF y Phillips Perron, indican integración en diferentes órdenes, y también se llevó a cabo la prueba de cointegración de límites propuesta por Pesaran. El estudio encuentra que la calidad institucional tiene un impacto positivo a corto plazo en el crecimiento económico. Además, a largo plazo, el estudio revela que la calidad institucional continúa influyendo positivamente en el crecimiento económico en Marruecos (valor P = 0,01 <5 %). Estos resultados aportan información valiosa a la literatura empírica existente y pueden guiar a los responsables políticos y partes interesadas en la implementación de reformas institucionales para promover el desarrollo económico.

Palabras clave: Crecimiento Económico; Calidad Institucional; ARDL; Cointegración; Estacionariedad.

INTRODUCTION

Research context

Economic growth is a crucial factor in reducing poverty and improving the standard of living for Moroccans. According to the World Bank, Morocco has witnessed an average annual growth rate of approximately 3,6 % over the past decade (from 2011 to 2020), positioning it among the fastest-growing economies in North Africa. The government has implemented several measures to stimulate economic growth, such as investing in infrastructure, promoting foreign investment, and expanding the manufacturing and tourism sectors. Despite its commendable growth trajectory, Morocco still confronts certain challenges such as high unemployment rates, income inequality, and a significant informal sector. To tackle these issues, the government has initiated various schemes, such as a national employment strategy, a social welfare program, and measures to enhance access to finance. Overall, sustained economic growth has the potential to significantly enhance the country’s development and improve the lives of its people.

The quality of institutions has been shown to have a significant impact on a country's economic development and growth. Institutions provide a stable and predictable environment for businesses to operate, which is crucial for fostering economic activity. The quality of institutions in Morocco has been a topic of debate, despite significant improvements in the country's institutional framework. This study aims to investigate the relationship between institution quality and economic development in Morocco, specifically focusing on how political stability, regulatory quality, and the rule of law impact economic growth. The findings of this study could be valuable for policymakers and stakeholders in Morocco, as they work towards promoting sustainable economic growth in the country.

In the given context, the study seeks to enhance the existing research on the influence of institutions on economic growth. Our specific objective is to examine the tangible effects of institutional quality on economic growth, utilizing an index developed by the Worldwide Governance Indicators (WGI). This will be accomplished by employing an Auto Regressive Distributed Lug RDL model.

Objectives of this study

This study aims to examine the relationship between institutional quality and economic growth, considering various control variables. It also intends to test for causality between these variables and assess the short-term and long-term impacts of institutional quality on economic growth.

To achieve this objective, the manuscript will be structured as follows: Firstly, a comprehensive theoretical framework will be provided, highlighting the critical role of institutions in driving economic growth. Secondly, an exploratory analysis will be conducted using descriptive and correlation techniques to establish an empirical context and initial insights. Thirdly, robust econometric methods will be employed to estimate the causal relationship between institutional quality and economic growth. Finally, the findings will be critically discussed, emphasizing their implications and limitations. Concluding remarks will then be presented, summarizing the key insights from the study and emphasizing their significance.

Literature review

In recent decades, numerous studies have examined the relationship between the quality of institutions and economic growth. This line of research has emerged as a prominent area of investigation within the field of economics, as scholars seek to understand the fundamental drivers of long-term economic development. The consensus that has emerged from these studies underscores the critical role of institutional quality in shaping economic outcomes.

In general, the term "institution" encompasses long-standing customs, traditions, organizations, and systems that hold significant importance in a particular society or group. According to Aristotle's Politics, the City-State is a natural institution that predates both households and individuals, existing primarily for the welfare and ultimate benefit of its citizens. In a broader sense, institutions establish the rules within societies and exert a crucial influence on the functioning of national economies, impacting all economic actors. Consequently, institutions play a vital role in economic growth, and the quality of institutions becomes a pivotal factor in the pursuit of economic prosperity and progress.(1)

Acemoglu et al.(2) provide compelling evidence on the impact of institutions by investigating the colonial origins of comparative development. Their empirical analysis reveals that countries with more secure property rights and stronger institutional frameworks tend to exhibit higher levels of economic growth. Building on this foundation, Rodrik et al.(3) emphasize the primacy of institutions over geography and trade in explaining economic development. Their findings suggest that institutions play a crucial role in determining long-term economic performance, surpassing the influence of geographical factors and trade integration.

Hall and Jones contribute to this body of literature by exploring the sources of economic growth across countries. Their research reveals that differences in institutional quality, particularly in terms of protection of property rights and efficient legal systems, explain a substantial portion of the variation in output per worker.

Easterly and Levine (4) further support the significance of institutions by examining the role of institutions, geography, and economic development. They find that the quality of institutions, including factors such as property rights, contract enforcement, and political stability, significantly influences economic growth, surpassing the impact of geographic characteristics. Hall et al.(5) contribute to this body of literature by exploring the sources of economic growth across countries. Their research reveals that differences in institutional quality, particularly in terms of protection of property rights and efficient legal systems, explain a substantial portion of the variation in output per worker.

