doi: 10.56294/dm2024.622

ORIGINAL

Harnessing Big Data and AI for Predictive Insights: Assessing Bankruptcy Risk in Indonesian Stocks

Aprovechar el big data y la inteligencia artificial para obtener información predictiva: evaluación del riesgo de quiebra en las acciones de Indonesia

Maureen Marsenne1 *, Tubagus Ismail2, Muhamad Taqi3, Imam Abu Hanifah3

1CandidateDoctor, Faculty of Economics and Business, Sultan Ageng Tirtayasa University, Serang, Indonesia/ Palangka Raya University, Indonesia.

2Professor, Faculty of Economics and Business, Sultan Ageng Tirtayasa University, Indonesia.

3Senior Lecturer, Faculty of Economics and Business, Sultan Ageng Tirtayasa University, Indonesia.

Cite as: Marsenne M, Ismail T, Taqi M, Hanifah IA. Harnessing Big Data and AI for Predictive Insights: Assessing Bankruptcy Risk in Indonesian Stocks. Data and Metadata. 2024; 3:.622. https://doi.org/10.56294/dm2024.622

Submitted: 01-02-2024 Revised: 12-07-2024 Accepted: 27-12-2024 Published: 28-12-2024

Editor: Dr.

Adrián Alejandro Vitón-Castillo ![]()

Corresponding author: Maureen Marsenne *

ABSTRACT

Introduction: this research aims to investigate the use of financial Big Data and artificial intelligence (AI) in predicting the bankruptcy risk of companies listed on the Indonesia Stock Exchange (BEI), with the Altman Z-Score model as the main framework.

Objective: in this research, an intervening variable in the form of financial data quality is introduced to assess the role of mediation in increasing the accuracy of bankruptcy predictions..

Method: the research method used is quantitative with the analytical method used is Structural Equation Modeling Partial Least Squares (SEM-PLS), which allows analysis of the relationship between independent variables (Big Data and AI), intervening variables (quality of financial data), and dependent variables (bankruptcy risk prediction).

Result: the research results show that the integration of financial Big Data and AI significantly increases the accuracy of company bankruptcy risk predictions on the IDX, with the quality of financial data acting as an intervening variable that strengthens this relationship. The influence of Big Data and AI on bankruptcy prediction through the quality of financial data has also been proven to provide more precise and faster results compared to the conventional Altman Z-Score model.

Conclusion: these findings confirm that the quality of financial data is a key factor that must be considered in optimizing bankruptcy predictions in the capital market. This research has implications for the development of financial technology (Fintech) and risk management strategies in public companies, especially in identifying bankruptcy risks more effectively by utilizing the latest technology.

Keywords: Big Data, Artificial Intelligence; Bankruptcy Prediction; Altman Z-Score; Indonesian Stock Exchange.

RESUMEN

Introducción: esta investigación tiene como objetivo investigar el uso de Big Data financiero e inteligencia artificial (IA) para predecir el riesgo de quiebra de las empresas que cotizan en la Bolsa de Valores de Indonesia (BEI), con el modelo Altman Z-Score como marco principal.

Objetivo: en esta investigación, se introduce una variable interviniente en forma de calidad de datos financieros para evaluar el papel de la mediación en el aumento de la precisión de las predicciones de quiebra.

Método: el método de investigación utilizado es cuantitativo con el método analítico utilizado es el Modelado de Ecuaciones Estructurales de Mínimos Cuadrados Parciales (SEM-PLS), que permite el análisis de la relación entre variables independientes (Big Data e IA), variables intervinientes (calidad de los datos financieros) y variables dependientes (predicción del riesgo de quiebra).

Resultado: los resultados de la investigación muestran que la integración de Big Data financiero e IA aumenta significativamente la precisión de las predicciones de riesgo de quiebra de la empresa en el IDX, y la calidad de los datos financieros actúa como una variable interviniente que fortalece esta relación. También se ha demostrado que la influencia de Big Data e IA en la predicción de quiebras a través de la calidad de los datos financieros proporciona resultados más precisos y rápidos en comparación con el modelo Z-Score de Altman convencional.

Conclusión: estos hallazgos confirman que la calidad de los datos financieros es un factor clave que debe considerarse para optimizar las predicciones de quiebra en el mercado de capitales. Esta investigación tiene implicaciones para el desarrollo de la tecnología financiera (Fintech) y las estrategias de gestión de riesgos en las empresas públicas, especialmente en la identificación de los riesgos de quiebra de manera más eficaz mediante el uso de la última tecnología.

Palabras clave: Big Data; Inteligencia Artificial; Predicción de Quiebras; Altman Z-Score; Bolsa de Valores de Indonesia.

INTRODUCTION

Predicting corporate bankruptcy has become an increasingly important topic in the world of finance and investment, especially for stakeholders such as investors, creditors, regulators and company management.(1) Bankruptcy not only has a negative impact on the company itself, but also on the wider economic ecosystem, including the financial sector, capital markets and society in general. Therefore, early identification of bankruptcy risk is crucial to anticipate greater impacts. In this case, the use of technology, such as financial Big Data and artificial intelligence (AI), provides new opportunities to increase the accuracy and speed of bankruptcy risk predictions.(2)

In Indonesia, the capital market represented by the Indonesian Stock Exchange (BEI) has experienced rapid development in the last few decades.(3) With the increasing number of companies listed on the IDX, the challenges in monitoring company financial performance are also becoming more complex. Bankruptcy risk is one of the main issues that regulators and market players need to pay attention to. In this context, the Altman Z-Score, which is one of the classic models for predicting bankruptcy, has been widely used in various countries as a tool to measure a company’s financial health. However, this model still has limitations, especially in dealing with dynamic changes in company financial data.(4)

The development of information technology, especially in the management of Big Data, provides great opportunities to overcome these limitations.(5) Financial Big Data includes big data generated from financial reports, daily transactions, market trends, and other external factors that influence company performance. Processing Big Data using conventional methods is often time consuming and inefficient, but with artificial intelligence (AI), data analysis can be done more quickly, precisely and in depth. AI is able to process very large and complex volumes of data to identify patterns that traditional methods cannot see, thereby increasing accuracy in bankruptcy predictions.(6)

The Altman Z-Score model itself uses several important financial ratios, such as profitability, liquidity, leverage and company efficiency, to predict bankruptcy risk.(7) Although this model has been proven to be quite accurate in various previous studies, it also requires adaptation to function better in a rapidly changing business environment, such as in the Indonesian capital market. By combining financial Big Data and AI, this bankruptcy prediction model can be adapted to dynamic market conditions and provide results that are more relevant to the latest developments.(8)

This research aims to examine the extent to which the integration of Big Data and AI can improve the performance of the Altman Z-Score model in predicting company bankruptcy on the IDX.(9) In this research, historical data from companies listed on the IDX will be analyzed using machine learning algorithms to detect patterns that indicate bankruptcy risk. The results of this analysis will be compared with the predictions of the conventional Altman Z-Score model to see whether there is an increase in accuracy by utilizing Big Data and AI technology.(10)

Apart from that, this research will also discuss the implications of more accurate bankruptcy predictions for stakeholders.(11) For investors, this information can be used to make wiser investment decisions and avoid potential losses from high-risk companies. For company management, prediction results can be used as a tool to evaluate financial performance internally and take preventive action before the risk of bankruptcy occurs. Regulators can also utilize these results to monitor companies’ financial health more effectively, thereby increasing the stability of the capital market in Indonesia.(12)

Overall, the use of Big Data and AI in bankruptcy prediction is an innovative step that can have a significant impact on the development of a smarter and more resilient financial system.(13) With the results of this research, it is hoped that it can contribute to the development of a more comprehensive bankruptcy prediction model, as well as strengthening capital market infrastructure in Indonesia.(14)

Theoretical review

Big financial data on bankruptcy risk prediction

Financial Big Data refers to the collection, processing, and analysis of large and varied volumes of financial data from various sources.(15) In the context of bankruptcy risk prediction, Big Data allows companies and financial analysts to access and utilize a wider range of data compared to traditional methods. With the ability to collect data from multiple sources, including financial reports, market transactions, social media, and public sentiment, companies can gain deeper insight into their financial condition and operational performance. This information helps in identifying patterns that may indicate future bankruptcy risk, providing stakeholders with better tools for decision making.(16)

