doi: 10.56294/dm2024.532

ORIGINAL

Evaluating the Efficacy of Artificial Intelligence Techniques for Proactive Risk Assessment in Oil and Gas: A Focus on Predictive Accuracy and Real Time Decision Support

Evaluación de la Eficiencia de las Técnicas de Inteligencia Artificial para la Evaluación Proactiva de Riesgos en Petróleo y Gas: Enfoque en la Precisión Predictiva y el Soporte de Decisión en Tiempo Real

Oubellouch Hicham1 ![]() *, Soulhi Aziz1

*, Soulhi Aziz1 ![]() *

*

1National Higher School of Mines. Rabat, Morocco.

Cite as: Hicham O, Aziz S. Evaluating the Efficacy of Artificial Intelligence Techniques for Proactive Risk Assessment in Oil and Gas: A Focus on Predictive Accuracy and Real Time Decision Support. Data and Metadata. 2024; 3:.532. https://doi.org/10.56294/dm2024.532

Submitted: 21-04-2024 Revised: 27-08-2024 Accepted: 02-12-2024 Published: 03-12-2024

Editor: Adrián

Alejandro Vitón-Castillo ![]()

Corresponding author: Oubellouch Hicham *

ABSTRACT

The oil and gas industry operates within a landscape of complex, high-stakes risks that span operational, environmental, and safety domains. Traditional risk assessment methodologies, while foundational, are constrained by their static nature and limited capacity to process dynamic, large-scale data. This dissertation investigates the application of artificial intelligence (AI) methodologies—specifically fuzzy logic and machine learning—to enhance risk assessment frameworks in the oil and gas sector. By systematically evaluating key performance criteria, including predictive accuracy, data processing capabilities, and user interactivity, this research establishes a comprehensive framework for integrating AI-driven approaches into risk management systems. The findings demonstrate that AI-based models significantly enhance the ability to anticipate and mitigate risks through real-time decision support and advanced predictive analytics. This work further introduces a scalable decision-making model leveraging fuzzy inference to handle uncertainty and improve the robustness of risk assessments. The proposed framework offers a pathway for transitioning from reactive to proactive safety management strategies, ensuring resilience and sustainability in increasingly complex industrial environments.

Key words: Risk Assessment; Fuzzy Logic; Gas and Oil Industry; Hazard Control; Decision-Making; Artificial Intelligence.

RESUMEN

La industria del petróleo y gas opera en un entorno de riesgos complejos y de alto impacto que abarcan los dominios operativos, ambientales y de seguridad. Las metodologías tradicionales de evaluación de riesgos, aunque fundamentales, están limitadas por su naturaleza estática y su capacidad restringida para procesar datos dinámicos y a gran escala. Esta tesis investiga la aplicación de metodologías de inteligencia artificial (IA), específicamente la lógica difusa y el aprendizaje automático, para mejorar los marcos de evaluación de riesgos en el sector del petróleo y gas. Mediante la evaluación sistemática de criterios clave de desempeño, como la precisión predictiva, la capacidad de procesamiento de datos y la interactividad del usuario, esta investigación establece un marco integral para integrar enfoques basados en IA en los sistemas de gestión de riesgos. Los hallazgos demuestran que los modelos basados en IA mejoran significativamente la capacidad de anticipar y mitigar riesgos a través del soporte a la toma de decisiones en tiempo real y análisis predictivo avanzado. Este trabajo también introduce un modelo de toma de decisiones escalable que aprovecha la inferencia difusa para manejar la incertidumbre y mejorar la robustez de las evaluaciones de riesgos. El marco propuesto ofrece una vía para la transición de estrategias de gestión de seguridad reactivas a proactivas, garantizando la resiliencia y sostenibilidad en entornos industriales cada vez más complejos.

Palabras clave: Evaluación de Riesgos; Lógica Difusa; Industria del Petróleo y Gas; Control de Peligros; Toma de Decisiones; IA.

