doi: 10.56294/dm2024.360

ORIGINAL

The relationship between risk and profitability of securities companies

La relación entre riesgo y rentabilidad de las sociedades de valores

Cao Minh Tien1 ![]() *, Dao Duy Thuan1

*, Dao Duy Thuan1 ![]() , Tran Thi Phuong Lien1

, Tran Thi Phuong Lien1 ![]() *

*

1Academy of Finance – Vietnam. Hanoi, Vietnam.

Cite as: Tien CM, Thuan DD, Phuong Lien TT. The relationship between risk and profitability of securities companies. Data and Metadata. 2024; 3:.360. https://doi.org/10.56294/dm2024.360

Submitted: 19-01-2024 Revised: 23-05-2024 Accepted: 09-09-2024 Published: 10-09-2024

Editor: Adrián

Alejandro Vitón Castillo ![]()

Corresponding Author: Tran Thi Phuong Lien *

ABSTRACT

Serving as the most important intermediary in the stock market, securities companies in Vietnam are exhibiting unsustainable development and low profitability. Meanwhile, research on this type of business remains limited in both quantity and systematic aspects. The aim of this paper is to clarify the relationship between company strategy, optimal capital structure, and the ability to generate profits for securities companies. Primary data was collected through interviews with 155 experts and managers (directors, deputy directors) from November 2023 to April 2024, and secondary data was sourced from the financial reports of securities companies from 2010 to 2023. The data was cleaned before being processed using SPSS 20 and AMOS 20. The test and analysis results indicate that company strategy has a significant impact on profitability, while the impact of capital structure is negligible. This study adds to the theory of capital structure and provides managerial policy decisions for securities company managers to enhance profitability.

Keywords: Company Strategy; Capital Structure; Profitability.

RESUMEN

Las compañías de valores de Vietnam, que actúan como el intermediario más importante en el mercado de valores, están mostrando un desarrollo insostenible y una baja rentabilidad. Mientras tanto, la investigación sobre este tipo de negocios sigue siendo limitada tanto en cantidad como en aspectos sistemáticos. El objetivo de este artículo es aclarar la relación entre la estrategia de la empresa, la estructura de capital óptima y la capacidad de generar ganancias para las compañías de valores. Los datos primarios se recopilaron a través de entrevistas con 155 expertos y gerentes (directores, subdirectores) desde noviembre de 2023 hasta abril de 2024, y los datos secundarios se obtuvieron de los informes financieros de las compañías de valores de 2010 a 2023. Los datos se limpiaron antes de procesarlos con SPSS. 20 y AMOS 20. Los resultados de las pruebas y análisis indican que la estrategia de la empresa tiene un impacto significativo en la rentabilidad, mientras que el impacto de la estructura de capital es insignificante. Este estudio se suma a la teoría de la estructura de capital y proporciona decisiones de política gerencial para que los gerentes de las compañías de valores mejoren la rentabilidad.

Palabras clave: Estrategia de la Empresa; Estructura de Capital; Rentabilidad.

INTRODUCTION

Securities companies are integral components of the stock market, performing functions such as securities brokerage, proprietary trading, financial advisory, fund management, and underwriting advisory. In recent years, there has been intense competition among domestic securities companies as well as between domestic and foreign firms. Many companies lack clear business strategies and have limitations in their capital structure. As a result, the profitability of many securities companies has been declining, with numerous firms operating inefficiently, experiencing prolonged losses, leading to mergers, acquisitions, and exits from the market. The remaining companies are focusing on their strengths in specific customer segments and gradually expanding their operations.

Today's strategic category is widely used in many different fields, especially in the field of corporate governance. In any field, we can see that strategy is an effective tool of management. In 1962, the researcher of management history(16) put forward the concept of strategy as follows: "Strategy includes the basic long-term orientations and goals of the organization, the formulation of action plans and the allocation of resources necessary to achieve those orientations, that goal." Chandler emphasized 3 important contents of strategic planning: Action plans to achieve the goal; The process of exploring basic ideas, not just the process of implementing current policies; How to form a strategy, not just see how the strategy needs to change.

Strategic planning plays a leading and directional role in the planning process. It links all resources to carry out the activities of the organization in order to achieve certain goals in the future. Strategic planning aims to develop a roadmap and implement to organize the implementation of the selected strategic objectives, guidelines and mottos.

Strategic planning is the first function in the management process, which includes defining operational goals, developing an overall strategy to achieve the goals, and establishing a system of plans to coordinate activities.

Planning involves forecasting and predicting the future, what goals need to be achieved, and how to achieve those goals. Without careful and correct planning, it is easy to lead to failure in management. There are many securities companies that do not operate or only operate at a fraction of their capacity due to no planning or poor planning.