The use of financial Big Data in bankruptcy risk analysis changes conventional approaches that are usually based on simple statistical models, such as the Altman Z-Score. These models often use a small number of financial ratios to predict bankruptcy, which may not cover all dimensions of complexity present in the financial data.(17) In contrast, with Big Data technology, machine learning algorithms can be applied to analyze interactions between various financial variables simultaneously, identify correlations that may not be visible, and predict the likelihood of bankruptcy more accurately. This results in a prediction model that is more dynamic and responsive to changes in market conditions and company behavior.(18)

However, it is important to note that the effectiveness of financial Big Data in predicting bankruptcy risk is highly dependent on the quality of the data collected and processed.(19) Inaccurate, incomplete, or biased data can result in erroneous predictions, potentially harming decision making. Therefore, managing the quality of financial data is the key to utilizing Big Data effectively. By paying attention to data quality, companies can ensure that the information used for analysis truly reflects the company’s condition and performance, thereby increasing accuracy in predicting bankruptcy risk.(20)

It can be concluded that the application of financial Big Data in bankruptcy risk prediction provides an opportunity to increase the accuracy and relevance of existing prediction models.(21) By utilizing greater volume and diversity of data, as well as the application of machine learning algorithms, bankruptcy risk analysis becomes more comprehensive and adaptive to changing conditions. However, challenges in managing data quality must still be considered, because low data quality can damage the reliability of analysis results. Therefore, integration between Big Data technology, artificial intelligence and good data management practices is very important to produce effective and useful predictions for stakeholders in making strategic decisions regarding bankruptcy risk management.(22)

H1: there is a significant influence of big financial data on bankruptcy risk prediction

AI towards bankruptcy risk prediction

Artificial intelligence (AI) is playing an increasingly important role in predicting bankruptcy risk by utilizing advanced algorithms and data analysis techniques that can process large amounts of information.(23) With the ability to learn from historical data, AI can identify patterns and trends that traditional methods may not detect. For example, machine learning algorithms can be used to analyze financial data, market behavior, and even public sentiment related to a company to produce more accurate predictions regarding the likelihood of bankruptcy. This is especially important given that bankruptcy is often the result of multiple interacting factors, and AI enables better modeling of this complexity.(24)

Additionally, AI is capable of real-time analysis, allowing companies to immediately respond to changes that may affect their financial performance.(25) By using predictive analytics techniques, companies can monitor key indicators that indicate potential bankruptcy risk, such as a decline in revenue, an increase in debt, or significant changes in consumer behavior. The use of AI in risk analysis not only increases the speed of decision making but also minimizes risks that may arise due to delays in responding to early warnings regarding the company’s financial health.(26)

However, the application of AI in bankruptcy risk prediction is also faced with several challenges. One of them is the need for high-quality data, which is an absolute requirement for producing effective prediction models.(27) Incomplete or biased data can produce inaccurate and confusing predictions. Additionally, there are challenges in terms of interpretability of AI models. Many AI algorithms, especially those based on machine learning, can function as “black boxes” that are difficult to understand. This can make it difficult for decision makers to understand the basis of the predictions provided and make appropriate decisions based on the results of the analysis.(28)

Overall, artificial intelligence offers great potential in improving the accuracy and efficiency of bankruptcy risk predictions. With the ability to analyze large amounts of data and learn from existing patterns, AI can provide companies with deep and timely insights into their financial condition. However, the success of AI implementation in bankruptcy risk prediction is highly dependent on the quality of the data used and the ability to interpret the analysis results. Therefore, the integration of AI technology, good data management and strong analytical skills is essential to maximize the benefits that can be gained from applying AI in this field.(29)

H2: there is a significant influence of AI on bankruptcy risk prediction

Big financial data on the quality of financial data

Financial Big Data refers to the collection and analysis of large amounts and diverse financial data generated from a variety of sources, including market transactions, financial reports, social media, and internal corporate information systems.(30) With these enormous volumes of data, the challenge faced is ensuring that the data used for analysis and decision making is accurate, relevant and reliable. The quality of financial data is crucial because inaccurate or incomplete data can cause errors in analysis, which in the end can affect the company’s strategic decisions. Therefore, in the Big Data era, organizations need to adopt good data management practices to maintain and improve the quality of their financial data.(31)

The use of advanced technology in processing financial Big Data can also improve data quality. For example, by applying machine learning algorithms and statistical analysis techniques, companies can automatically detect and correct errors in data, identify anomalies, and ensure that the data used for analysis is of high quality.(32) In addition, Big Data allows organizations to validate data in real-time, so they can improve and update financial information continuously. This not only increases the accuracy of the data but also increases the speed of decision making based on that data.(33)

However, although Big Data offers many benefits, challenges remain when it comes to managing data quality. Companies have to face problems such as fragmented data, non-uniformity of data formats, and privacy issues related to the use of big data.(34) To overcome this problem, organizations need to implement strict policies in the collection, storage and use of financial data.(35)

H3: there is a significant influence of financial big data on the quality of financial data

AI on financial data quality

Artificial intelligence (AI) has emerged as an invaluable tool in improving the quality of financial data. With the ability to process and analyze large amounts of diverse data, AI can help organizations detect and correct errors in financial data.(36) Machine learning algorithms can identify patterns and anomalies that may not be visible to humans, such as data input errors or inconsistencies in financial reports. This automation process not only improves data accuracy but also reduces the time and resources required to perform manual checks, allowing companies to focus on more strategic analysis.(37)

Apart from that, AI can also improve the quality of financial data through real-time data processing. By using predictive analysis techniques, AI can monitor incoming financial data and validate it automatically.(38) For example, if there is transaction data that does not match the expected pattern, the AI system can provide a warning to the user to carry out further checks. In this way, companies can immediately address data quality problems before the data is used in decision making. Speed and accuracy in processing financial data are important factors in maintaining the integrity of financial reports and ensuring that the information presented to stakeholders is accurate and reliable.(39,40,41)

Overall, artificial intelligence has significant potential to improve the quality of financial data in organizations. With the ability to detect errors, validate data in real-time, and automate data processing, AI can help companies maintain the integrity and accuracy of financial reports. However, challenges in terms of input data quality and interpretability of AI models must be overcome to maximize the benefits that can be obtained. With proper management and judicious application of AI technology, organizations can improve the quality of their financial data and, in turn, increase the reliability of the information used in strategic decision making.(42)

H4: there is a significant influence of AI on the quality of financial data

The quality of financial data on bankruptcy risk prediction

The quality of financial data has a significant impact on the ability to predict the risk of bankruptcy of a company. High-quality financial data, including accuracy, completeness, consistency and currency, is key to building effective predictive models.(43) When financial data is inaccurate or incomplete, analyzes performed based on that data can be misleading and lead to bad decisions. For example, in the context of a predictive model such as the Altman Z-Score, the use of flawed financial data can result in incorrect estimates of a company’s financial health, which can result in an inability to detect bankruptcy risk in a timely manner.(44)

Apart from that, the quality of financial data also influences the validity and reliability of analytical models used to predict bankruptcy.(45) Models built with low-quality data tend to produce unreliable output and are detrimental to the company. This can lead to errors in strategic decision making, such as reducing investments, cutting costs, or changes in organizational structure, which would not be necessary if bankruptcy risk predictions were carried out with the right data.(46)

On the other hand, improving the quality of financial data can provide additional benefits in risk management. When financial data is more accurate and consistent, companies can more easily identify trends and patterns that indicate potential financial problems.(47) For example, analysis of financial ratios, cash flows and other performance indicators can be carried out more effectively, allowing management to take proactive action in overcoming existing risks. In other words, improving the quality of financial data not only improves bankruptcy risk predictions, but also helps companies better manage overall risk.(48)

Overall, the quality of financial data plays a crucial role in bankruptcy risk prediction. Accurate, complete, and consistent data is needed to build reliable and valid analytical models. Inaccuracies in financial data can lead to wrong predictions, potentially harming the company in making strategic decisions. Therefore, companies should focus on improving the quality of financial data as part of their risk management strategy. In this way, not only will predictions of bankruptcy risk be more precise, but companies will also be better able to manage financial risks more effectively, increasing their chances of surviving and developing in a competitive business environment.(49)

H5: There is a significant influence of financial data quality on bankruptcy risk prediction

H6: There is a significant influence of big financial data on bankruptcy risk prediction through the quality of financial data

H7: There is a significant influence of AI on bankruptcy risk prediction through the quality of financial data.

METHOD

Research design

This research uses an explanatory quantitative design to predict the risk of bankruptcy of companies listed on the Indonesia Stock Exchange (BEI).(50)

Place and time of research

The research location specifically focuses on the IDX digital platform as the main data source, with data processing carried out virtually using financial analysis software and AI in the researcher’s work environment. All data used comes from companies registered on the IDX, so the company’s physical location is in Indonesia, although data access and processing can be done online.