INTRODUCTION

The oil and gas industry faces a wide range of risks, from operational incidents to environmental disasters. To mitigate these risks, robust risk assessment systems are essential, capable of anticipating potential threats and guiding risk management decisions. Artificial intelligence (AI) holds significant potential to enhance these processes, enabling deeper data analysis, more precise identification of trends and emerging risks, and faster, more informed decision-making. By leveraging advanced algorithms and machine learning models, companies can develop predictive analytics that not only identify risks but also suggest proactive measures to minimize their impact.(1)

However, for these AI tools to be truly effective, it is necessary to define key performance criteria that guide the selection of technologies and ensure their relevance in the context of risk assessment. Among these criteria, prediction accuracy, the ability to analyze large volumes of data, and interactivity between AI and users are critical.(2) Additionally, the use of fuzzy logic allows better management of uncertainties and helps to develop an AI model capable of making decisions by considering these criteria. By integrating these elements, companies can not only improve the accuracy of their risk assessments but also optimize resources and enhance the resilience of their operations.(3)

Literature review

This technology-driven approach to risk assessment, combining encoded human knowledge with AI techniques, fosters safer operational designs and continuous adaptation of risk management strategies to evolving industry dynamics and regulatory requirements. The integration of these innovations can lead to improved safety protocols, optimized resource allocation, and ultimately, a more resilient operational framework.

|

Table 1. Comparison of Risk Assessment and Safety Analysis Methods(1,2,3) |

|||

|

Method |

Advantages |

Disadvantages |

Best Applications |

|

HAZOP (Hazard and Operability Study) |

Systematic identification of potential hazards and operability issues; facilitates team-based evaluation. |

Time-consuming and relies on expert judgment, which may introduce bias. |

Design and operational stages to identify safety issues. |

|

FMEA (Failure Modes and Effects Analysis) |

Focuses on failure modes and their potential consequences, useful for early design phases. |

Limited in scope; may not capture interactions between different failure modes. |

Early design phases to identify and prioritize potential failure points. |

|

Bowtie Analysis |

Provides a clear visual representation of risk pathways; easy to communicate risk scenarios. |

Can oversimplify complex systems and focus only on specific scenarios. |

Visualizing risk pathways for critical safety reviews and regulatory reporting. |

|

Fault Tree Analysis (FTA) |

Breaks down system failures logically to determine root causes; suitable for complex systems. |

Requires extensive data and logical gate definitions; difficult to apply without detailed system knowledge. |

Analyzing root causes of system failures and assessing preventive measures. |

|

Event Tree Analysis (ETA) |

Evaluates sequences of events that can lead to accidents, helping to assess overall risk likelihood. |

Can become complex with numerous branches; may overlook dependent events. |

Assessing complex accident scenarios involving multiple events or failures. |

|

QRA (Quantitative Risk Assessment) |

Provides a quantified approach to risk, enabling decision-makers to assess risk acceptability numerically. |

Relies heavily on accurate data input; often requires complex mathematical modeling. |

Making decisions about risk tolerance levels based on numerical data. |

|

Layer of Protection Analysis (LOPA) |

Focuses on independent protection layers; useful for determining safety levels in complex systems. |

Requires detailed knowledge of safeguards and risk control measures; may not be suitable for early design phases. |

Determining the effectiveness of independent protection layers in preventing accidents. |

|

What-If Analysis |

Flexible and easy to implement; encourages brainstorming of hypothetical scenarios. |

Highly subjective and reliant on team expertise; less structured than other methods. |

Quick identification of potential hazards in brainstorming sessions. |

|

Monte Carlo Simulation |

Uses probabilistic methods to model risk variability; accounts for uncertainty in risk predictions. |

Requires significant computational resources and statistical expertise; results depend on input data quality. |

Assessing risk variability and uncertainty in systems with stochastic behavior. |

The Limitations of Traditional Risk Assessment Methods and the Need for AI Integration