Porter ME(5) has proposed 3 approaches to competitive strategy as follows: cost-leading strategy, product differentiation strategy, and centricity strategy. Each strategy has its own distinct differences.

Cost-leading strategy

A cost-first strategy is a strategy in which a business strives to have the lowest costs in its business and produce products that have a wide customer base. Low costs give businesses higher profit margins than the industry average despite the presence of other competitive forces. When it has the lowest cost in the industry, businesses can sell products at the lowest price and still make a profit. When there is a price competition strategy, the business with the lowest cost will of course be in a better position and continue to be profitable. To pursue this strategy, the following conditions are required: Producing products in large quantities. There is no policy of extensive development of items, no changes in products and services, not based on different product bases because it will be very expensive; Large market share; Stable and regular input supply with a large supply quantity, minimizing hidden costs in the production and business process.; There are customers who consume products in large and stable quantities.

This strategy is suitable for large, market-leading enterprises. It is difficult for new businesses or businesses that produce alternative products to apply this strategy. This strategy also has the following disadvantages: Due to too much focus on cost, there is a lack of ability to see the requirements of product change or marketing; Competitors will easily imitate through their ability to invest in machinery and technical equipment; Changes in modern technology will nullify the investments of past experience.

Product differentiation strategy

Product differentiation strategy is a strategy in which businesses compete to provide unique products and services with characteristics that customers appreciate, recognize as different and are willing to pay more for that difference. This additional payment creates for businesses to have a profit level that encourages competition on the basis of product and service differentiation. Methods of differentiation of products and services are expressed in many forms: typicality of design, reputation of products, characteristics of products, customer service, distribution system and others. Pursuing this strategy should pay attention to the following characteristics: To prioritize and focus on the research and design of products and services; It is not necessary to occupy a large market; It is necessary to emphasize Marketing; Focus on building branding and corporate image.

This strategy has some of the following disadvantages:

It is very difficult to keep the uniqueness of products and services under the perception of customers. As buyers become more demanding, their demand for those differences of the product will decrease, and they will no longer want to pay a high price for it. As product differences become less important, customers often become more price-sensitive. Imitation limits the perception of differentiation.

Focused strategy

It is a strategy, in which the business pursues either a cost advantage, or an advantage due to product differentiation, but only within the target customer group or market segment or angular markets in a more positive and effective way than competitors who are serving large markets.

This strategy focuses on the following 03 ways of market segmentation: Geographical location, that is, a certain market area; Customer type; Separate product lines.

This strategy helps businesses understand their market, get closer to customers and respond quickly to changes in customer needs, thereby building customer loyalty to the business's products and the business's brand.

However, this strategy also reveals some of the following disadvantages:

Due to the small scale of operation, it is difficult to reduce costs drastically. However, with today's technological advances, this disadvantage is not as serious as before. Customers of small markets are prone to changing their preferences and needs. Because it is difficult for businesses pursuing this strategy to change the market quickly and easily, this is a serious problem. Competitors find narrow markets in their strategic markets, or in other words, businesses that pursue a centralized strategy become "unfocused" by their competitors.

In recent years, researchers have applied the theory to practice in different countries, with research aspects revolving around such as the impact of corporate strategy on the risk exposure of securities companies(2,4) Corporate strategy has the same or opposite influence on the capital structure strategy of securities companies.(17,27,9,25,18) Capital structure has an impact on the profitability of securities companies.(3,21,6,24,26,15,1,10)

Literature Review and Theoretical Framework

Relationship between corporate strategy and risk capability of securities companies

Consider the strategy of diversification and performance of companies based on the database on the stock exchange. Portfolio diversification in the capital market is an acceptable investment strategy. However, diversification companies have attracted many competitors, especially those who argue that executives are not diversified on behalf of shareholders. However, diversification is a strategic option used by many managers to improve company efficiency and reduce risk(2) Operational efficiency is measured by revenue growth, gross profit, ROS, ROE, ROA along with diversified growth. The paper uses a combination of primary and secondary data. Primary data is collected through expert and client interviews, secondary data is collected from financial statements and account management. The models used are the linear model, the inverted U-pattern, and the intermediate model. The paper has proven that through diversification, corporations have created value and proven their existence as they can build and leverage unique resources to gain a competitive advantage, increase profits, market value of companies that ultimately improve shareholder value.

According to Raei, Tehrani & Farhangzadeh (2015). To study the relationship between diversification strategies, business performance of companies, and risk tolerance. The data was conducted on 63 companies listed on the Tehran Stock Exchange between 2008 and 2012(4) Analysis of research models based on time table data analysis. The accreditation standard is based on a significance level and a P value, any value or significance level of the test that is less than h 0,05 is rejected at 95 % confidence. The experimental results show that there is no difference between the diversification strategy, operational efficiency, and risk tolerance.