Population and sample

The population of this research is all companies listed on the Indonesia Stock Exchange (BEI) during a certain period. The sampling technique used is purposive sampling, namely selecting companies that meet certain criteria, such as having complete financial reports that are suitable for Z-Score analysis. Sampel pada penelitian ini adalah 190.

Data analysis

The quality of financial data will be assessed based on surveys or questionnaires given to financial experts, auditors and analysts who are experienced in managing financial data in public companies. Secondary data, historical financial data for companies listed on the IDX, such as financial reports, balance sheets and profit and loss statements, will be taken from official sources such as IDX (Indonesia Stock Exchange), Thomson Reuters or Bloomberg. This data is used to calculate the financial ratios required in the Altman Z-Score model as well as Big Data processing.(51)

|

Table 1. Instrument test |

||||

|

|

Artificial Intelligence (AI) |

Financial Big Data |

Financial Data Quality |

Predict Bankruptcy Risk |

|

IK10 |

|

0,805 |

|

|

|

IK11 |

|

0,719 |

|

|

|

IK2 |

|

0,874 |

|

|

|

IK3 |

|

0,866 |

|

|

|

IK4 |

|

0,783 |

|

|

|

IK5 |

|

0,775 |

|

|

|

IK6 |

|

0,754 |

|

|

|

IK7 |

|

0,844 |

|

|

|

IK8 |

|

0,788 |

|

|

|

KG1 |

|

|

|

0,883 |

|

KG10 |

|

|

|

0,766 |

|

KG2 |

|

|

|

0,896 |

|

KG3 |

|

|

|

0,872 |

|

KG5 |

|

|

|

0,905 |

|

KG6 |

|

|

|

0,897 |

|

KG9 |

|

|

|

0,784 |

|

KK1 |

|

|

0,764 |

|

|

KK10 |

|

|

0,849 |

|

|

KK11 |

|

|

0,831 |

|

|

KK12 |

|

|

0,817 |

|

|

KK2 |

|

|

0,778 |

|

|

KK3 |

|

|

0,765 |

|

|

KK4 |

|

|

0,830 |

|

|

KK5 |

|

|

0,864 |

|

|

KK6 |

|

|

0,828 |

|

|

KK7 |

|

|

0,746 |

|

|

KK8 |

|

|

0,763 |

|

|

KK9 |

|

|

0,797 |

|

|

PG1 |

0,812 |

|

|

|

|

PG10 |

0,837 |

|

|

|

|

PG11 |

0,892 |

|

|

|

|

PG12 |

0,815 |

|

|

|

|

PG3 |

0,823 |

|

|

|

|

PG4 |

0,893 |

|

|

|

|

PG5 |

0,877 |

|

|

|

|

PG8 |

0,897 |

|

|

|

|

PG9 |

0,842 |

|

|

|

|

Source: data analysis of SEM PLS 2024 |

||||

Based on table 1, it can be explained that all the instruments tested were declared valid with a loading factor value > 0,70. So it can be explained that the chosen instrument is capable of measuring each latent variable.

|

Table 2. Analysis average variance extracted (AVE) |

|

|

|

Average Variance Extracted (AVE) |

|

Artificial Intelligence (AI) |

0,731 |

|

Financial Big Data |

0,644 |

|

Financial Data Quality |

0,646 |

|

Predict Bankruptcy Risk |

0,738 |

|

Source: SEM PLs 2024 |

|

Based on table 2, it can be explained that each variant of the indicators tested has good convergent validity because the value is > 0,50. It can be concluded that the AVE value in this analysis is able to explain most of the indicator variance.

The composite reliability value of each latent variable exceeds 0,90, which indicates a high level of consistency between indicators in measuring their respective latent variables. Results of each latent variable composite reliability. The reliability of each latent variable is strengthened by the analysis value of alpha cronbach where the research results obtained that each Cronbach’s alpha was greater than 0,60, which illustrates that each indicator of the latent variable has reliable consistency as seen in table 3 below:

|

Table 3. Reliability |

|

|

|

Composite Reliability |

|

Artificial Intelligence (AI) |

0,961 |

|

Financial Big Data |

0,942 |

|

Financial Data Quality |

0,956 |

|

Predict Bankruptcy Risk |

0,952 |

|

Source: SEM PLS 2024 |

|

Based on table 3, it can be explained that the composite reliability test results show a value of > 0,70, this illustrates that the indicators used to measure this construct have good consistency. This means that the indicators consistently reflect the construct being measured and can be relied upon to produce stable measurements.

RESULT AND DISCUSSION

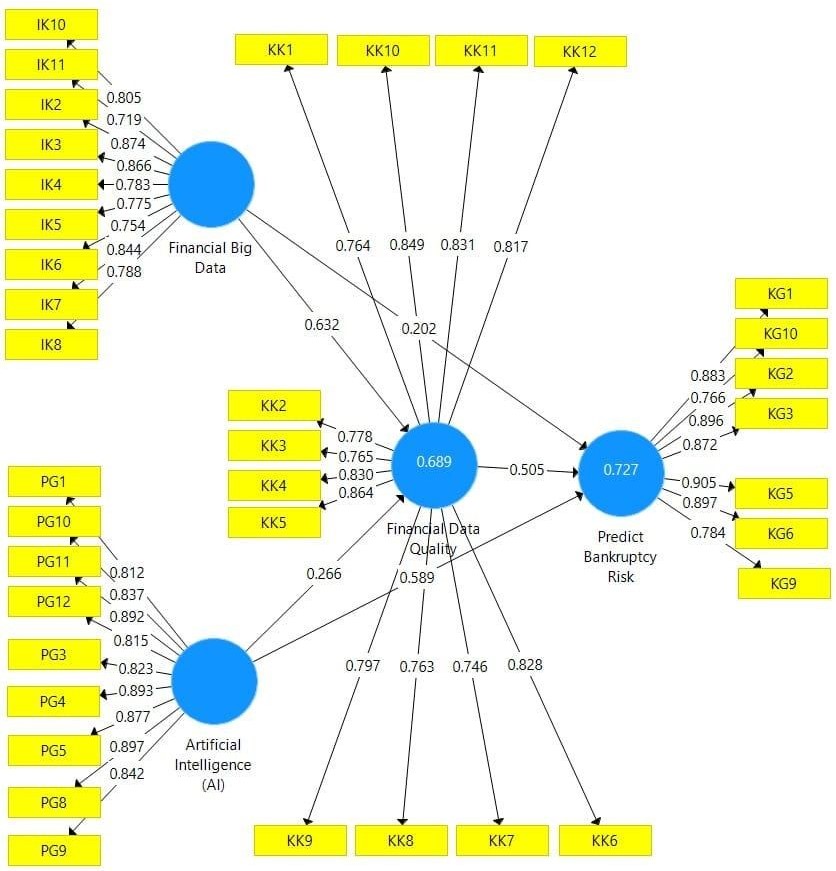

Figure 1. Outer model analysis (Algorithm)

The figure above shows that the highest path coefficient is the influence of financial big data on financial data quality. The second largest is the influence of artificial intelligence on predicting bankruptcy risk. The smallest factor loading is the influence of financial big data on predicting bankruptcy risk.