Traditional risk assessment methods in the oil and gas industry, such as HAZOP,FMEA, and QRA, are valuable but have significant limitations.(3) These methods often rely on expert judgment, making them prone to subjectivity and potential bias, especially in complex or novel scenarios.(4)

Additionally, traditional models are less capable of handling the vast amounts of operational data generated by modern industrial systems, leading to slower and less dynamic risk assessments.(5) Many of these methods assume precise, reliable data and struggle with uncertainty and ambiguity, which are inherent in real-world operations.(6) Furthermore, the static nature of models like FTA and ETA makes them unsuitable for adapting to rapidly evolving risks, particularly in environments where automation and digitalization are transforming operations.(7)

To address these challenges, integrating Artificial Intelligence (AI) into risk assessment processes offers a transformative solution.(8) AI can process large datasets, learn from historical patterns, and predict future risks more accurately than traditional methods. However, to maximize the effectiveness of AI in risk assessment, it is essential to define clear criteria for selecting the most appropriate AI technique.(7) These criteria should include factors such as accuracy, data handling capacity, interpretability, and the ability to integrate with existing safety protocols. By establishing these criteria, organizations can ensure that the chosen AI model not only enhances the accuracy and timeliness of risk assessment but also provides transparent and actionable insights, leading to better decision-making and improved safety outcomes.(7,8)

Furthermore, ongoing evaluation and adaptation of the AI model are crucial to address evolving risks and incorporate new data, ensuring that the system remains relevant and effective over time.

The criteria to evaluate the AI model should also consider scalability, user-friendliness, and the potential for continuous learning, allowing organizations to stay ahead of emerging threats and maintain a proactive approach to safety management.(9)

Additionally, collaboration with stakeholders and subject matter experts can enhance the model’s effectiveness, fostering a culture of shared responsibility and innovation in safety practices.

Prediction accuracy Big data analysis Interactivity

Applications of AI in risk assessment

The application of Artificial Intelligence (AI) in the oil and gas industry is rapidly developing and being introduced in various areas such as smart drilling, smart pipeline, and smart refinery. AI can help extend the life cycle of oil fields, improve decision-making efficiency and quality, reduce costs, and increase economic benefits.(10)

Furthermore, predictive analytics powered by AI can identify potential failures before they occur, allowing for proactive maintenance and minimizing downtime, which is crucial in maintaining operational integrity and safety in these high-stakes environments.(5)

Furthermore, predictive analytics powered by AI can identify potential failures before they occur, allowing for proactive maintenance and minimizing downtime, which is crucial in maintaining operational integrity and safety in these high-stakes environments.

The machine learning (ML) and time-series forecasting techniques have significant benefits in risk-based inspection (RBI) methods in the oil and gas industry, particularly in assessing equipment risk and predicting remaining useful life (RUL) (Review of Risk-Based Inspection Development to Support Service Excellence in the Oil and Gas Industry: An Artificial Intelligence Perspective) (9)The use of machine learning classifiers such as Decision Trees, Logistic Regression, Support Vector Machines, K-nearest neighbours, and Random Forests shows promise in risk assessment and prediction of equipment condition and severity level . Review of Risk-Based Inspection Development to Support Service Excellence in the Oil and Gas Industry: An Artificial Intelligence Perspective) These techniques enable more accurate predictions, allowing for proactive maintenance strategies that can significantly reduce downtime and operational costs.(10)

METHOD

Introduction fuzzy logic

The notion of fuzzy sets introduced by Zadeh (11) serves as the foundation for fuzzy logic. It is a broadening of the traditional set theory. This method allows for flexible thinking and takes subjectivity, subjectivity, ambiguity, and ambiguity.

Fuzzy logic defines rules and membership functions in sets termed “fuzzy sets,” which provide up a variety of possibilities for working with imprecise linguistic data.(12)

For evaluating indicators for which there is no traditional model for estimation, fuzzy sets theory is useful. If the model is too complicated and measuring. Zadeh(11) claims that this theory is the best formalism for qualitatively describing linguistic variables.