Examining the detrimental effects of weak institutions, Mauro(6) focuses on corruption and its impact on economic growth. His analysis highlights the negative association between corruption and long-term economic development, underscoring the importance of strong institutions in fostering sustainable growth.

A seminal contribution to this field comes from the work of North,(7) who provides a comprehensive analysis of institutions and their influence on economic performance. His influential book emphasizes that institutions serve as the rules of the game in a society, shaping economic behavior and outcomes.

According to Siddiqui,(8) there are strong connections between the quality of institutions, macroeconomic stability, and economic performance. Additionally, Siddiqui's research supports the idea of conditional convergence as predicted by modern growth theories.

Walid et al. (9) conducted a recent study that explores how political institutions influence economic development through their impact on economic reforms. The study primarily focuses on the relationship between political institutions and economic reforms and concludes that democracy plays a vital role in driving redistributive policies such as transfers, subsidies, trade liberalization, and credit market deregulation.

In summary, the existing literature consistently demonstrates that the quality of institutions, encompassing factors such as property rights, rule of law, and governance, is a crucial determinant of economic growth. Countries with stronger and more inclusive institutions tend to experience higher levels of economic development.(10,11) However, further investigation is warranted to explore the precise mechanisms through which institutions impact growth and to identify the specific dimensions of institutional quality that are most influential in different contexts.

This review provides a solid foundation for this study, which seeks to contribute to the understanding of the relationship between institutional quality and economic growth. By addressing the gaps in the literature and building upon the existing body of research, we aim to provide valuable insights into the mechanisms and dynamics underlying this crucial nexus.

METHODOLOGY

Data

To test the hypothesis introduced earlier, this analysis concentrates on studying time series data sourced from the World Bank development indicators and the Worldwide Governance Indicators (WGI). The dataset covers the period from 1970 to 2020. A concise summary of the selected variables for analysis is provided in table 1.

|

Table 1. Variables Description |

|||

|

Label |

Description |

Sign |

Data source |

|

Dependent variable |

|||

|

GDPG |

Gross Domestic Product Growth refers to the increase in the value of all goods and services produced within a country's borders over a year. |

|

World Bank |

|

Independent variables |

|||

|

QI |

Quality of Institutions Index: This index is constructed from six individual measures: Voice and Accountability, Political Stability and Absence of Violence/Terrorism, Government Effectiveness, Regulatory Quality, Rule of Law, and Control of Corruption. |

Positive effect expected |

Worldwide Governance Indicators |

|

Controls variables |

|||

|

GSPEND |

Government Spending: to measure macroeconomic stability we will use government expenditure by a percentage of the GDP. |

Negative effect expected |

World Bank |

|

INF |

Inflation rate: we will take the annual percentage rate of inflation and treat it as an indicator of macroeconomic stability. |

Negative effect expected |

World Bank |

|

TOINDEX |

Trade Openness Index: we use as an indicator of trade openness the sum of exports and imports of goods and services measured as a share of gross domestic product. |

Positive effect expected. |

World Bank |

|

HCAPI |

Human Capital: we use the gross secondary school enrollment rate. |

Positive effect expected. |

World Bank |

|

PGROWTH |

Population Growth: we will use the population growth rate of countries as a determinant of economic growth |

Negative effect expected |

World Bank |

ARDL Methodology

Based on the literature review, the growth model employed in this study can be expressed as follows:

GDPG=f(IGDP,INF,GSPEND,PGROWTH,TOINDEX,HCAPI,QI) (1)

Autoregressive Distributed Lag (ARDL) models are dynamic models used for analyzing time series data. Unlike simple models that only account for instantaneous effects, ARDL models consider the temporal dynamics of variables. These dynamics encompass factors such as adjustment delays, expectations, and other influences that shape the variable's behavior over time.

By incorporating these temporal dynamics, ARDL models can better capture the complexities of real-world phenomena. Consequently, they provide more accurate forecasts and more effective policy recommendations. This is particularly valuable in scenarios where a variable's behavior is influenced by less obvious factors or when the impacts of policy interventions unfold gradually.

If we consider the dependent variable "Yt "and the independent variable "Xt", we will note:

![]()

In its explicit general form, an ARDL model is written as follows:

![]()

Or also:

![]()

ARDL models are part of the dynamic model family, enabling the analysis of both short-term dynamics and long-term effects in series that exhibit different levels of integration, including cointegration. This is exemplified by the bounds testing method developed by Pesaran et al.(12) However, it is important to note that ARDL models cannot be applied to series integrated up to order 1.

In this study, we utilize the Auto-Regressive Distributed Lag (ARDL) model, a widely adopted approach for analyzing the relationships among economic variables in a single-equation time series. This model is favored due to its ability to treat the co-integration of non-stationary variables as an Error Correction (EC) process. By employing the EC representation, we can test for the presence of long-term relationships and co-integration. The ARDL/EC model serves as a valuable tool for forecasting long-term relationships and capturing short-term dynamics.