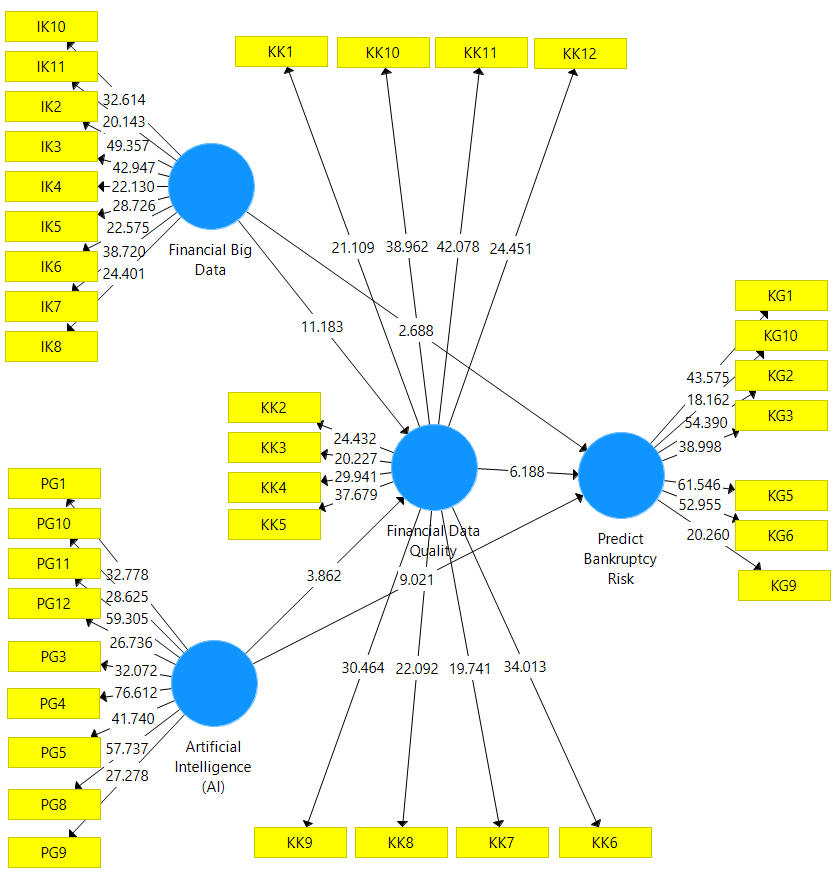

Figure 2. Inner model analysis (boostrapping)

|

Table 4. Test Result of Path Coefficient |

|||||

|

|

Original Sample (O) |

Sample Mean (M) |

Standard Deviation (STDEV) |

T Statistics (|O/STDEV|) |

P Values |

|

Artificial Intelligence (AI) -> Financial Data Quality |

0,266 |

0,264 |

0,069 |

3,862 |

0,000 |

|

Artificial Intelligence (AI) -> Predict Bankruptcy Risk |

0,589 |

0,588 |

0,065 |

9,021 |

0,000 |

|

Financial Big Data -> Financial Data Quality |

0,632 |

0,633 |

0,057 |

11,183 |

0,000 |

|

Financial Big Data -> Predict Bankruptcy Risk |

0,202 |

0,196 |

0,075 |

2,688 |

0,007 |

|

Financial Data Quality -> Predict Bankruptcy Risk |

0,505 |

0,504 |

0,082 |

6,188 |

0,000 |

|

Source: Sem pls 2024 |

|||||

Based on table 4 the results of the hypothesis test, the direct influence of financial big data on predicting bankruptcy risk shows a t-statistic value of 2,688 > 1,96 and a p-value of 0,007 < 0,05, so it can be explained that there is a significant influence of financial big data on predicting bankruptcy risk and the hypothesis. first accepted.

Furthermore, the test results of AI’s direct influence on predicting bankruptcy risk show a t-statistic value of 9,021 > 1,96 and a p-value of 0,000 < 0,05, so it can be explained that there is a significant influence of AI on predicting bankruptcy risk and the second hypothesis is accepted.

Based on the results of the hypothesis test, the direct influence of financial big data on financial data quality shows a t-statistic value of 11,183 > 1,96 and a p-value of 0,000 < 0,05, so it can be explained that there is a significant influence of financial big data on financial data quality and the hypothesis. third accepted.

Furthermore, the test results of AI’s direct influence on financial data quality show a t-statistic value of 3,862 > 1,96 and a p-value of 0,000 < 0,05 so it can be explained that there is a significant influence of AI on financial data quality and the fourth hypothesis is accepted.

Furthermore, the results of hypothesis testing on the influence of financial data quality on predicting bankruptcy risk show a t-statistic value of 6,188> 1,96 and a p-value of 0,000 < 0,05 so it can be explained that there is a significant influence of financial data quality on predicting bankruptcy risk and the fifth hypothesis is accepted.

|

Table 5. Test Result of Path Coefficient (indirect effect) |

|||||

|

|

Original Sample (O) |

Sample Mean (M) |

Standard Deviation (STDEV) |

T Statistics (|O/STDEV|) |

P Values |

|

Artificial Intelligence (AI) -> Financial Data Quality -> Predict Bankruptcy Risk |

0,134 |

0,134 |

0,043 |

3,139 |

0,002 |

|

Financial Big Data -> Financial Data Quality -> Predict Bankruptcy Risk |

0,319 |

0,319 |

0,059 |

5,378 |

0,000 |

|

Source: Sem Pls 2024 |

|||||

Based on table 5 the results of hypothesis testing of the indirect influence of financial big data on predicting bankruptcy risk through financial data quality, the t-statistic value was 5,378 > 1,96 and the p-value was 0,000 < 0,05 so it can be explained that there is a significant indirect influence of financial big data on predict bankruptcy risk through financial data quality and the sixth hypothesis is accepted.

Furthermore, the results of hypothesis testing of the indirect influence of AI on predicting bankruptcy risk through financial data quality t-statistic value 3,139 > 1,96 and p-value 0,002 < 0,05 so it can be explained that there is a significant indirect influence of AI on predicting bankruptcy risk through financial data quality and the seventh hypothesis is accepted.

There is a significant influence of financial big data on bankruptcy risk prediction

In today’s digital era, available data is no longer limited to annual or quarterly financial reports, but includes a wider variety of data sources, including daily transactions, social media, and even macroeconomic data.(52) By collecting and analyzing these large amounts of data, companies can identify more accurate patterns and trends in their financial performance.(53) This is especially important because bankruptcy is often the result of problems that develop over a long time, and big data provides the insights needed to detect these problems early.(4)

One of the reasons why financial big data has a significant impact on bankruptcy risk prediction is its ability to increase the accuracy of analysis.(8) By using advanced analytical techniques, such as machine learning and predictive algorithms, companies can process large volumes of data and obtain more precise results.(54) For example, bankruptcy prediction models based on big data can take into account factors that traditional models may not take into account, such as market dynamics and investor sentiment.(55) This allows companies to make better and more timely decisions regarding their financial health.(6)

Apart from that, big financial data also allows deeper analysis of risk factors that can lead to bankruptcy.(56) Richer and more diverse data provides a better context for understanding how variables, such as debt, cash flow and earnings growth, interact with each other.(18) By understanding these interactions, companies can be more proactive in identifying risk areas that may lead to bankruptcy.(57) For example, if analysis shows that high debt and low cash flow are correlated with negative sentiment on social media,(58) the company can take steps to address the issue before it is too late.(10)

The implementation of financial big data also provides competitive advantages for companies that are able to utilize it well.(12) Companies that can collect and analyze data effectively will have a greater ability to respond to changing market conditions and anticipate potential bankruptcy risks.(24) Additionally, big data allows companies to benchmark against their competitors,(59) so they can understand their position in the market and take necessary actions to maintain good performance.(59) Thus, big data is not only a tool for risk analysis but also a strategic tool that helps companies to stay relevant and competitive.(14)

However, while financial big data offers many benefits, companies also need to be aware of the challenges associated with data collection and management.(16) Data quality is an important issue, because flawed or inconsistent data can produce inaccurate analysis.(60) Therefore, companies must ensure that they have effective systems and processes to manage their data, including regular data monitoring and validation.(61,62) By maintaining data quality, companies can maximize the benefits obtained from big data in predicting bankruptcy risk.(16)

Based on this, overall it can be concluded that there is a significant influence between financial big data and bankruptcy risk prediction.(63,64) Big data allows companies to collect and analyze information in large volumes and from multiple sources, thereby increasing the accuracy and depth of risk analysis.(65,66) With a better understanding of the factors that influence financial health, companies can take proactive steps to prevent bankruptcy.(67,68) Although there are challenges in data management and quality, companies that successfully utilize big data well will have a competitive advantage in dealing with risks and maintaining their financial performance in a dynamic market.(18)

There is a significant influence of AI on bankruptcy risk prediction

One of the reasons why AI has a significant impact on bankruptcy risk prediction is its ability to analyze very complex data (Reddy et al., 2024). AI can integrate various types of data, including financial data, operational data, and even external data such as market trends and consumer sentiment.(69,70) By carrying out this multidimensional analysis, AI is able to provide a more holistic picture of the condition of a company.(71,72) This is important, because bankruptcy risk is often influenced by many interacting factors. With a more integrated approach, predictive models can improve accuracy and provide more reliable results.(24)

In addition, AI can perform continuous learning, which means the models built can be continuously updated and refined as data and market conditions change. This allows companies to remain relevant and responsive to rapid changes in the business environment.(12) In bankruptcy risk prediction, AI’s ability to adapt to new data is critical, as factors influencing bankruptcy can change over time.(73,74) For example, regulatory changes, economic fluctuations, or even the impact of new technology can affect the risks a company faces. With an adaptive model, companies can conduct more timely risk assessments and take necessary actions to reduce the potential for bankruptcy.(26)