According to Mousavi Hanjani, & Iranban (2019). The relationship between business strategy, capital structure, and profitability of companies listed on the stock exchange using a combination of data lines and VAR methods.(7) The data was taken for 78 typical companies operating on the Tehran Stock Exchange in the period 1387 - 1395. Rigorous tests such as Chow (Flemmer) and Hausman tests are used to check the suitability of the data. Ensure that the data table model is evaluated, the residue has been normalized, and the waste chart survey has been performed. The results of the experiment show that there is a significant relationship between the diversification strategy, capital structure, and profitability of companies accepted in the stock market. In particular, the results of the experiment show that the diversification strategy has a significant effect on the profitability of companies.

H1: the development of the economy has an influence on the Company Strategy.

H2: corporate strategy affects the profitability of a securities company.

The relationship between the company's strategy and the capital structure of the securities company

According to Manrai, Rameshwar & Nangia (2014). Product diversification can bring benefits to the company and shareholders, thereby achieving advantages and sustainable development. The paper clarifies the impact of the product diversification strategy on the capital structure and performance of companies in India(9) The database is collected from stock exchanges, variables are used such as business growth, company size, materiality of profitability and assets. The testing and regression steps are carried out on the E-views statistical software. The results show that there is a relationship between the company's strategy and the company's capital structure.

According to Cappa, Cetrini & Oriani (2020). The influence of a company's business strategy on its structure has attracted significant attention from managers and scientists alike. While previous studies have focused on the impact brought about by a single strategy at a time(18) Based on the Strategic Decentralization Theory, the authors estimated the impact brought by three defined strategies at the company level: internationalization, diversification, and integration. The results show that the above-mentioned strategies impact the capital structure of enterprises simultaneously and independently. The process of integration and internationalization of the business environment has an inverse correlation with the debt ratio while diversification has a positive correlation with the debt ratio.

Recent studies have also shown that there is a significant relationship between corporate strategy and capital structure.(17,27,25)

H3: corporate strategy affects the capital structure of securities companies

Relationship between capital structure and profitability of securities companies

The theory of capital structure is(8) and the authors have outlined the necessary conditions for an optimal capital structure. Since the time of the theory, many economists have accepted and implemented it. The cost of capital for a company is used to buy assets with uncertain returns. Economists have focused on and addressed the nature of the cost of capital problem by considering physical assets like bonds, which are considered to bring profits and a cash flow to owners. Harris M et al.(13) proposed models related to capital structure with inputs as the most promising.

According to Singapurwoko & El-Wahid (2011). Many companies use debt as leverage to increase business capital and profitability. However, the effects are not always favorable, there are many other factors that affect profits. The paper considers determinants of activities such as scale and industry factors to be fully considered(3) Other factors considered have certain significance, like total asset turnover that explains how well companies can use their assets to generate profits. Company size: This factor is represented by assets to measure the company's ability to generate profits. The results indicate that in the uncategorized data (not categorized into different industries), debt, firm size, and operational determinant impact have a positive impact on profitability.

According to Alarussi & Alhaderi (2018). Profitability is the main pillar of any company that wants to survive and grow. The team of researchers used 5 independent variables to examine the relationship between profitability, company size (as seen by total revenue), net working capital, company efficiency as measured by asset turnover, liquidity as measured by current solvency, and leverage. Data of 120 companies listed on Bursa Malaysia between 2012 and 2014.(26) Using the usual least squared regression method, pooling and fixed effects are used to analyze the data. The results show that a negative relationship has been detected between both debt ratio and leverage ratio and profitability.

Recent studies have also shown a positive or opposite relationship between capital structure and a company's profitability.(21,6,24,15,1,10)

H4: Capital structure affects the profitability of securities companies

METHOD

The paper uses the SEM linear structure model to clarify the relationship between the company's competitive strategy, capital structure, and the profitability of securities companies. The tests were carried out on SPSS 20 and AMOS 20.(22)

For the best results, the authors perform the verification process including: according to Anderson et al.(23) the linear structure model analysis process includes:

1. Scale Test, overall alpha coefficient >0,6 and corrected item – total correlation > 0,3;

2. Exploratory Factor Analysis (EFA): the appropriateness of the measure 0,5<=KMO<=1, the Bartlett linear correlation test with the significance level (Sig) <=0,05, the extraction variance test >50 % and the Eigenvalues >1, the load factor with a sample size greater than 255 requires >0,3.(14)

3. Confirmatory Factor Analysis (CFA): Freely Adjusted Squared Index (Cmin/Df) <=5 (Bentler, et al. 1980), Tucker-Lewis index >0,9.(12) Comparative Fit Index (CFI) >0,9(12) NFI (Normal Fit Index)>0,9(12,20), RMSEA (Root Mean Square Error Approximation)<0,05.(19)