Moreover, the ARDL model is well-suited for this dataset as it can accommodate a combination of variable stationarity, including both I(0) and I(1) variables observed in our study. The primary equation of the ARDL model can be formulated as follows:

![]()

Where: is the first deference operator, constant, represents the short-run effect, α1… α7 represents the long-run effect and μ_t~iid(0,σ) is the error term.

Unit Root Test

To determine the stationarity or order of the variables, the study employed the Augmented Dickey-Fuller (ADF) test. This test was conducted to examine whether the variables exhibit a unit root. Dickey and Fuller propose that if the variables are stationary at the level, they are classified as integrated at order zero I(0). Conversely, if the variables are stationary at the first difference, they are categorized as integrated at order one I(1). For the ARDL model to be applicable, it necessitates that all variables are either I(0) or I(1). However, it's crucial to note that if a variable is integrated at order two I(2), the estimation of the ARDL model is no longer valid. Results are presented in table 4.

Cointegration test

Cointegration between series assumes the existence of one or more long-term equilibrium relationships among them. These relationships can be incorporated with the short-term dynamics of the series in an error correction (vector) model, which has the following form:

![]()

Where: vector of stationary variables under study (whose dynamics are being explained), matrix of the same dimension as (where r(A)= number of cointegration relation), matrix of parameters associated with

Several tests and approaches exist in the econometric literature to examine the presence of cointegration between series. These include the Pesaran et al. test, (12) the Engel and Granger test, (13) and the Johansen test.(14)

When dealing with multiple variables integrated at different orders (I(0), I(1)), the "bounds test to cointegration" developed by Pesaran can be utilized. This cointegration test allows for the examination of cointegration in such cases. The results of the cointegration test in this study are presented in the table 5.

Causality test

Traditional causality tests, such as the Granger test, are designed to be applied only to stationary time series. However, these tests become ineffective when variables are integrated at different orders. In such cases, the Toda-Yamamoto causality test (15) is used. This test allows for the evaluation of the presence or absence of causality between variables, with the null hypothesis stating the absence of causality (probability χ2 > 5 %). The procedure of the Granger causality test proposed by Toda and Yamamoto is as follows:

· Find the maximum order of integration of the series under study by using stationarity tests.

· Determine the optimal lag or delay of the VAR in the level under study or autoregressive polynomial (AR) by using information criteria (AIC, SIC, and HQ).

· Estimate a VAR in the augmented.

RESULTS AND DISCUSSION

Descriptive Statistics and correlation analysis

The table below represents the descriptive statistics of the variables considered in the development of the econometric model

|

Table 2. Descriptive analysis |

|||||||

|

|

GDPG |

CAPIH |

GSPEND |

INF |

PGROWTH |

QI |

TOINDEX |

|

Mean |

4,188320 |

39,49470 |

17,34668 |

4,477507 |

1,793501 |

5,414510 |

58,28246 |

|

Median |

4,029738 |

37,24092 |

17,69217 |

3,024895 |

1,552141 |

5,300000 |

54,99236 |

|

Maximum |

12,37288 |

82,45423 |

21,67107 |

33,02313 |

2,656761 |

6,890000 |

85,67282 |

|

Minimum |

-7,187080 |

11,25432 |

11,66719 |

-0,742288 |

1,043584 |

3,550000 |

36,67924 |

|

Std. Dev. |

4,078350 |

19,84362 |

2,138101 |

6,106441 |

0,565361 |

0,841518 |

12,22197 |

|

Skewness |

-0,430534 |

0,584005 |

-0,800509 |

2,952939 |

0,389678 |

-0,496745 |

0,685216 |

|

Kurtosis |

3,588309 |

2,666389 |

4,418995 |

13,31442 |

1,485947 |

2,415372 |

2,704273 |

|

Jarque-Bera |

2,084460 |

2,828121 |

8,772215 |

270,7612 |

5,557858 |

3,377907 |

3,767282 |

|

Probability |

0,352667 |

0,243154 |

0,012449 |

0,000000 |

0,062105 |

0,184713 |

0,152036 |

|

Sum |

192,6627 |

1816,756 |

797,9471 |

205,9653 |

82,50105 |

255,2100 |

2680,993 |

|

Sum Sq. Dev. |

748,4821 |

17719,62 |

205,7165 |

1677,988 |

14,38347 |

19,43412 |

6721,944 |

|

Observations |

51 |

51 |

51 |

51 |

51 |

51 |

51 |

The average GDP growth rate for Morocco from 1970 to 2020 was 4,18 %, with a minimum of -7,18 % recorded in 2020 and a maximum of 12,37 % recorded in 1996. The average value of our quality of institutions index is 5,41, ranging from a minimum of 3,55 to a maximum of 6,89. In terms of other control variables, government expenditure averaged 17,34 % of the GDP. The average inflation rate during this period was 4,47 %. The population growth rate averaged 1,79 %, and the human capital index had an average value of 39,49.