On the other hand, AI also helps in automating the analysis process, reducing dependence on subjective human judgment. In many cases, manual analysis can introduce unconscious bias or errors, which can affect prediction results.(10) By utilizing AI, the analysis process becomes more objective and data-based.(75,76) This is especially important in the context of bankruptcy risk, where decisions based on inaccurate analysis can have a major impact on a company’s business strategy and survival. Therefore, the application of AI in bankruptcy risk analysis can increase the transparency and reliability of the decision-making process.(28)

However, the challenges in applying AI in bankruptcy risk prediction should not be overlooked. One of the main challenges is the need for high-quality data. Without accurate and representative data, AI models cannot provide reliable predictions.(14) Additionally, there are also concerns regarding the interpretability of AI models, especially complex algorithms such as deep learning. Decision makers need to understand how and why the model makes certain predictions in order to take appropriate action. Therefore, companies must ensure that they not only focus on AI technology but also on data management and model transparency.(29)

Overall, it can be concluded that there is a significant influence between artificial intelligence (AI) and bankruptcy risk prediction.(77,78) With its ability to analyze complex data, learn from new data, and automate analysis processes, AI increases accuracy and effectiveness in predicting bankruptcy risk. While there are challenges regarding data quality and model interpretability, the advantages offered by AI in terms of more objective, data-driven decision making are invaluable.(79,80) Therefore, companies that are able to effectively utilize AI in bankruptcy risk analysis will have a competitive advantage in managing risks and ensuring the sustainability of their operations in an increasingly competitive market.(31)

There is a significant influence of financial big data on the quality of financial data

One important aspect of financial big data is its ability to increase data accuracy. More efficient data collection processes, supported by advanced technologies such as the Internet of Things (IoT) and blockchain, enable companies to obtain more precise and real-time information.(81) With more accurate data, the risk of errors in financial reports can be minimized, and companies can rely on this information to conduct better analysis. For example, with transaction data collected automatically, companies can ensure that every transaction is recorded correctly, which is critical in maintaining the integrity of financial reports.(81)

Apart from increasing accuracy, big data also helps in maintaining data consistency and completeness. A sophisticated data management system can identify and correct inconsistencies or gaps in data, so that companies have a more reliable database.(35) In this context, the use of analytical technology can help detect anomalies or unusual patterns, which could be indicators of error or fraud. By proactively addressing these issues, companies can improve the reliability of their financial data and build greater trust among stakeholders.(37)

Apart from that, big data also allows companies to carry out more in-depth analysis of their financial performance.(33) By combining multiple data sources and applying sophisticated analytical techniques, companies can more comprehensively evaluate financial ratios, trends and historical performance. This provides better insight into the factors influencing financial performance and allows management to take appropriate actions based on valid data. Thus, big data not only improves the quality of the data itself, but also provides a better context for understanding that data.(39)

Although big data offers many benefits in improving the quality of financial data, challenges also need to be considered.(28) Companies must ensure that they have the right infrastructure and policies to manage data effectively. Data obtained from various sources must be managed carefully to ensure regulatory compliance and privacy protection. In addition, companies also need to equip employees with the skills necessary to analyze and interpret complex data. Thus, companies must create a data culture that prioritizes quality and accuracy to maximize the potential of big data.(41)

Overall, it can be concluded that there is a significant influence between financial big data and financial data quality. Through more accurate, consistent and complete data collection, big data provides a strong basis for better decision making. By leveraging advanced analytical technology and data management systems, companies can improve the integrity and reliability of their financial data. Although there are challenges in implementing big data, the benefits it offers in terms of improving data quality are invaluable to a company’s success. Therefore, companies that are able to integrate financial big data into their management practices will have a competitive advantage in understanding and managing their financial performance.(42,43)

There is a significant influence of AI on the quality of financial data

Furthermore, the results of the direct influence hypothesis test show a significant influence of AI on financial data quality with a t-statistic value of 3,862 > 1,96 and a p-value of 0,000 < 0,05. Artificial intelligence (AI) has become an important catalyst in improving the quality of financial data in today’s digital era.(44) With the ability to analyze and process large amounts of data, AI can help companies identify patterns, detect errors and provide more accurate insights into their financial condition. In the context of financial data management, AI serves as a tool that allows companies to reduce inaccuracies and improve data integrity, which is an important foundation for informed and strategic decision making.(46)

One of AI’s significant impacts on financial data quality is its ability to automate the process of data collection and cleansing. Manual processes are often prone to errors, either due to human error or incomplete data.(26) Using machine learning algorithms, AI can automate the identification and removal of duplicate, inconsistent, or irrelevant data. This not only saves time and effort, but also ensures that the data available for analysis is accurate and relevant. Thus, companies can be more confident in using this data for financial reports and analysis.(48)

Apart from that, AI is also able to improve the quality of financial data through predictive analysis capabilities.(31) By leveraging advanced analytical techniques, such as deep learning and big data analytics, AI can analyze historical trends and identify factors that may influence future financial performance. With these insights, companies can not only improve data collection, but also forecast and anticipate changes in market conditions. Thus, the resulting data is not only of high quality, but can also be used for better strategic planning.(49)

Data quality is also improved through AI’s ability to validate and monitor data in real-time. AI-based systems can analyze incoming financial data continuously, allowing companies to detect anomalies or discrepancies as soon as they arise. With tighter monitoring, companies can address problems before they become larger, reducing the risk of errors in financial reporting. This is especially important in highly regulated industries where accuracy and regulatory compliance are paramount.(51)

While the benefits are clear, the challenges of applying AI to improve the quality of financial data also need to be acknowledged.(48) Companies must ensure that they have adequate data infrastructure, as well as the technical capabilities to manage and maintain AI systems. Additionally, it is important for companies to train employees to work effectively with AI tools, as this technology continues to develop. Otherwise, the potential benefits of using AI in financial data management could be wasted.(2)

Overall, it can be concluded that there is a significant influence between artificial intelligence (AI) and the quality of financial data. AI not only improves data accuracy and consistency through automation and predictive analysis, but also enables real-time data monitoring and validation. By reducing human error and improving data integrity, AI helps companies make better, more informed decisions. While challenges in implementing AI remain, the advantages it offers in terms of improving data quality are invaluable for companies looking to remain competitive in an ever-evolving market. Therefore, investment in AI technology and good data management will be the key to long-term success in financial management.(4)

There is a significant influence of the quality of financial data on bankruptcy risk prediction

Accurate and reliable financial data is the basis for proper analysis of an organization’s financial health. When financial data is incomplete or contains errors, the resulting analysis can be misleading, resulting in incorrect conclusions regarding bankruptcy risk. Therefore, high quality financial data is essential to ensure that bankruptcy risk predictions can be carried out precisely and effectively.(8)

One important aspect of financial data quality is accuracy. Accurate data allows companies to better analyze financial ratios and performance indicators.(46) For example, liquidity, solvency and profitability ratios can provide a clear picture of a company’s ability to meet its financial obligations. If financial data is inaccurate, analysis of these ratios can be misleading, and companies may not realize the potential bankruptcy risk they face. Thus, good quality financial data greatly contributes to producing more precise risk predictions.(10)

The quality of financial data is also closely related to the completeness of the information. Incomplete data can miss important aspects of a company’s financial performance; such as changes in cost structure or revenue trends.(51) In this context, the use of predictive models based on historical data can provide better insight into the factors that can trigger bankruptcy. By having complete and comprehensive data, companies can conduct a more holistic analysis and consider all relevant variables. This will increase accuracy in predicting bankruptcy risk.(12)

Apart from that, data consistency is also key in predicting bankruptcy risk. If financial data is inconsistent, for example, if there are changes in accounting methods or revenue recognition that are not explained, this can create confusion and make analysis difficult.(49) Consistency in the collection and reporting of financial data allows stakeholders to make valid comparisons over time. With consistent data, companies can track trends and patterns that indicate an increased risk of bankruptcy, and take necessary actions to mitigate.(14)

Although the importance of financial data quality in predicting bankruptcy risk is clear, companies often face challenges in ensuring such quality.(41) Factors such as a lack of technology infrastructure, inadequate data management policies, and lack of training for employees can hinder efforts to improve data quality. Therefore, companies need to invest in good data management systems, as well as training for employees to ensure that the financial data produced is high quality and reliable.(16)