Fuzzy logic is used for dependability and risk evaluation, in fact.(3) The benefit of using fuzzy theory for risk assessment is that the system evaluation that results is qualitative and that it can work with language variables because certain occurrences cannot be quantified mathematically. Fuzzy logic, on the other hand, works with subjective, imperfect, or unreliable knowledge sources.

A suitable method to identify the crucial system components quickly and precisely is fuzzy logic. To determine how each risk factor level contributes to the operational risk indicator, it concurrently assesses each degree of risk. They can aid in developing and putting into practice remedial actions for lowering risks.

The fuzzy inference is a formulation method that applies fuzzy logic to the input data and the output data. It has all the following episodes: fuzzy logic operators, if-then statements, and membership functions.(13)

While creating the membership functions and decision matrix for a fuzzy system, for example, the designer relies heavily on statistical data or expert opinion.(14) The procedures shown in Figure 1 are used to create a fuzzy logic system:

1. Choose the main factors that have an impact on the dependent variables.

2. Build fuzzy sets for both independent and dependent variables, and then use membership functions to describe the degree of truth that each variable belongs to a certain fuzzy set.

3. Set the system’s inference guidelines.

4. Based on the independent variables and the inference rules, create the output fuzzy set of the dependent variable, after which the defuzzification process calculates the output fuzzy set’s numerical value.

5. Make a choice based on the model’s findings.

RESULTS AND DISCUSSION

Evaluating artificial intelligence (AI) for rheumatoid arthritis (RA) involves several critical criteria that ensure the effectiveness and reliability of AI applications in clinical settings. The following sections outline key evaluation criteria based on recent research. (8)

These criteria include prediction accuracy, data integration capabilities, and the ability to adapt to individual patient needs, which are essential for tailoring treatment plans and improving patient outcomes. Furthermore, the incorporation of real-time data monitoring and feedback mechanisms can significantly enhance the responsiveness of AI systems, allowing for timely adjustments in treatment strategies as new information becomes available. Moreover, the ethical considerations surrounding data privacy and informed consent must be addressed to foster trust among patients and healthcare providers, ensuring that AI technologies are implemented responsibly and transparently.

Figure 1. Fuzzy Logic Framework for AI-Based Risk Assessment

The Fuzzy Logic model was developed using expert knowledge to evaluate the effectiveness of AI in risk assessment by assessing prediction accuracy, data volume analysis, and interactivity. The model utilized linguistic variables such as “high,” “medium,” and “low” to handle uncertain and imprecise information, enabling more nuanced decision-making in selecting the most suitable AI tools for risk management. This approach allows the system to account for varying degrees of uncertainty and improves the robustness of the overall risk assessment process.

Figure 2. Fuzzy Logic Inference System Framework

To construct the evaluation tables for AI performance criteria, a qualitative approach was adopted, where each criterion was assessed based on its impact on AI-driven risk assessment. Key factors such as prediction accuracy, data volume analysis, interactivity, and fuzzy logic integration were analyzed using linguistic terms like High, Medium, Low, Very Low, and Negligible to reflect the varying levels of influence these criteria have on the overall AI performance. This qualitative method is grounded in fuzzy logic theory, which utilizes linguistic variables to handle uncertainty and imprecise information.(15,16) These tables were developed by synthesizing expert knowledge and insights from existing literature, allowing for the creation of a structured, scalable framework that helps in selecting the most appropriate AI tools for risk management.(17) This methodology provides a flexible and adaptable model, enabling decision-makers to account for uncertainties while optimizing the effectiveness of AI in risk assessment.