|

Table 3. Correlation Matrix |

|||||||

|

|

GDPG |

CAPIH |

GSPEND |

INF |

PGROWTH |

QI |

TOINDEX |

|

GDPG |

1,000000 |

|

|

|

|

|

|

|

CAPIH |

-0,201405 |

1,000000 |

|

|

|

|

|

|

|

0,1795 |

----- |

|

|

|

|

|

|

GSPEND |

-0,074430 |

0,327345 |

1,000000 |

|

|

|

|

|

|

0,6230 |

0,0264 |

----- |

|

|

|

|

|

INF |

-0,004086 |

-0,497135 |

-0,141824 |

1,000000 |

|

|

|

|

|

0,9785 |

0,0004 |

0,3471 |

----- |

|

|

|

|

PGROWTH |

0,162527 |

-0,852005 |

-0,194782 |

0,611777 |

1,000000 |

|

|

|

|

0,2805 |

0,0000 |

0,1946 |

0,0000 |

----- |

|

|

|

QI |

-0,169959 |

0,878879 |

0,139541 |

-0,541878 |

-0,873557 |

1,000000 |

|

|

|

0,2588 |

0,0000 |

0,3550 |

0,0001 |

0,0000 |

----- |

|

|

TOINDEX |

-0,059609 |

0,813942 |

0,353440 |

-0,308573 |

-0,611992 |

0,754166 |

1,000000 |

|

|

0,6939 |

0,0000 |

0,0160 |

0,0369 |

0,0000 |

0,0000 |

----- |

The correlation analysis conducted on the variables presented in table 7 reveals no significant relationship between the dependent variable (GPDG) and the explanatory variables. In fact, the degree of association, particularly in the first column, does not surpass 0,16. However, the analysis suggests the presence of a strong correlation between some explanatory variables:

• CAPIH is strongly correlated to PGROWTH (-0,85), QI (0,87) and TOINDEX (0,81);

• INF is strongly correlated to PGROWTH (0,61) and QI (-0,54);

• PGROWTH is strongly correlated to QI (-0,87) and TOINDEX (-0,61);

• QI is strongly correlated to TOINDEX (0,75).

Unit Root Test

Prior to performing inferential estimation on the selected variables, it is essential to examine the characteristics of their respective time series. This is a crucial step in order to appropriately apply the ARDL approach, which is tailored for I(0) and I(1) variables. To accomplish this, the augmented Dickey-Fuller (ADF, 1979) and Phillips Perron tests were employed. The results are displayed in the table below.

|

Table 4. Unit Root Test |

||||||

|

Variables |

Model |

Level |

1st difference |

Result |

||

|

ADF |

PP |

ADF |

PP |

|||

|

CAPIH |

Trend and Intercept |

-1,60 (0,77) |

-1,41 (0,84) |

-2,66 (0,08*) |

-2,45 (0,13) |

I(1) |

|

Intercept |

0,68 (0,99) |

0,55 (0,98) |

||||

|

None |

2,37 (0,99) |

4,09 (1,00) |

||||

|

GDPG |

Trend and Intercept |

-9,19 (0,00***) |

-9,15 (0,00***) |

- |

- |

I(0) |

|

Intercept |

-9,24 (0,00***) |

-9,19 (0,00***) |

||||

|

None |

-1,44 (0,13) |

-5,22 (0,00***) |

||||

|

GSPEND |

Trend and Intercept |

-2,92 (0,16) |

-3,07 (0,12) |

- |

- |

I(0) |

|

Intercept |

-2,95 (0,04**) |

-3,02 (0,03**) |

||||

|

None |

0,40 (0,79) |

0,34 (0,78) |

||||

|

INF |

Trend and Intercept |

-6,89 (0,00***) |

-6,89(0,00***) |

- |

- |

I(0) |

|

Intercept |

-1,74 (0,40) |

-5,26 (0,0001) |

||||

|

None |

-1,88 (0,05**) |

-3,98 (0,0002) |

||||

|

PGROWTH |

Trend and Intercept |

-2,22 (0,46) |

-1,52 (0,80) |

-2,20** (0,027) |

-2,23** (0,026) |

I(1) |

|

Intercept |

-1,26 (0,64) |

-0,91 (0,77) |

||||

|

None |

-1,55 (0,11) |

-2,47 (0,014) |

||||

|

TOINDEX |

Trend and Intercept |

-2,65 (0,25) |

-2,64 (0,26) |

-6,84 (0,000) |

-7,07 (0,000) |

I(1) |

|

Intercept |

-1,86 (0,34) |

-1,75 (0,39) |

||||

|

None |

0,37 (0,78) |

0,70 (0,86) |

||||

|

QI |

Trend and Intercept |

-2,53 (0,30) |

-2,52 (0,31) |

-6,54 (0,000) |

-6,51 (0,000) |

I(1) |

|

Intercept |

0,03 (0,95) |

0,02 (0,95) |

||||

|

None |

1,60 (0,97) |

1,59 (0,97) |

||||

Observations reveal that the CAPIH, PGROWTH, TOINDEX, and QI series are integrated at order 1, meaning they become stationary after the first difference. On the other hand, the GDPG, GSPEND, and INF series remain stationary at the same level without the need for differentiation. Consequently, the series exhibit integration at different orders, rendering the Engle-Granger cointegration test (in the multivariate case) and the Johansen test ineffective. In this context, the bounds cointegration test proposed by Pesaran proves to be appropriate.