4. Structural Equation Modeling SEM.

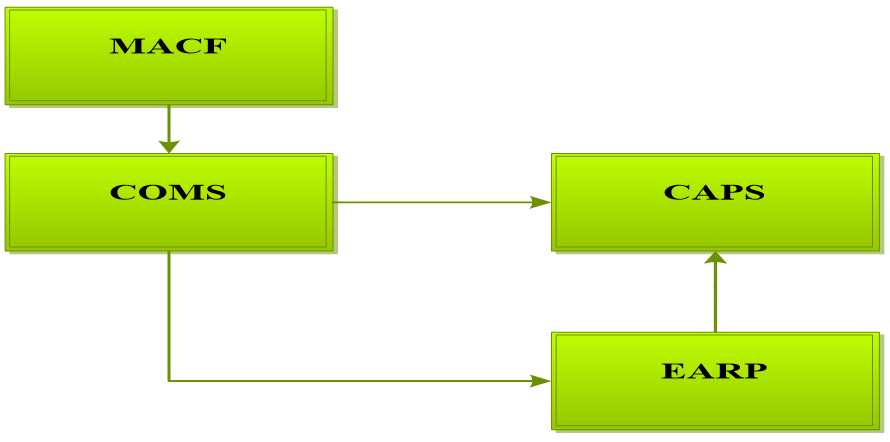

The model looks like figure 1, The economic equation is COMS = f(MACF); EARP = f(COMS); CAPS = f(COMS, EARP).

Figure 1. Research model

All variables in the model are measured using the 5-degree Linkert scale(11) which takes the form of a list of responses related to attitudes in the survey question and the securities officer will choose only one of those answers. Each response is given a score that reflects the level of interest (1 is absolutely none, 2 – disagree, 3 – neutral, 4 – agree, 5 – completely agree) and the corresponding scores can be aggregated to measure the attitude of the respondents.

* Research data. Primary data through interviews with 155 experts and managers (directors, deputy directors) in the period from 11/2023 to 04/2024 and secondary data are financial statements of securities companies in the period 2010-2023. Data is cleaned before running the model using SPSS 20 and AMOS 20 software

* Structure of the survey object: The results collected from the survey object are imported into the excel sheet. Accordingly, if classified by gender, there are 140 males (accounting for 90,32 %), 15 females (9,68 %). In terms of age, there are 21 people aged 31-35 years old (13,55 %), 96 people aged 36-40 years old (61,94 %), 38 people over 40 years old (24,52 %). In terms of training and professional qualifications, there are 52 employees with a university degree (33,55 %), 103 people with a university degree (66,45 %). In terms of job positions, there are 15 directors (accounting for 9,68 %), 16 deputy directors (10,32 %) and 124 experts (80,00 %). In terms of experience and seniority at work, 31 employees are from 6-10 years (20,00 %), 22 employees are from 11-15 years (14,19 %), 102 employees are over 16 years (65,81 %).

|

Table 1. Statistics describing the survey object of the research model |

|||

|

No. |

Survey Subject Characteristics |

Quantity (people) |

(%) |

|

1 |

Gender |

||

|

Female |

15 |

9,68 |

|

|

Male |

140 |

90,32 |

|

|

2 |

Age |

||

|

31-35 years old |

21 |

13,55 |

|

|

36-40 years old |

96 |

61,94 |

|

|

Over 40 years old |

38 |

24,52 |

|

|

3 |

Education |

||

|

Bachelor's Degree |

52 |

33,55 |

|

|

Postgraduate |

103 |

66,45 |

|

|

4 |

Position |

||

|

Director |

15 |

9,68 |

|

|

Deputy Director |

16 |

10,32 |

|

|

Specialist |

124 |

80,00 |

|

|

5 |

Experience |

||

|

6-10 years |

31 |

20,00 |

|

|

11-15 years |

22 |

14,19 |

|

|

Over 16 years |

102 |

65,81 |

|

Table 1 shows that the data collected in the paper accurately reflects the common reality of a young workforce structure at securities companies. The workforce is characterized by high professional quality, with the majority having university degrees or higher.

The Vietnamese stock market is developing both in breadth and depth, in terms of both quantity and quality. This is evident from the increasing scale of the market, with a shift from quantity to quality, and the growing number of retail investors and market intermediaries. Along with opportunities come intertwined challenges. However, given that the Vietnamese stock market is considered to have the highest development potential in the region, it is a highly promising sector with significant demand. Therefore, the structure of the human resources in this industry needs to differ from that of other industries.