|

Table 2. Evaluation tables for AI performance criteria |

|

|

Linguistic Term |

Description |

|

1. Prediction Accuracy |

|

|

High |

Essential for ensuring precise and accurate risk predictions. |

|

Medium |

Moderately impacts the accuracy of predictions, depending on the risk model used. |

|

Low |

Has a limited effect on prediction accuracy in less critical scenarios. |

|

2. Data Volume Analysis |

|

|

Extensive |

Critical for analyzing large datasets and identifying risk patterns. |

|

moderate |

Necessary for medium-sized datasets and dynamic data environments. |

|

Limited |

Relevant in smaller datasets or simplified risk models. |

|

3. Interactivity |

|

|

High |

Key to ensuring effective human-AI interaction for decision-making. |

|

Medium |

Important when human input is occasionally required for oversight. |

|

Low |

Only relevant in specific cases where human interaction improves outcomes. |

In our study on evaluating AI performance for risk assessment (RA), fuzzy inference plays a crucial role in defining how different AI performance criteria—such as prediction accuracy, data volume analysis, and interactivity—contribute to the overall effectiveness of AI in managing risks. Using linguistic variables, we translate expert judgments into structured rules, helping us manage uncertainties and imprecise information.

Similar to the HAZOP process,(3) where linguistic terms like “high,” “medium,” and “low” describe system failures, we employ these variables to evaluate the AI’s ability to predict risks, analyze large datasets, and facilitate decision-making. The inference engine in our system operates on a rule-based structure using fuzzy logic, such as:

If prediction accuracy is High, and data volume analysis is Low, then AI performance risk is Medium.

In our context, the rules are formed based on combinations of these criteria, leading to a comprehensive evaluation of the AI system’s ability to manage risk assessments effectively. For example:

If prediction accuracy is High, and interactivity is Low, then overall AI performance is Medium.

However, we have 27 rules because there are 3 levels in Prediction Accuracy;Big data ;Interactivity.our fuzzy inference model provides a detailed, adaptable framework for assessing AI performance in RA.

This approach allows us to ensure that AI systems are evaluated holistically, taking into account both technological capabilities and human interaction, providing a robust decision-making tool for managing risk.

The defuzzification

The fuzzification is the linguistic-to-numerical translation of several factors defining overall effectiveness. The center of gravity approach is the one employed in this situation. This approach considers all information at hand.(8)

Figure 3. Centre of Gravity Approach for Defuzzification

We will use the membership functions, making by the experts like filling plant managers HSSE Manager, Maintenance Manager Technical engineer and IT Lead , to demonstrate the corresponding level of validity of each variable. The indicators are described by a trapezoidal membership function using language phrases relevant to each indicator.

Figure 4. Interactivity Membre Ship Function

RESULTS

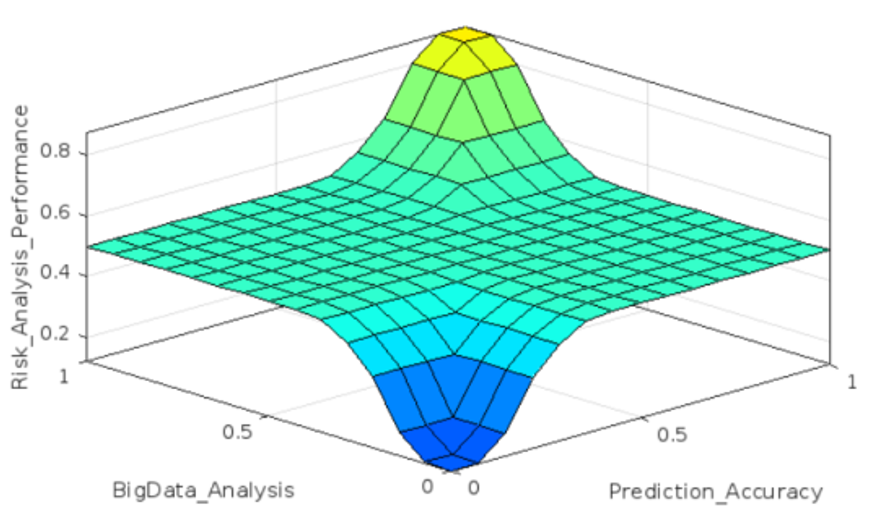

Case N°1 : (Input1 = Bigdata analysis ; Input2 = Prediction Accuracy)

The index of interactivity is fixed in advance in Medium.