Cointegration Test

Two steps to follow when applying Pesaran’s cointegration test:

• Determine the optimal lag order (using AIC, SIC).

• Use the Fisher test to test the cointegration between the series.

The optimal lag order

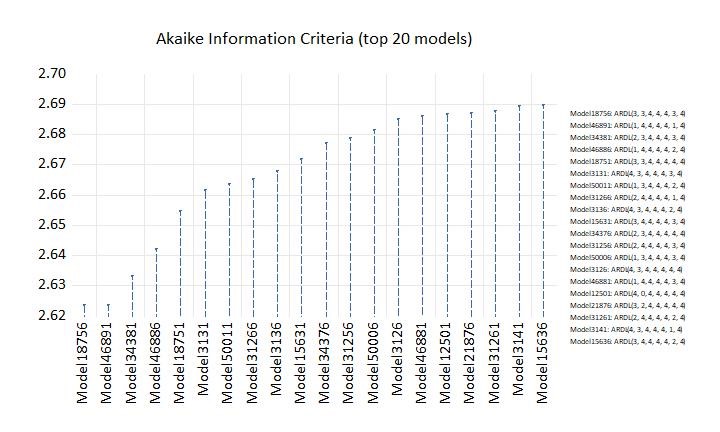

To ensure statistically significant results, we carefully selected the optimal ARDL model. Lag selection plays a crucial role in the ARDL model. In order to capture dynamic relationships and identify the most appropriate ARDL estimation model, we employed the Akaike Information Criterion (AIC). The lag length findings, illustrated in figure 1, revealed that among the 20 models considered, the ARDL (3, 3, 4, 4, 4, 3, 4) model was selected due to its lowest value on the Akaike information criteria.

Figure 1. The optimal lag selection

Cointegration bounds test

The conclusion of the bounds cointegration test indicates that the data series in our model are cointegrated, as the Fisher statistic (F=13,47) significantly exceeds the upper limit for all levels of significance.

|

Table 5. Cointegration bounds test results |

||||

|

K |

F-statistic |

Critical value |

Lower bound value I(0) |

Upper bound value I(1) |

|

5 |

13,47674 |

10 % |

1,99 |

2,94 |

|

5 % |

2,27 |

3,28 |

||

|

1 % |

2,88 |

3,99 |

||

Stability parameters

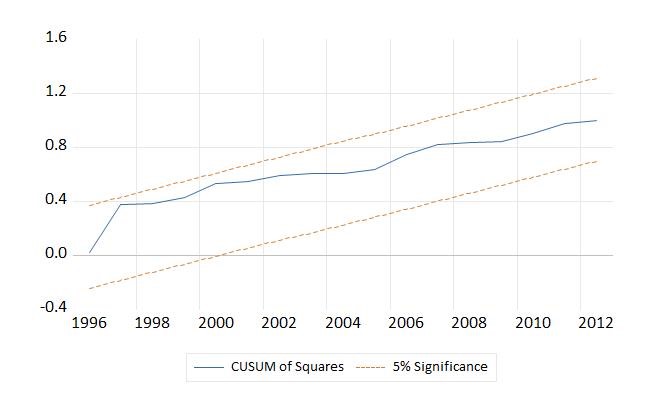

To ensure the reliability of the findings and examine the stability of both short- and long-term parameters in the cointegrating equation, we employed two statistical tests: the cumulative sum of recursive residuals (CUSUM) and the CUSUM of squares. Figures 2 and 3 present the results of these tests. The figures illustrate that the curve falls within the critical interval at a significance level of 5 %. This observation indicates that the ARDL model utilized in our study remains stable.

Furthermore, considering the tests used to diagnose the estimated ARDL model, it is observed that there is no autocorrelation of errors, no heteroscedasticity, the errors are normally distributed, and the model has been well specified.