Based on theoretical foundations, the paper constructs a measurement scale as shown in table 2.

|

Table 2. Measurement Scale and Variables in the PLS-SEM Model |

|||

|

No. |

Code |

Survey Question Categories |

Source |

|

I. |

Competitive Strategy (COMS) |

||

|

1. |

COMS1 |

Cost Leadership Strategy |

(2), (4), (7) |

|

2. |

COMS2 |

Product Differentiation Strategy |

|

|

3. |

COMS3 |

Focus Strategy |

|

|

II. |

Capital Structure (CAPS) |

||

|

4. |

CAPS1 |

General debt ratio of the securities company at the end of year t. This includes both interest-bearing and non-interest-bearing debts (Total liabilities/Total capital) |

(8), (13), (3), (26), (21), (6), (24), (15), (1), (10) |

|

5. |

CAPS2 |

Debt ratio of the securities company at the end of year t. Only includes interest-bearing debts (Short-term loans + Long-term loans)/Total capital |

|

|

6. |

CAPS3 |

Short-term debt ratio at the end of year t (Short-term liabilities/Total liabilities) |

|

|

III. |

Macro factors (MACF) |

||

|

7. |

MACF1 |

Gross domestic product (GDP) |

(2), (4), (7) |

|

8. |

MACF2 |

Consumer Price Index (CPI) |

|

|

9. |

MACF3 |

VN30 Index Growth |

|

|

IV. |

Earnings Power (EARP) |

||

|

10. |

EARP1 |

Basic Earning Power (BEP) |

Expert Interviews |

|

11. |

EARP2 |

Return on Equity (ROE) |

|

|

12. |

EARP3 |

Return On total Assets (ROA) |

|

|

Source: synthesis from theoretical basis |

|||

The model is built with 4 scales and 12 observation variables.

RESULTS

Analyze the reliability of the scale

Perform Cronbach alpha testing to evaluate the quality of the scale. The results of the reliability analysis of the scale for the variables that make up the scale have the alpha coefficient of the overall >0,6 and the corrected item-total correlation coefficient >0,3, detailed in table 3 below.

|

Table 3. Scale analysis results for variables in PLS-SEM model |

|||||||||||||||

|

Item-Total Statistics |

|||||||||||||||

|

Variable |

Scale Mean if Item Deleted |

Scale Variance if Item Deleted |

Corrected Item-Total Correlation |

Squared Multiple Correlation |

Cronbach's Alpha if Item Deleted |

||||||||||

|

COMS1 |

5,7760 |

2,130 |

0,808 |

0,832 |

0,591 |

||||||||||

|

COMS2 |

5,9369 |

2,205 |

0,774 |

0,825 |

0,629 |

||||||||||

|

COMS3 |

5,3281 |

2,810 |

0,450 |

0,411 |

0,952 |

||||||||||

|

Cronbach's Alpha = 0,814 |

|||||||||||||||

|

CAPS1 |

7,67 |

3,122 |

0,628 |

0,504 |

0,738 |

|

|||||||||

|

CAPS2 |

7,50 |

3,346 |

0,541 |

0,344 |

0,830 |

|

|||||||||

|

CAPS3 |

7,49 |

2,934 |

0,770 |

0,606 |

0,589 |

|

|||||||||

|

Cronbach's Alpha = 0,798 |

|

||||||||||||||

|

COMS1 |

5,7760 |

2,130 |

0,808 |

0,832 |

0,591 |

|

|||||||||

|

COMS2 |

5,9369 |

2,205 |

0,774 |

0,825 |

0,629 |

|

|||||||||

|

COMS3 |

5,3281 |

2,810 |

0,450 |

0,211 |

0,952 |

|

|||||||||

|

Cronbach's Alpha = 0,828 |

|

||||||||||||||

|

EARP1 |

8,44 |

2,114 |

0,669 |

0,464 |

0,684 |

|

|||||||||

|

EARP2 |

8,21 |

2,031 |

0,660 |

0,457 |

0,690 |

|

|||||||||

|

EARP3 |

8,55 |

2,052 |

0,579 |

0,436 |

0,781 |

|

|||||||||

|

Cronbach's Alpha = 0,792 |

|

||||||||||||||

|

Source: statistics on SPSS 20 software |

|

||||||||||||||

Discovery factor analysis

Since the sample size of 155 is in the range of 100 to 350, the Absolute value below option is 0,5. Table 4 shows that the KMO measure with Kaiser-Meyer-Olkin Measure of Sampling Adequacy = 0,695 is within 0,5<KMO<1; The Bartlett test has a Bartlett's Test of Sphericity of 0,000, the data used for factor analysis is appropriate.

|

Table 4. KMO and Bartlett's Accreditation |

||

|

KMO and Bartlett's Test |

||

|

Kaiser-Meyer-Olkin Measure of Sampling Adequacy. |

0,695 |

|

|

Bartlett's Test of Sphericity |

Approx. Chi-Square |

1 950,627 |

|

df |

66 |

|

|

Sig. |

0,000 |

|

|

Source: statistics on SPSS 20 software |

||

According to the results of table 5. for the results of the examination of the extracted variance, the Cumulative coefficient %=75,016 %>50 %. The Eigenvalues of a group of factors greater than 1 are 5 factors.