Overall, there is a significant influence between financial data quality and bankruptcy risk prediction. High data quality, which includes accuracy, completeness, and consistency, is critical to producing sound analysis of a company’s financial health. When companies can ensure that their financial data is of high quality, they will be better able to detect potential bankruptcy risks and take necessary mitigation steps. Thus, investment in financial data quality management should be a priority for companies that want to maintain sustainability and prevent bankruptcy.(18)

There is a significant influence of financial big data on bankruptcy risk prediction through the quality of financial data

With the high volume, speed and variety of data, big data allows companies to gain deeper and more holistic insight into their financial condition.(20) However, to ensure that big data-based analysis is accurate and reliable, the quality of the financial data used is very important. Therefore, there is a significant influence of financial big data on bankruptcy risk prediction through the quality of financial data.(22)

First of all, financial big data gives companies access to various sources of information that can be used for risk analysis.(39) By integrating data from multiple sources, including historical data, market data, and non-traditional data, companies can build more comprehensive prediction models. However, it is important to ensure that data drawn from various sources is high quality, accurate and relevant. If the data is flawed or inconsistent, then the resulting analysis and prediction of bankruptcy risk will also be flawed. Therefore, the quality of financial data is an important bridge connecting big data with bankruptcy risk prediction.(24)

Furthermore, the use of financial big data allows companies to carry out more in-depth and predictive analysis. With advanced analytical methods, such as machine learning and statistical analysis, companies can analyze patterns that may not be visible in smaller datasets.(4) However, the accuracy of this analysis is highly dependent on the quality of the data used. Inaccurate or incomplete data can lead to misleading results, which can result in poor decisions. Therefore, to improve bankruptcy risk prediction capabilities, it is important for companies to ensure that their financial data is of high quality.(26)

Furthermore, financial big data can also improve the quality of the data itself through real-time data monitoring and processing. By using big data technology, companies can continuously validate and update their financial data.(2) This process helps detect errors and inconsistencies more quickly, so that the quality of financial data can be maintained. Good data quality not only ensures that bankruptcy risk analysis is more accurate, but also allows companies to respond quickly to changes in financial conditions that may trigger bankruptcy risk.(28)

Although the benefits of financial big data in bankruptcy risk prediction are clear, companies often face challenges in managing such data.(6) Data quality can be affected by various factors, including data collection policies, technology infrastructure, and staff skill level in data analysis. Therefore, companies must invest in effective data management systems, training for employees, and ongoing maintenance to ensure that financial big data can be used optimally in predicting bankruptcy risk.(29)

Overall, there is a significant influence between financial big data and bankruptcy risk prediction through financial data quality. Financial big data allows companies to access and analyze a wider range of information, but high data quality remains key to ensuring the accuracy and reliability of the analysis. By maintaining good quality financial data, companies can improve their ability to predict bankruptcy risk, so they can take appropriate mitigation steps. Therefore, it is important for companies to focus efforts on data quality management in order to harness the potential of financial big data for better decision making.(31)

There is a significant influence of AI on bankruptcy risk prediction through the quality of financial data

With the ability to process and analyze large volumes of data quickly and accurately, AI can provide deeper insight into a company’s financial condition. However, the effectiveness of AI in making accurate predictions depends greatly on the quality of the financial data used. Therefore, there is a significant influence between AI on bankruptcy risk prediction through the quality of financial data.(35)

First of all, AI is capable of performing complex analyzes by using machine learning algorithms to recognize patterns and trends that may not be visible with traditional analysis.(8) By relying on high-quality financial data, AI can identify financial indicators related to bankruptcy, such as liquidity, solvency and profitability ratios. If the data used is inaccurate or incomplete, the AI analysis results can be misleading. Therefore, the quality of financial data plays an important role in improving the accuracy of bankruptcy risk predictions produced by AI systems.(81)

Furthermore, AI can also improve the quality of financial data through advanced data processing techniques (Ranta & Ylinen, 2024). Using natural language processing (NLP) algorithms and other techniques, AI can analyze data from unstructured sources, such as annual reports and industry news, to add context to existing financial data. This process helps ensure that the information used in the analysis is complete and relevant, thereby improving the overall quality of the data. With better quality financial data, AI’s ability to predict bankruptcy risk will increase.(37)

Furthermore, AI can help in real-time data monitoring, allowing companies to detect financial problems quickly. By continuously monitoring financial performance and risk indicators, AI can provide early warning if there are signs indicating possible bankruptcy.(42) However, to take advantage of this capability, it is important for companies to have quality financial data. If the data used is inaccurate or inconsistent, AI may fail to provide appropriate alerts, which could result in major losses.(39)

Although the potential of AI in bankruptcy risk prediction is enormous, challenges in managing the quality of financial data remain. Companies often face problems such as inconsistencies in data collection, limitations in technological infrastructure, and lack of skills in data analysis. Therefore, to increase the effectiveness of AI in predicting bankruptcy risk, companies need to invest in good data management systems and training for employees to ensure that the data used is of high quality.(41)

Overall, there is a significant influence between AI and bankruptcy risk prediction through financial data quality. AI can improve bankruptcy risk analysis and prediction capabilities, but high data quality is an absolute requirement to achieve accurate results. By leveraging AI to improve the collection, processing and monitoring of financial data, companies can strengthen their position in the face of bankruptcy risk. Therefore, investing in managing the quality of financial data should be a priority for companies that want to fully utilize the potential of AI in decision making and risk mitigation strategies.(42)

CONCLUSION

Based on the results of the analysis, it was found that all hypotheses were accepted, 1) there was a significant direct influence of financial big data on predicting bankruptcy risk with a t-statistic value of 2,688 > 1,96 and a p-value of 0,007 < 0,05. 2) there is a significant direct effect of AI on predicting bankruptcy risk with a t-statistic value of 9,021 > 1,96 and a p-value of 0,000 < 0,05. 3) there is a significant direct influence of financial big data on financial data quality with a t-statistic value of 11,183 > 1,96 and a p-value of 0,000 < 0,05. 4) there is a significant direct influence of AI on financial data quality with a t-statistic value of 3,862 > 1,96 and a p-value of 0,000 < 0,05. 5) there is a significant influence of financial data quality on predicting bankruptcy risk with a t-statistic value of 6,188> 1,96 and a p-value of 0,000 < 0,05. 6) there is a significant indirect effect of financial big data on predicting bankruptcy risk through financial data quality with a t-statistic value of 5,378 > 1,96 and a p-value of 0,000 < 0,05. 7) there is a significant indirect effect of AI on predicting bankruptcy risk through financial data quality with a t-statistic value of 3,139 > 1,96 and a p-value of 0,002 < 0,05. Thus, this research concludes that the combination of financial big data, AI, and financial data quality management has great potential in predicting bankruptcy risk. The recommendation for companies listed on the Indonesia Stock Exchange is to invest in technological infrastructure that supports real-time data collection and analysis, as well as training for staff in the use of advanced technology. With these steps, companies can increase financial resilience and reduce the risk of bankruptcy which could threaten the continuity of their operations.

REFERENCES

1. Mahmud H, Islam AKMN, Mitra RK. What drives managers towards algorithm aversion and how to overcome it? Mitigating the impact of innovation resistance through technology readiness. Technol Forecast Soc Change. 2023;193(May):122641.

2. Bodaghi A, Oliveira J. A financial anomaly prediction approach using semantic space of news flow on twitter. Decis Anal J. 2024;10(January):100422.

3. Graham B, Bonner K. The role of institutions in early-stage entrepreneurship: An explainable artificial intelligence approach. J Bus Res. 2024;175(February):114567.

4. Brenes RF, Johannssen A, Chukhrova N. An intelligent bankruptcy prediction model using a multilayer perceptron. Intell Syst with Appl. 2022;16(September).

5. Hartley N, Kunz W, Tarbit J. The corporate digital responsibility (CDR) calculus: How and why organizations reconcile digital and ethical trade-offs for growth. Organ Dyn. 2024;53(2):101056.

6. Yin Y, Wang X, Wang H, Lu B. Application of edge computing and IoT technology in supply chain finance. Alexandria Eng J. 2024;108(August):754–63.

7. Gallego-García S, Gallego-García D, García-García M. Sustainability in the agri-food supply chain: a combined digital twin and simulation approach for farmers. Procedia Comput Sci. 2022;217(2022):1280–95.

8. Pattnaik D, Ray S, Raman R. Applications of artificial intelligence and machine learning in the financial services industry: A bibliometric review. Heliyon. 2024;10(1):e23492.