Figure 2. CUSUM Test

Figure 3. CUSUM Squares test

|

Table 6. Diagnostic tests |

||||

|

Test Adopted |

Null Hypothesis |

Statistic |

P-value |

Conclusion |

|

Jarque-Bera |

The residuals are normally distributed |

0,88 |

0,64 |

Non-rejection of Ho as the P-value is not significant, indicating that the model residuals are normally distributed. |

|

Breusch-Godfrey |

No autocorrelation |

2,56 |

0,11 |

Non-rejection of Ho as the P-value is not significant, suggesting that the residuals are not correlated. |

|

Breusch-Pagan |

Homoscedasticity |

1,16 |

0,37 |

Non-rejection of Ho as the P-value is not significant, indicating the absence of heteroscedasticity. |

|

Ramsey |

The model is correctly specified |

0,44 |

0,66 |

Non-rejection of Ho as the P-value is not significant, suggesting the correct specification of the model. |

Toda-Yamamoto causality test

When non-stationary variables are not cointegrated or have different degrees of integration, the traditional Granger causality test becomes less effective. In such cases, the Toda-Yamamoto causality test is employed, which is based on the Wald statistic 'W' following a chi-squared distribution. The null hypothesis asserts the absence of causality between the variables. The results of this case study are presented in the table 7.

|

Table 7. Causality test |

|||||||

|

Dependent variables |

Explanatory or causal variables |

||||||

|

GDPG |

QI |

INF |

PGROWTH |

HCAPI |

TOINDEX |

GSPEND |

|

|

GDPG |

- |

3,18 (0,20) |

0,65 (0,72) |

0,19 (0,90) |

2,01 (0,36) |

4,69 (0,09)* |

0,52 (0,77) |

|

QI |

0,41 (0,81) |

- |

1,06 (0,58) |

0,08 (0,95) |

1,05 (0,59) |

7,84 (0,01)** |

0,34 (0,84) |

|

INF |

2,62 (0,26) |

3,23 (0,19) |

- |

4,46 (0,10) |

0,06 (0,96) |

1,43 (0,48) |

1,33 (0,51) |

|

PGROWTH |

2,41 (0,29) |

5,81 (0,05) |

0,32 (0,84) |

- |

4,41 (0,11) |

0,64 (0,72) |

3,23 (0,19) |

|

HCAPI |

0,18 (0,91) |

1,50 (0,47) |

6,36 (0,04)** |

2,05 (0,35) |

- |

9,80 (0,00)*** |

1,17 (0,55) |

|

TOINDEX |

0,20 (0,90) |

2,91 (0,23) |

1,03 (0,59) |

8,32 (0,01)** |

9,86 (0,00)*** |

- |

11,29 (0,00)** |

|

GSPEND |

1,87 (0,39) |

1,59 (0,45) |

11,88 (0,00)*** |

5,40 (0,06)* |

2,66 (0,26) |

3,88 (0,14) |

- |

|

(.): P-value *: Significant at the 10 % level. **: Significant at the 5 % level. ***: Significant at 1 % level. |

|||||||

Based on the information presented in the table, we derive the following causal relationships according to the Toda-Yamamoto’s test:

• A bidirectional causality between Trade Openness Index and Human capital index: Economic openness has an impact on human capital, and it, in turn, influences economic openness.

• Unidirectional causalities: Economic openness is caused by GDP growth, institutional quality, and human capital. Inflation is caused by human capital and public expenditure. Demographic growth is caused by economic openness and public expenditure. Lastly, economic openness is the cause of human capital.

ARDL Results

Table 8 reveals an important finding: the error correction coefficient (CointEq(-1)) is both negative and significant (-0,782510). This result serves as a confirmation of the presence of a long-term causal relationship (cointegration) among the variables.

|

Table 8. Short-run estimation |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