Figure 5. Interactivity between variables Prediction Accuracy and Big Data Analysis

The curve shows a synergistic relationship between these two criteria. When both Prediction Accuracy and Big Data Analysis are maximized (towards the top-right corner), the performance of the risk assessment system reaches its highest level (Z-axis peaks in yellow). This suggests that to achieve optimal performance in risk analysis, both accuracy in prediction and a robust ability to process big data are essential.

Compromise between the two: If one of these factors is weak (e.g., high accuracy but limited data analysis or vice versa), the system’s performance is suboptimal. This indicates that both elements must be well-developed for the RA system to function at its best.

To enhance Risk Assessment (RA) performance, improving both Prediction Accuracy and Big Data Analysis is essential. High prediction accuracy ensures that the risks are identified with precision, while extensive data analysis allows the system to capture a wide range of potential issues and patterns. Together, these factors lead to a highly effective risk management framework that can anticipate and mitigate risks with greater reliability.

Figure 6. Relation between variables Prediction Accuracy and Interactivity

Interactivity’s Impact

The curve highlights the importance of Interactivity in risk analysis. Even if Prediction Accuracy is low, improving the interaction between the human operator and the AI system can still lead to moderate risk analysis performance. This shows that human oversight and input can compensate for limitations in prediction accuracy to some extent.

Prediction Accuracy’s Impact: Prediction Accuracy has a significant impact on risk analysis. As accuracy increases, the system becomes more reliable in predicting potential risks, which improves the overall performance.

Synergy: The highest risk analysis performance is achieved when both Prediction Accuracy and Interactivity are high, suggesting a synergistic relationship between these two factors. Maximizing both is key to obtaining the best results in AI-driven risk management.

This curve shows that while both Interactivity and Prediction Accuracy independently improve risk analysis performance, the best outcomes are achieved when both are maximized. Enhancing the accuracy of predictions and improving the way users interact with the system are crucial for a robust risk management process.

Figure 7. Relation between variables Big Data Analysis and Interactivity

Impact of Interactivity:

Moderate Impact: Even with low data analysis capabilities, increasing Interactivity (human-AI collaboration) can moderately improve the performance of risk analysis. This highlights the importance of human oversight, as experts can compensate for the AI’s limitations in data processing by providing contextual understanding and real-time decision-making.

Compensatory Role: Interactivity acts as a compensatory factor when data processing capabilities are limited.

Impact of Big Data Analysis:

Critical for Performance: As expected, improving Big Data Analysis significantly enhances Risk Analysis Performance. The more data the AI system can process, the more precise and comprehensive its risk predictions will be, leading to better outcomes in risk management.

Dependency: For maximum performance, Big Data Analysis needs to be coupled with strong interactivity. Big Data alone, without proper user interaction and feedback, may not yield the best possible results, as seen from the relatively lower performance when Interactivity is low, even with high Big Data Analysis.

Combined Impact:

The highest Risk Analysis Performance is achieved when both Interactivity and Big Data Analysis are optimized. This synergy indicates that the AI system works best when it has access to large datasets for analysis and when human operators can interact with it to refine predictions and decisions.

To maximize Risk Analysis Performance, both Interactivity and Big Data Analysis must be enhanced. While each factor individually improves performance, their combined effect is much more powerful. For optimal results, systems should aim to both facilitate effective human-AI interaction and leverage comprehensive data analysis, ensuring that the AI has sufficient information and contextual feedback to make accurate and reliable risk assessments.

DISCUSSION

The results from our study reveal a synergistic relationship between key criteria, namely Prediction Accuracy, Big Data Analysis, and Interactivity, in enhancing the performance of AI-driven risk assessment systems. Each of these criteria plays a vital role in optimizing RA performance, and their combined effect leads to more reliable, accurate, and efficient risk management processes.