|

Table 5. Extract variance |

|||||||

|

Total Variance Explained |

|||||||

|

Component |

Initial Eigenvalues |

Extraction Sums of Squared Loadings |

Rotation Sums of Squared Loadingsa |

||||

|

|

Total |

% of Variance |

Cumulative % |

Total |

% of Variance |

Cumulative % |

Total |

|

1 |

3,539 |

29,489 |

29,489 |

3,539 |

29,489 |

29,489 |

2,362 |

|

2 |

2,364 |

19,704 |

49,192 |

2,364 |

19,704 |

49,192 |

2,482 |

|

3 |

1,878 |

15,646 |

64,838 |

1,878 |

15,646 |

64,838 |

2,738 |

|

4 |

1,221 |

10,178 |

75,016 |

1,221 |

10,178 |

75,016 |

2,688 |

|

5 |

0,660 |

5,501 |

80,517 |

|

|

|

|

|

6 |

0,646 |

5,382 |

85,899 |

|

|

|

|

|

7 |

0,421 |

3,510 |

89,409 |

|

|

|

|

|

8 |

0,399 |

3,325 |

92,734 |

|

|

|

|

|

9 |

0,331 |

2,761 |

95,495 |

|

|

|

|

|

10 |

0,255 |

2,122 |

97,617 |

|

|

|

|

|

11 |

0,207 |

1,725 |

99,343 |

|

|

|

|

|

12 |

0,079 |

0,657 |

100,000 |

|

|

|

|

|

Extraction Method: principal Component Analysis. |

|||||||

|

a When components are correlated, sums of squared loadings cannot be added to obtain a total variance. |

|||||||

|

Source: statistics on SPSS 20 software |

|||||||

Factor Loading coefficients >0.3; After checking the load coefficients of the variables, the variables with a load coefficient greater than 0.3 are 12 observed variables. The results of the EFA analysis are satisfactory.

|

Table 6. Component rotation matrix |

||||

|

Pattern Matrixa |

||||

|

Variable |

Component |

|||

|

1 |

2 |

3 |

4 |

|

|

MACF3 |

0,918 |

|

|

|

|

MACF1 |

0,897 |

|

|

|

|

MACF2 |

0,818 |

|

|

|

|

COMS2 |

|

0,903 |

|

|

|

COMS1 |

|

0,897 |

|

|

|

COMS3 |

|

0,756 |

|

|

|

CAPS3 |

|

|

0,937 |

|

|

CAPS1 |

|

|

0,843 |

|

|

CAPS2 |

|

|

0,725 |

|

|

EARP1 |

|

|

|

0,898 |

|

EARP2 |

|

|

|

0,875 |

|

EARP3 |

|

|

|

0,689 |

|

Extraction Method: Principal Component Analysis. Rotation Method: Promax with Kaiser Normalization. |

||||

|

a Rotation converged in 5 iterations. |

||||

|

Source: statistics from SPSS 20 |

||||

Confirmatory Factor Analysis (CFA) and PLS-SEM Structural Equation Modeling

The results of the Confirmatory Factor Analysis (CFA) and the estimation of the structural equation model are shown in the figures below:

Figure 2. Summary of Confirmatory Factor Analysis (CFA)

The CFA results indicate that the adjusted Chi-square value per degree of freedom (Cmin/df) is 4,88, which is within the acceptable range of less than or equal to 5. The Tuker-Lewis Index (TLI) value is 0,992, greater than 0,9, the Comparative Fit Index (CFI) value is 0,922, greater than 0,9, the Normal Fit Index (NFI) value is 0,991, greater than 0,9, and the Root Mean Square Error of Approximation (RMSEA) value is 0,045, less than 0,05. In conclusion, the integrated model fits the actual data as it meets the testing criteria.

Source: NCS Statistics from AMOS 20 software

Figure 3. Regression Model Estimation Results

Figure 5 shows that the adjusted Chi-square value per degree of freedom (Cmin/df) is 4,29, within the acceptable range of less than or equal to 5. The TLI value is 0,968, greater than 0,9, the CFI value is 0,932, greater than 0,9, the NFI value is 0,926, greater than 0,9, and the RMSEA value is 0,036, less than 0,05. In conclusion, the integrated model fits the actual data as it meets the testing criteria.