D(GDPG(-1)) |

-0,103706 |

0,098291 |

-1,055096 |

0,3222 |

|

D(GDPG(-2)) |

-0,128575 |

0,094215 |

-1,364691 |

0,2095 |

|

D(QI) |

5,458272 |

0,241024 |

22,64620 |

0,0000 |

|

D(QI(-1)) |

-3,015252 |

0,681885 |

-4,421934 |

0,0022 |

|

D(QI(-2)) |

-1,463169 |

0,617935 |

-2,367835 |

0,0454 |

|

D(INF) |

0,003021 |

0,026302 |

0,114859 |

0,9114 |

|

D(INF(-1)) |

0,143132 |

0,037088 |

3,859268 |

0,0048 |

|

D(INF(-2)) |

0,031971 |

0,036880 |

0,866899 |

0,4112 |

|

D(INF(-3)) |

0,054782 |

0,033346 |

1,642814 |

0,1390 |

|

D(TOINDEX) |

-0,147690 |

0,031948 |

-4,622798 |

0,0017 |

|

D(TOINDEX(-1)) |

0,489837 |

0,066281 |

7,390288 |

0,0001 |

|

D(TOINDEX(-2)) |

0,385824 |

0,050241 |

7,679524 |

0,0001 |

|

D(TOINDEX(-3)) |

0,309764 |

0,047666 |

6,498634 |

0,0002 |

|

D(GSPEND) |

0,076525 |

0,204907 |

0,373461 |

0,7185 |

|

D(GSPEND(-1)) |

0,738235 |

0,215808 |

3,420792 |

0,0091 |

|

D(GSPEND(-2)) |

0,219998 |

0,144213 |

1,525502 |

0,1656 |

|

D(GSPEND(-3)) |

0,311152 |

0,130179 |

2,390196 |

0,0438 |

|

D(HCAPI) |

27,71242 |

8,790563 |

3,152519 |

0,0135 |

|

D(HCAPI(-1)) |

7,346561 |

7,293225 |

1,007313 |

0,3433 |

|

D(HCAPI(-2)) |

11,74251 |

8,915043 |

1,317157 |

0,2243 |

|

D(PGROWTH) |

0,338281 |

4,531370 |

0,074653 |

0,9423 |

|

D(PGROWTH(-1)) |

20,29360 |

5,645509 |

3,594645 |

0,0070 |

|

D(PGROWTH(-2)) |

-16,84761 |

6,368004 |

-2,645666 |

0,0295 |

|

D(PGROWTH(-3)) |

19,09492 |

4,327064 |

4,412904 |

0,0022 |

|

CointEq(-1)* |

-0,782510 |

0,122649 |

-8,203328 |

0,0000 |

From the analysis of the table, we can observe the following points:

• The quality of institutions has a positive short-term effect on economic growth. An improvement of 1-point in institutional quality leads to a 5-point increase in economic growth. However, this effect reverses over time, as the quality of institutions from one and two years ago has a negative impact on economic growth. In summary, an improvement in institutional quality initially stimulates economic growth, but over time, the negative effects of past institutions become evident.

• The other control variables did not exhibit the expected short-term effects. Specifically, the openness rate and demographic growth had immediate negative impacts on short-term growth. However, inflation, public expenditure, and human capital demonstrated a positive effect on short-term growth. In summary, the results indicate that the openness rate and demographic growth have an unfavorable short-term impact on economic growth, while inflation, public expenditure, and human capital have a beneficial short-term effect.

|

Table 9. Long-run estimation |

||||

|

Variable |

Coefficient |

Std. Error |

t-Statistic |

Prob. |

|

QI |

9,197970 |

3,125113 |

2,943244 |

0,0186 |

|

INF |

-0,184813 |

0,323585 |

-0,571141 |

0,5836 |

|

TOINDEX |

-0,776488 |

0,320641 |

-2,421670 |

0,0417 |

|

GSPEND |

-0,788039 |

0,660808 |

-1,192538 |

0,2672 |

|

HCAPI |

17,01071 |

9,132278 |

1,862702 |

0,0995 |

|

PGROWTH |

8,374480 |

5,223448 |

1,603247 |

0,1475 |

|

C |

-62,77082 |

27,98339 |

-2,243146 |

0,0552 |

|

EC = GDPG - (9,1980*QI -0,1848*INF -0,7765*TOINDEX -0,7880*GSPEND + |

||||

|

17,0107*HCAPI + 8,3745*PGROWTH - 62,7708) |

||||

Table 9 presents the estimated coefficients in the long term. Just like in the short term, the effects of quality of institutions on economic growth in Morocco remain positive in the long term and show a relationship that is rather greater than proportional: an increase of 1 point in the quality of institutions accelerates economic growth by 9 points in the long term.

Furthermore, unlike the short-term results, only the openness rate of the economy and human capital have a significant effect on economic growth. Human capital has a positive impact on economic growth, while the openness of the economy has a negative effect on long-term economic growth in Morocco.

CONCLUSION

The primary objective of this study was to investigate the relationship between institutional quality and economic growth in Morocco. Specifically, we aimed to determine whether improving the institutional environment has a positive impact on macroeconomic performance. To achieve this, we employed a novel approach by developing a customized Auto Regressive Distributed Lag (ARDL) model tailored to the unique context of Morocco. This dynamic model effectively captures time-related factors such as adjustment delays and anticipations when analyzing variables.

The analysis focused on examining the effects of institutional quality (QI) on economic growth (GDPG), while also accounting for other important control variables widely utilized in empirical research. These additional variables, including GSPEND, INF, PGROWTH, TOINDEX, and HCAPI, were included to enhance the robustness of the findings.

To explore the causal relationships among the variables under investigation, we utilized the Toda-Yamamoto causality test, suitably adapted for this study. Furthermore, we employed the bounds cointegration test following the procedure introduced by Pesaran. This enabled us to establish the existence of a cointegration relationship among the variables and subsequently estimate short-term coefficients (CT) and long-term elasticities (LT). The results can be summarized as follows:

• The quality of institutions has a positive short-term impact on economic growth. Specifically, a 1-point improvement in institutional quality leads to a 5-point increase in economic growth. However, this effect diminishes over time, as the quality of institutions from one and two years ago negatively influences economic growth. In essence, while an enhancement in institutional quality initially stimulates economic growth, the adverse effects of past institutions become evident in the long run;

• Among the other control variables, the openness rate and demographic growth did not exhibit the expected short-term effects, instead having immediate negative impacts on growth. On the contrary, inflation, public expenditure, and human capital demonstrated positive effects on short-term growth. In summary, our results suggest that the openness rate and demographic growth have unfavorable short-term effects on economic growth, while inflation, public expenditure, and human capital have beneficial short-term effects;

• Importantly, the positive relationship between institutional quality and economic growth in Morocco extends to the long term, showing a relationship that is stronger than proportional. Specifically, a 1-point increase in institutional quality accelerates economic growth by 9 points in the long term.