Impact of Prediction Accuracy and Big Data Analysis

The analysis indicates that Prediction Accuracy and Big Data Analysis are two critical factors that significantly impact the overall performance of the RA system. The surface plot demonstrates that when both criteria are maximized, the RA system achieves its highest performance (Z-axis peaks in yellow). This suggests that high prediction accuracy allows the system to identify risks with greater precision, while robust data analysis enables the AI model to process large amounts of data, uncovering patterns and anomalies that contribute to proactive risk management.

However, the system’s performance diminishes when either criterion is underdeveloped. For instance, even if Prediction Accuracy is high, the absence of sufficient Big Data Analysis may result in incomplete or inaccurate risk predictions. Similarly, extensive data analysis without high Prediction Accuracy leads to suboptimal decision-making. Therefore, both criteria must be well-developed for the AI-based RA system to function effectively.

These findings align with previous studies highlighting the necessity of combining accurate predictive models with the ability to handle large datasets in complex industrial environments, such as the oil and gas sector. This combination leads to improved safety protocols and optimized resource allocation by mitigating risks more effectively.

Interactivity’s Role in Risk Analysis:

In addition to technical capabilities like prediction and data analysis, the study underscores the importance of Interactivity in RA performance. Even in scenarios where Prediction Accuracy is low, increased human-AI interaction can improve performance. This is because human oversight compensates for AI limitations by offering contextual understanding and real-time feedback, enabling better decision-making.

The compensatory role of Interactivity becomes particularly crucial when Big Data Analysis is limited. Experts can intervene and refine predictions, ensuring that critical decisions are not entirely reliant on AI, especially in high-risk environments. These findings are consistent with the growing body of literature emphasizing the role of human-AI collaboration in enhancing system reliability.

Synergy between Criteria

The study highlights the synergistic effect of these criteria. While Prediction Accuracy, Big Data Analysis, and Interactivity each improve performance independently, their combined optimization leads to the highest level of Risk Analysis Performance. This suggests that the best results in AI-driven risk management can be achieved when all three factors are balanced and maximized.

For example, high prediction accuracy combined with extensive data analysis allows the AI system to produce highly reliable predictions, while human-AI interaction provides the flexibility needed to manage unexpected risks or anomalies that the AI might not fully comprehend.

Practical Implications

The findings have significant practical implications for industries that rely on AI for risk management, such as the oil and gas, healthcare, and manufacturing sectors. Organizations should focus on developing AI models that balance prediction accuracy and data analysis capabilities while also fostering environments that encourage active human-AI collaboration.

Incorporating this approach into risk management frameworks will enhance the system’s ability to anticipate and mitigate risks with greater reliability. As these factors are further optimized, companies can expect to see improvements in safety, decision-making, and overall operational efficiency

CONCLUSION

To conclude, the study demonstrates that enhancing Prediction Accuracy, Big Data Analysis, and Interactivity significantly improves Risk Analysis Performance. A combined, well-optimized approach to these factors is essential for AI-driven systems to manage risks effectively. Future research could explore the scalability of this model across various industries and further refine the criteria for evaluating AI performance in risk assessments.

By grounding your discussion in these key insights, you can build a strong narrative that emphasizes the critical factors influencing AI-driven risk management systems and the potential for further developments in this field.

REFERENCES

1. Popescu C, Avram L, Mocanu I. Risk Management in the Oil and Gas Industry Related to the AI Tools. In: Emerging Trends and Applications in Cognitive Computing. IGI Global; 2021. https://doi.org/10.4018/978-1-7998-5077-9.CH017

2. Choubey S, Karmakar GP. Artificial intelligence techniques and their application in oil and gas industry. Artificial Intelligence Review. 2021. https://doi.org/10.1007/S10462-020-09935-1

3. Canon J, Broussard T, Johnson A, Singletary W, Colmenares-Diaz L. A Knowledge-Based Artificial Intelligence Approach to Risk Management. SPE Technical Report. https://doi.org/10.2118/210303-MS