Table 5 with significance levels of estimation coefficients: p-value <= 0,05; confidence level >= 95 %, the factors included in the model are statistically significant and the hypotheses are accepted.

|

Table 5. Hypothesis Testing Results |

||||||

|

Hypothesis |

Impact |

Estimate |

S.E. |

C.R. |

P |

Label |

|

H1 |

COMS <--- MACF |

-0,037 |

0,068 |

-0,542 |

0,048 |

Accepted |

|

H2 |

EARP <--- COMS |

0,763 |

3,36 |

0,525 |

0,06 |

Accepted |

|

H3 |

CAPS <--- COMS |

0,188 |

0,059 |

0,088 |

*** |

Accepted |

|

H4 |

EARP <--- CAPS |

0,477 |

0,059 |

8,088 |

*** |

Accepted |

|

Source: statistics from AMOS 20 software |

||||||

From table 5, we can see that there is a close relationship between company strategy, capital structure, and the profitability of securities companies, with statistical significance at P-value <= 0,05. Accordingly, economic development negatively affects company strategy, and company strategy, in turn, affects the capital structure of securities companies. Meanwhile, company strategy and capital structure affect the profitability of securities companies, with statistical significance at P-value <= 0,05. Thus, hypotheses H2, H3, and H4 are accepted, while hypothesis H1 is rejected.

This testing result is appropriate for Vietnam. Securities companies are not yet keeping pace with market changes and are adjusting their strategies accordingly. However, maintaining a capital structure, mainly leaning towards short-term capital, is temporarily bringing profits to the securities companies.

Policy Implications for Managers

Based on the SEM regression model results, the authors propose solutions to enhance the profitability of securities companies, specifically:

Firstly, for a specific segment or target market, if a securities company (SC) is unique, the service fees will undoubtedly bring profits to the company. However, in reality, many SCs pursue target markets and products with no significant differences, leading to fees not meeting the expectations of SCs. Therefore, SCs need to identify niche investor segments to penetrate. In these segments, SCs must operate flawlessly, providing investors with the best, most reliable, and competitive services. They must maintain close relationships with investors, deeply understand their needs and desires, and have the capacity to quickly meet specific and specialized demands.

Securities company managers need to enhance their strategic action capabilities. Strategic action capabilities involve understanding the general mission and values of the organization and ensuring that their activities and those of their subordinates are clearly defined. This includes:

· Understanding the industry in which the organization operates:

a. Being aware of the actions of competitors and strategic partners.

b. Being able to analyze general industry trends and their future impacts.

· Understanding the organization:

a. Being aware of stakeholder interests.

b. Mastering the unique capabilities within the organization.

· Taking strategic actions:

a. Identifying priorities and making decisions based on the organization's mission and strategic objectives.

b. Being aware of the management challenges of each strategic option and overcoming them.

c. Establishing tactics and operational goals to facilitate the implementation of the strategy.

Secondly, solutions for optimizing the capital structure of securities companies include increasing retained earnings, raising equity capital, and mobilizing from bank credits and other forms of capital to adjust the capital structure optimally.

Thirdly, focusing resources to improve business efficiency. SCs should reassess growth in relation to profitability. It is important to note that growth has a dual nature: excessive growth (overheating growth) is associated with risks and financial dangers but can also propel the company forward. Conversely, slow growth, no growth, or recession can cause the company to lag far behind its industry peers.

CONCLUSION

Securities companies play a crucial role as intermediaries in the stock market, determining the stable and sustainable development of the securities market. However, recently, Vietnamese securities companies have shown many limitations, with low and uneven profitability across different companies. This paper, based on theoretical foundations and empirical research, explores the close relationship between company strategy, capital structure, and profitability of securities companies. The authors tested hypotheses through the PLS-SEM linear structural model. The empirical research model used by the authors analyzed results such as scale reliability, exploratory factor analysis (EFA), confirmatory factor analysis (CFA), and structural equation modeling (SEM). The results show that three hypotheses were accepted, and one was rejected. The rapid economic development has made it challenging for companies to keep pace with these changes; however, maintaining a reasonable capital structure has boosted profitability for companies.

Based on the research results, the authors propose solutions to enhance the profitability of securities companies in the current and future contexts. Solutions include reviewing and focusing on business strategies and strong segments, enhancing brand image to mobilize capital from various sources, thus ensuring sufficient capital for profitability and sustainable development. In the future, the research team will expand studies to broader geographic areas such as Southeast Asia and Asia to gain a comprehensive view of enhancing the profitability of securities companies.

BIBLIOGRAPHIC REFERENCES

1. Xu MT, Hu K, Das MUS. Bank profitability and financial stability: International Monetary Fund; 2019.

2. Wisnuwardhana A, Diyanty V. Pengaruh strategi diversifikasi terhadap kinerja perusahaan dengan moderasi efektivitas pengawasan dewan komisaris. Simposium Nasional Akuntansi XVIII. 2015.

3. Singapurwoko A, El-Wahid MSM. The impact of financial leverage to profitability study of non-financial companies listed in Indonesia stock exchange. European Journal of Economics, Finance and Administrative Sciences. 2011;32(32):136-48.