9. Emrouznejad A, Abbasi S, Sıcakyüz Ç. Supply chain risk management: A content analysis-based review of existing and emerging topics. Supply Chain Anal. 2023;3(August).

10. Abioye SO, Oyedele LO, Akanbi L, Ajayi A, Davila Delgado JM, Bilal M, et al. Artificial intelligence in the construction industry: A review of present status, opportunities and future challenges. J Build Eng. 2021;44(April 2020):103299.

11. Guo Y, Liu F, Song JS, Wang S. Supply chain resilience: A review from the inventory management perspective. Fundam Res. 2024;(xxxx).

12. Zhang J, Cai K, Wen J. A survey of deep learning applications in cryptocurrency. iScience. 2024;27(1):108509.

13. Attah-Boakye R, Adams K, Hernandez-Perdomo E, Yu H, Johansson J. Resource Re-orchestration and firm survival in crisis periods: The role of business models of technology MNEs during COVID-19. Technovation. 2023;125(May):102769.

14. Citterio A. Bank failure prediction models: Review and outlook. Socioecon Plann Sci. 2024;92(March 2023):101818.

15. Zhu W, Ouyang P, Kong M. Research on the evolution mechanism of intelligent manufacturing transformation of Chinese pharmaceutical manufacturing enterprises based on system dynamics. Heliyon. 2024;10(13):e33959.

16. Nissim D. Big data, accounting information, and valuation. J Financ Data Sci. 2022;8:69–85.

17. Voorneveld M, de Groot M. Optimal investment strategy on data analytics capabilities of startups via Markov decision analysis. Decis Anal J. 2024;10(February):100438.

18. Cheng X, Liu S, Sun X, Wang Z, Zhou H, Shao Y, et al. Combating emerging financial risks in the big data era: A perspective review. Fundam Res. 2021;1(5):595–606.

19. Doumpos M, Zopounidis C, Gounopoulos D, Platanakis E, Zhang W. Operational research and artificial intelligence methods in banking. Eur J Oper Res. 2023;306(1):1–16.

20. Filip FG, Shi Y, Pocatilu P, Ciurea C, Li J, Tien JM, et al. ScienceDirect Table of Contents. 2024;242.

21. Zeb A, Kortelainen J, Rantala T, Saunila M, Ukko J. On the alleviation of imminent technical and business challenges of long-lasting functional digital twins. Comput Ind. 2022;141:103701.

22. Byrapu Reddy SR, Kanagala P, Ravichandran P, Pulimamidi DR, Sivarambabu PV, Polireddi NSA. Effective fraud detection in e-commerce: Leveraging machine learning and big data analytics. Meas Sensors. 2024;33(March):101138.

23. Singh V, Chen S-S, Singhania M, Nanavati B, kar A kumar, Gupta A. How are reinforcement learning and deep learning algorithms used for big data based decision making in financial industries–A review and research agenda. Int J Inf Manag Data Insights. 2022;2(2):100094.

24. Ranta M, Ylinen M. Employee benefits and company performance: Evidence from a high-dimensional machine learning model. Manag Account Res. 2024;(March 2022):100876.

25. Freeman S, Vissak T, Nummela N, Trudgen R. Do technology-focused fast internationalizers’ performance measures change as they mature? Int Bus Rev. 2023;32(5).

26. Musarat MA, Alaloul WS, Khan MHF, Ayub S, Guy CPL. Evaluating cloud computing in construction projects to avoid project delay. J Open Innov Technol Mark Complex. 2024;10(2):100296.

27. Kumar A, Naz F, Luthra S, Vashistha R, Kumar V, Garza-Reyes JA, et al. Digging DEEP: Futuristic building blocks of omni-channel healthcare supply chains resiliency using machine learning approach. J Bus Res. 2023;162(March 2022):113903.

28. Murphy B, Feeney O, Rosati P, Lynn T. Exploring accounting and AI using topic modelling. Int J Account Inf Syst. 2024;55(July 2023):100709.

29. Parhizkar H, Taddei P, Weziak-bialowolska D, Mcneely E, Spengler D, Guillermo J, et al. Jo ur l P re of. Build Environ. 2023;110984.

30. Shahroodi K, Avakh Darestani S, Soltani S, Eisazadeh Saravani A. Developing strategies to retain organizational insurers using a clustering technique: Evidence from the insurance industry. Technol Forecast Soc Change. 2024;201(March 2023):123217.

31. Sanga B, Aziakpono M. FinTech and SMEs financing: A systematic literature review and bibliometric analysis. Digit Bus. 2023;3(2):100067.

32. Faltein SA, Sukdeo NI. Culture-driven quality enhancement: Uncovering the impact of robotics integration in the South African construction sector. Ain Shams Eng J. 2024;15(6):102728.

33. Yang J, Amrollahi A, Marrone M. Harnessing the Potential of Artificial Intelligence: Affordances, Constraints, and Strategic Implications for Professional Services. J Strateg Inf Syst. 2024;33(4):101864.

34. Veríssimo C, Pereira L, Fernandes A, Martinho R. Complex problem solving as a source of competitive advantage. J Open Innov Technol Mark Complex. 2024;10(2).

35. Amato A, Osterrieder JR, Machado MR. How can artificial intelligence help customer intelligence for credit portfolio management? A systematic literature review. Int J Inf Manag Data Insights. 2024;4(2):100234.

36. Johnston C, Pratt G. Automating adult social care in the UK: Extracting value from a crisis. Geoforum. 2024;151(April):103997.

37. KV DS. Neural network-based liquidity risk prediction in Indian private banks. Intell Syst with Appl. 2024;21(December 2023):200322.

38. Huang F, No WG, Vasarhelyi MA, Yan Z. Audit data analytics, machine learning, and full population testing. J Financ Data Sci. 2022;8:138–44.

39. Muparuri L, Gumbo V. On logit and artificial neural networks in corporate distress modelling for Zimbabwe listed corporates. Sustain Anal Model. 2022;2(May):100006.

40. Afriyie JK, Tawiah K, Pels WA, Addai-Henne S, Dwamena HA, Owiredu EO, et al. A supervised machine learning algorithm for detecting and predicting fraud in credit card transactions. Decis Anal J. 2023;6(November 2022):100163.

41. Hajek P, Henriques R. Predicting M&A targets using news sentiment and topic detection. Technol Forecast Soc Change. 2024;201(March 2023):123270.

42. Cooke P. Questionable relations: On aggressive financialised ‘assemblages’ in creative and ecologically-challenged space-economies. J Open Innov Technol Mark Complex. 2024;10(2):100293.

43. Najem R, Amr MF, Bahnasse A, Talea M. Artificial Intelligence for Digital Finance, Axes and Techniques. Procedia Comput Sci. 2022;203(2021):633–8.

44. Allen F, Barbalau A. Security design: A review. J Financ Intermediation. 2024;60(December 2023):101113.

45. Esposito P, Marrasso E, Martone C, Pallotta G, Roselli C, Sasso M, et al. A roadmap for the implementation of a renewable energy community. Heliyon. 2024;10(7):e28269.

46. Zhao J, Ouenniche J, De Smedt J. Survey, classification and critical analysis of the literature on corporate bankruptcy and financial distress prediction. Mach Learn with Appl. 2024;15(January):100527.

47. Sun X, Zheng C, Wandelt S, Zhang A. Airline competition: A comprehensive review of recent research. J Air Transp Res Soc. 2024;2:100013.

48. Pham TN, Powell R, Bannigidadmath D. Tail risk network analysis of Asian banks. Glob Financ J. 2024;62(October 2023):101017.

49. Bilotto F, Harrison MT, Vibart R, Mackay A, Christie-Whitehead KM, Ferreira CSS, et al. Towards resilient, inclusive, sustainable livestock farming systems. Trends Food Sci Technol. 2024;152(July 2023):104668.

50. Giwa AS, Maurice NJ, Luoyan A, Liu X, Yunlong Y, Hong Z. Advances in sewage sludge application and treatment: Process integration of plasma pyrolysis and anaerobic digestion with the resource recovery. Heliyon. 2023;9(9):e19765.

51. Armenia S, Franco E, Iandolo F, Maielli G, Vito P. Zooming in and out the landscape: Artificial intelligence and system dynamics in business and management. Technol Forecast Soc Change. 2024;200(December 2022):123131.