4. Hicham O, Aziz S. Risk assessment for the liquefied petroleum gas filling industry using fuzzy logic and hazard and operability. Salud, Ciencia y Tecnologia. 2024;4. https://doi.org/10.56294/saludcyt2024749

5. Azizan K. A Review on Risks and Project Risks Management: Oil and Gas Industry.International Journal of Scientific & Engineering Research, Volume 6, Issue 8, August-2015 938 ISSN 2229-5518

6. Zulqarnain M, Tyagi M. Quantitative Risk Assessment (QRA) of an Exploratory Drilling Oil Spill in Deepwater Gulf of Mexico. Proceedings of OMAE 2014. 2014. https://doi.org/10.1115/OMAE2014-24685

7. Bedford T, Cooke RM. Probabilistic Risk Analysis: Foundations and Methods. Cambridge University Press; 2001. https://doi.org/10.1017/CBO9780511813597

8. Jia Z, Wang J, Deng C. IIoT-based Predictive Maintenance for Oil and Gas Industry. Proceedings of ACM Conference. 2022. https://doi.org/10.1145/3573428.3573503

9. Desikan J, Devi AJ. AI and ML-based Assessment to Reduce Risk in Oil and Gas Retail Filling Station: A Literature Review. Journal of Information Technology and Digital World. 2023;4:5. https://doi.org/10.36548/jitdw.2022.4.005

10. Guan Z, Sheng YN, Xi CM, Luo M, Li W. Oil & Gas Drilling Risk Analysis Utilizing Quantitative Risk Assessment. Journal of Advanced Science and Engineering. 2018;214. https://doi.org/10.6180/jase.201812_21(4).0005

11. Zadeh LA. Fuzzy Sets as a Basis for Theory of Possibility. International Journal of Fuzzy Sets and Systems. 1978;1001:3-28.https://doi.org/10.1016/0165-0114(78)90029-5.

12. Kaushik M, Kumar R. An application of fault tree analysis for computing the bounds on system failure probability through qualitative data in intuitionistic fuzzy environment. Quality and Reliability Engineering International. 2022. https://doi.org/10.1002/qre.3084

13. Malinowska A, Cui X, Salmi EF, Hejmanowski R. A novel fuzzy approach to gas pipeline risk assessment under influence of ground movement. International Journal of Coal Science & Technology. 2022;91. https://doi.org/10.21203/rs.3.rs-929951/v1

14. Veliyev EF, Shirinov S, Mammedbeyli TE. Intelligent oil and gas field based on artificial intelligence technology. Elmi əsərlər. 2022;4. https://doi.org/10.5510/ogp20220400785

15. Agrawal A, Maan V. Brain tumour detection via EfficientDet and classification with DynaQ-GNN-LSTM. Salud, Ciencia y Tecnología. 2024; 4:1079.

16. Abbassi R, Khan F, Hawboldt K. A fuzzy logic approach for offshore risk assessment. Safety Science. 2022. DOI: 10.3233/JIFS-219191

17. Development of a risk assessment methodology for intelligent technology of diagnosing industrial equipment for complex oil and gas facilities https://doi.org/10.1016/j.procs.2023.10.110

FINANCING

No financing.

CONFLICT OF INTEREST

The authors declare that there is no conflict of interest.

AUTHORSHIP CONTRIBUTION

Conceptualization: Hicham OUBELLOUCH.

Data curation: Hicham OUBELLOUCH.

Formal analysis: Hicham OUBELLOUCH.

Research: Hicham OUBELLOUCH.

Methodology: Aziz SOULHI.

Project management: Hicham OUBELLOUCH.

Resources: Hicham OUBELLOUCH.

Software: Hicham OUBELLOUCH.

Supervision: Hicham OUBELLOUCH.

Validation: Aziz SOULHI.

Display: Hicham OUBELLOUCH.

Drafting - original draft: Hicham OUBELLOUCH.

Writing - proofreading and editing: Hicham OUBELLOUCH.