4. Raei R, Tehrani R, Farhangzadeh B. A study on relationship between diversification strategy, firm performance and risk: Evidence from Tehran Stock Exchange. International Journal of Business and Social Science. 2015;6(1).

5. Porter ME. Competitive strategy. Measuring business excellence. 1997;1(2):12-7.

6. Popa A-E, Ciobanu R. The financial factors that influence the profitability of SMEs. International Journal of Academic Research in Economics and Management Sciences. 2014;3(4):177.

7. Mousavi Hanjani S-M, Iranban S-J. The relationship between diversification strategy, capital structure and profitability in companies listed in the stock exchange by combining the data line and VAR methods. Journal of System Management. 2019;5(1):41-60.

8. Modigliani F, Miller MH. The cost of capital, corporation finance and the theory of investment. The American economic review. 1958;48(3):261-97.

9. Manrai R, Rameshwar R, Nangia V. Interactive effect of diversification strategy on capital structure and corporate performance: An analytical evaluation. Global Journal of Management and Business Research. 2014;14(4):75-91.

10. Lv S, Du Y, Liu Y. How do fintechs impact banks’ profitability?—an empirical study based on banks in China. FinTech. 2022;1(2):155-63.

11. Likert R. A technique for the measurement of attitudes. Archives of psychology. 1932.

12. Hu L-t, Bentler PM. Fit indices in covariance structure modeling: Sensitivity to underparameterized model misspecification. Psychological methods. 1998;3(4):424.

13. Harris M, Raviv A. The theory of capital structure. the Journal of Finance. 1991;46(1):297-355.

14. Hair JF, Black WC, Babin BJ, Anderson RE, Tatham RL. Multivariate data analysis 6th Edition. Pearson Prentice Hall. New Jersey. humans: Critique and reformulation …; 2006.

15. Dalci I. Impact of financial leverage on profitability of listed manufacturing firms in China. Pacific Accounting Review. 2018;30(4):410-32.

16. Chandler AD. Strategy and structure: Chapters in the history of the industrial empire. Cambridge Mass. 1962;5(1):12-48.

17. Chaganti R, Damanpour F. Institutional ownership, capital structure, and firm performance. Strategic management journal. 1991;12(7):479-91.

18. Cappa F, Cetrini G, Oriani R. The impact of corporate strategy on capital structure: evidence from Italian listed firms. The Quarterly Review of Economics and Finance. 2020;76:379-85.

19. Browne MW, Cudeck R. Alternative ways of assessing model fit. Sociological methods & research. 1992;21(2):230-58.

20. Bentler PM. Multivariate analysis with latent variables: Causal modeling. Annual review of psychology. 1980;31(1):419-56.

21. Barakat A. The impact of financial structure, financial leverage and profitability on industrial companies shares value (applied study on a sample of Saudi industrial companies). Research Journal of Finance and Accounting. 2014;5(1):55-66.

22. Arbuckle JL. IBM SPSS Amos 20 user’s guide. Amos development corporation, SPSS Inc. 2011:226-9.

23. Anderson JC, Gerbing DW. Structural equation modeling in practice: A review and recommended two-step approach. Psychological bulletin. 1988;103(3):411.

24. Amelia E. Financial Ratio and Its Influence to Profitability in Islamic Banks. Al-Iqtishad: Jurnal Ilmu Ekonomi Syariah. 2015;7(2):229-40.

25. Alipour M, Mohammadi MFS, Derakhshan H. Determinants of capital structure: an empirical study of firms in Iran. International Journal of Law and Management. 2015;57(1):53-83.

26. Alarussi AS, Alhaderi SM. Factors affecting profitability in Malaysia. Journal of Economic Studies. 2018;45(3):442-58.

27. Ahmad Z, Abdullah NMH, Roslan S. Capital structure effect on firms performance: Focusing on consumers and industrials sectors on Malaysian firms. International review of business research papers. 2012;8(5):137-55.

FINANCING

The authors did not receive financing for the development of this research.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Cao Minh Tien.

Data curation: Cao Minh Tien.

Formal analysis: Cao Minh Tien.

Acquisition of funds: Cao Minh Tien.

Research: Cao Minh Tien.

Methodology: Cao Minh Tien, Dao Duy Thuan, Tran Thi Phuong Lien.

Project management: Cao Minh Tien.

Resources: Cao Minh Tien.

Software: Cao Minh Tien.

Supervision: Cao Minh Tien.

Validation: Cao Minh Tien.

Display: Cao Minh Tien, Dao Duy Thuan, Tran Thi Phuong Lien.

Drafting - original draft: Cao Minh Tien, Tran Thi Phuong Lien.

Writing - proofreading and editing: Cao Minh Tien, Dao Duy Thuan, Tran Thi Phuong Lien.