52. Nuryanto UW, Basrowi, Quraysin I, Pratiwi I. Magnitude of digital adaptability role: Stakeholder engagement and costless signaling in enhancing sustainable MSME performance. Heliyon [Internet]. 2024;10(13):e33484. Tersedia pada: https://doi.org/10.1016/j.heliyon.2024.e33484

53. Himmatul I, Nugroho I, Mardian T, Syakina D, Suryo A, Sutoto A, et al. Uncertain Supply Chain Management Enhancing company performance and profitability through agile practices : A comprehensive analysis of three key perspectives. 2024;12:1205–24.

54. Ayamga M, Annosi MC, Kassahun A, Dolfsma W, Tekinerdogan B. Adaptive organizational responses to varied types of failures: Empirical insights from technology providers in Ghana. Technovation. 2024;129(August 2023):102887.

55. Lisaria R, Prapanca D, Amatul S, Arifin K. Uncertain Supply Chain Management Forging a resilient pathway : Uncovering the relationship between the supply chain sustainability and the tax compliance , and the sustainable future of the micro , small , and medium enterprise. 2024;12:1097–112.

56. Himmatul I, Junaedi A. International Journal of Data and Network Science Understanding Roblox ’ s business model and collaborative learning on participation in the deci- sion-making process : implications for enhancing cooperative literacy. 2024;8:1247–60.

57. Shofwa Y, Hadi R, Isna A, Amaludin A. Uncertain Supply Chain Management Harmonization of social capital and philanthropic culture : A catalyst for smooth household supply chains and successful economic development. 2024;12:1053–64.

58. Kharis A, Masyhari A, Suci W, Priatnasari Y. Uncertain Supply Chain Management Optimizing state revenue through government-driven supply chain efficiency and fair corporate taxation practices. 2024;12:659–68.

59. Nuryanto UW, Basrowi, Quraysin I, Pratiwi I. Environmental management control system, blockchain adoption, cleaner production, and product efficiency on environmental reputation and performance: Empirical evidence from Indonesia. Sustain Futur [Internet]. 2024;7:100190. Tersedia pada: https://www.sciencedirect.com/science/article/pii/S2666188824000406

60. Saeri M, Burhansyah R, Kilmanun JC, Hanif Z. Uncertain Supply Chain Management Strategic resilience : Integrating scheduling , supply chain management , and advanced operations techniques in production risk analysis and technical efficiency of rice farming in flood-prone areas. 2024;12:1065–82.

61. Suseno BD, Sutisna, Hidyat S, Basrowi. Halal supply chain and halal tourism industry in forming economic growth Bambang. Uncertain Supply Chain Manag. 2018;6(4):407–22.

62. Basrowi B, Utami P. Building Strategic Planning Models Based on Digital Technology in the Sharia Capital Market. J Adv Res Law Econ Vol 11 No 3 JARLE Vol XI Issue 3(49) Summer 2020DO - 1014505/jarle.v113(49)06 [Internet]. 15 Juni 2020; Tersedia pada: https://journals.aserspublishing.eu/jarle/article/view/5154

63. Soenyono S, Basrowi B. Form and Trend of Violence against Women and the Legal Protection Strategy. Int J Adv Sci Technol [Internet]. 25 April 2020;29(05 SE-Articles):3165–74. Tersedia pada: http://sersc.org/journals/index.php/IJAST/article/view/11636

64. Marwanto IGGH, Basrowi B, Suwarno S. The Influence of Culture and Social Structure on Political Behavior in the Election of Mayor of Kediri Indonesia. Int J Adv Sci Technol [Internet]. 15 April 2020;29(05 SE-Articles):1035–47. Tersedia pada: http://sersc.org/journals/index.php/IJAST/article/view/9759

65. Basrowi B, Maunnah B. The Challenge of Indonesian Post Migrant Worker’s Welfare. J Adv Res Law Econ Vol 10 No 4 JARLE Vol X Issue 4(42) Summer 2019DO - 1014505//jarle.v104(42)07 [Internet]. 30 Juni 2019; Tersedia pada: https://journals.aserspublishing.eu/jarle/article/view/4716

66. Basrowi B, Utami P. Development of Market Distribution through Digital Marketing Transformation Trends to Maximize Sales Turnover for Traditional Beverage Products. J Distrib Sci. 2023;21(8):57–68.

67. Suwarno Basrowi, IGGHM. Technology of Qualitative Analysis to Understand Community Political Behaviors in Regional Head Election in Wates District, Kediri, Indonesia. Int J Adv Sci Technol [Internet]. 23 April 2020;29(05 SE-Articles):2624–35. Tersedia pada: http://sersc.org/journals/index.php/IJAST/article/view/11159

68. Marwanto IGGH, Basrowi, Suwarno. The Influence of Culture and Social Structure on Political Behavior in the Election of Mayor of Kediri Indonesia. Int J Adv Sci Technol [Internet]. 15 April 2020;29(05 SE-Articles):1035–47. Tersedia pada: http://sersc.org/journals/index.php/IJAST/article/view/9759

69. Kittie S, Basrowi B. Environmental education using SARITHA-Apps to enhance environmentally friendly supply chain efficiency and foster environmental knowledge towards sustainability. Uncertain Supply Chain Manag. 2024;12(1):359–72.

70. Junaidi A, Masdar A Zum, Basrowi B, Robiatun D, Situmorang JW, Lukas A, et al. Uncertain Supply Chain Management Enhancing sustainable soybean production in Indonesia : evaluating the environmental and economic benefits of MIGO technology for integrated supply chain sustainability. Uncertain Supply Chain Manag. 2024;12(1):221–34.

71. Miar M, Rizani A, Pardede RL, Basrowi B. Analysis of the effects of capital expenditure and supply chain on economic growth and their implications on the community welfare of districts and cities in central Kalimantan province. Uncertain Supply Chain Manag. 2024;12(1):489–504.

72. Hadi R, Shafrani YS, Hilyatin DL, Riyadi S, Basrowi B. Digital zakat management, transparency in zakat reporting, and the zakat payroll system toward zakat management accountability and its implications on zakat growth acceleration. Int J Data Netw Sci. 2019;8(1):103–8.

73. Purwaningsih E, Muslikh M, Suhaeri S, Basrowi B. Utilizing blockchain technology in enhancing supply chain efficiency and export performance , and its implications on the financial performance of SMEs. Uncertain Supply Chain Manag. 2024;12(1):449–60.

74. Nuryanto UW, Basrowi B, Quraysin I. Big data and IoT adoption in shaping organizational citizenship behavior: The role of innovation organiza- tional predictor in the chemical manufacturing industry. Int J Data Netw Sci. 2019;8(1):103–8.

75. Hamdan H, Basrowi B. Do community entrepreneurial development shape the sustainability of tourist villages? Hamdana*. Uncertain Supply Chain Manag. 2024;12(1):407–22.

76. Mulyani S, Basrowi B. The effect of environmentally oriented leadership and public sector management quality on supply chain performance : The moderating role of public sector environmental policy. Uncertain Supply Chain Manag. 2024;12:471–80.

77. Alexandro R, Basrowi B. Measuring the effectiveness of smart digital organizations on digital technology adoption : An em- pirical study of educational organizations in Indonesia. Int J Data Netw Sci. 2024;8(1):139–50.

78. Yusuf ZFA, Yusuf FA, Nuryanto UW, Basrowi B. Assessing organizational commitment and organizational citizenship behavior in ensuring the smoothness of the supply chain for medical hospital needs towards a green hospital : Evidence from Indonesia. Uncertain Supply Chain Manag. 2024;12(1):181–94.

79. Junaidi A, Basrowi B, Sabtohadi J, Wibowo AM, Wiboho SS, Asgar A, et al. The role of public administration and social media educational socialization in influencing public satisfaction on population services : The mediating role of population literacy awareness. Int J Data Netw Sci. 2024;8(1):345–56.

80. Alexandro R, Basrowi B. The influence of macroeconomic infrastructure on supply chain smoothness and national competitiveness and its implications on a country ’ s economic growth : evidence from BRICS. Uncertain Supply Chain Manag. 2024;12(1):167–80.

81. Beemamol M. Mapping the trends of Financial Statement Fraud detection research from the historical roots and seminal work. J Econ Criminol. 2024;6(July):100096.

FINANCING

None.

CONFLICT OF INTEREST

None.

AUTHORSHIP CONTRIBUTION

Conceptualization: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Data curation: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Formal analysis: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Research: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Methodology: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Project management: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Resources: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Software: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Supervision: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Validation: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Visualization: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Writing – original draft: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.

Writing – revision and editing: Maureen Marsenne, Tubagus Ismail, Muhamad Taqi, Imam Abu Hanifah.