In conclusion, this study provides valuable insights into the role of institutional quality in driving economic growth. The findings emphasize the importance of improving the institutional environment in Morocco to foster sustainable macroeconomic performance. These results contribute to the existing body of empirical literature and offer valuable guidance for policymakers and stakeholders seeking to promote economic development through institutional reforms.

REFERENCES

1. Acemoglu, Daron, and James A. Robinson. Why Nations Fail: The Origins of Power, Prosperity and Poverty (1st). 2012. 1st ed. New York: Crown.

2. Acemoglu, Daron, Simon Johnson, and James A. Robinson. "The Colonial Origins of Comparative Development: An Empirical Investigation." American Economic Review, 2001. 91(5), 1369-1401.

3. Rodrik, D., Subramanian, A., & Trebbi, F. "Institutions Rule: The Primacy of Institutions Over Geography and Integration in Economic Development." Journal of Economic Growth. 2004, 9, 131–165.

4. Easterly, William, and Ross Levine. “Africa’s Growth Tragedy: Policies and Ethnic Divisions.” The Quarterly Journal of Economics, vol. 112, no. 4, 1997, pp. 1203–50.

5. Hall, Robert E., and Charles I. Jones. “Why Do Some Countries Produce So Much More Output Per Worker Than Others?” The Quarterly Journal of Economics 114, no. 1 1999: 83–116.

6. Mauro, Paolo. “Corruption and Growth.” The Quarterly Journal of Economics 110, no. 3. 1995: 681–712.

7. North, Douglass C. “Institutions.” The Journal of Economic Perspectives 5, no. 1. 1991: 97–112.

8. Siddiqui, D. A. "Institutions and Economic Growth: A Cross Country Evidence." International Journal of Business Management & Research, 2013. 3(2), 89-102.

9. Alali, Walid Y, Role of Political Institutions on Economic Growth: Empirical Evidence November 2, 2022.

10. Fathi, E.H., Qafas, A., Jouilil, Y. A Dynamic Panel Data Analysis on the Impact of Quality of Institutions on the Economic Growth: Evidence from Wu-Hausman Specification Test. Artificial Intelligence and Smart Environment. ICAISE 2022. Lecture Notes in Networks and Systems, vol 635. Springer, Cham, 2023. pp 42–47.

11. E. H. Fathi, A. Qafas and Y. Jouilil, "Institutional Quality’s Impact on Moroccan Economic Growth: Insights from ARDL Modeling Approach," 2023 9th International Conference on Optimization and Applications (ICOA), AbuDhabi, United Arab Emirates, 2023, pp. 1-5.

12. Pesaran, M. H., Shin, Y., & Smith, R. J. "Bounds Testing Approaches to the Analysis of Level Relationships." Journal of Applied Econometrics, 2001. 16(3), 289–326.

13. Engle, Robert F., and C. W. J. Granger. “Co-Integration and Error Correction: Representation, Estimation, and Testing.” Econometrica 55, no. 2. 1987: 251–76.

14. Johansen, Søren. “Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models.” Econometrica 59, no. 6. 1991: 1551–80.

15. Toda, Hiro Y. and Yamamoto, Taku, Statistical inference in vector autoregressions with possibly integrated processes, Journal of Econometrics, 66, 1995. issue 1-2, p. 225-250.

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: El Houssaine Fathi, Ahlam qafas, Youness Jouilil.

Data curation: El Houssaine Fathi, Ahlam qafas, Youness Jouilil.

Formal analysis: El Houssaine Fathi, Ahlam qafas, Youness Jouilil.

Acquisition of funds: El Houssaine Fathi, Ahlam qafas, Youness Jouilil.

Research: El Houssaine Fathi, Ahlam qafas, Youness Jouilil.

Methodology: El Houssaine Fathi, Ahlam qafas, Youness Jouilil.

Project management: El Houssaine Fathi, Ahlam qafas, Youness Jouilil.

Resources: El Houssaine Fathi, Ahlam qafas, Youness Jouilil Resources.

Software: El Houssaine Fathi.

Supervision: El Houssaine Fathi, Ahlam qafas, Youness Jouilil.

Validation: El Houssaine Fathi, Ahlam qafas, Youness Jouilil Resources.

Display: El Houssaine Fathi, Ahlam qafas, Youness Jouilil Resources.

Drafting - original draft: El Houssaine Fathi.

Writing - proofreading and editing: El Houssaine Fathi.